What is prop firm account in forex? It’s essentially a funded trading account provided by a proprietary trading firm. Instead of risking personal savings, skilled traders get access to the firm’s capital to trade larger amounts of money. Profits are then split between the trader and the firm, often at a favorable ratio for the trader. For instance, FTMO – one of the leading forex prop firms – offers demo accounts with up to $200,000 in virtual capital, allowing successful traders to earn up to 90% of the profits they generate. In short, prop trading is all about trading with “house money” under agreed rules.

What is Prop Firm Account in Forex: How does it work?

Forex prop accounts typically involve an evaluation phase (often called a “challenge” or “test”) followed by a funded trading phase. In the evaluation, a trader must meet specific targets and rules to prove their skill. Common requirements include:

- Profit Target: Reach a set profit (e.g. 5–10% of the account) within a time frame.

- Drawdown Limits: Stay within maximum daily loss and overall loss limits to show disciplined risk management.

- Trading Rules: Avoid prohibited behaviors (like holding news trades or over-leveraging) as defined by the firm.

If the trader passes the challenge, they earn a live funded account. At that point, the firm allocates real capital to trade under the same rules. For example, once a trader is accepted by a prop firm, they are given a certain amount of capital to trade, and typically the trader keeps a large share of any profits. Profit splits can range from 70–90% to the trader, depending on the firm. Prop traders essentially trade on behalf of the firm: the firm supplies the capital, and the trader manages risk to generate profits.

During funding, risk management rules remain strict. If the trader’s losses hit the firm’s drawdown limit, the trading account may be paused or closed to prevent further losses. In summary, a prop account works like a high-stakes demo account with real outcomes – you trade with big capital, follow the firm’s risk rules, and share the profits.

Benefits of a Forex Prop Trading Account

- Access to Big Capital: Gain trading power far beyond personal savings. Prop firms fund accounts ranging from $10K to $200K+ (some even scale accounts into the millions).

- Limited Personal Risk: Your own money isn’t on the line for losses (beyond any evaluation fee). You can make big trades without risking personal capital.

- High Profit Splits: Earn a large percentage of your profits. Many firms offer 70–90% share for traders. For example, FTMO’s standard payout is 80%, rising to 90% under their scaling plan.

- Scalable Growth: Successful traders often can scale up to larger accounts. Some prop firms double account size at profit milestones or allow stepping up to multi-million-dollar capital.

- Professional Tools & Mentorship: Firms may provide advanced trading platforms, real-time market data, coaching, and analytics to help you succeed.

- Discipline and Structure: The challenge process imposes solid trading rules (profit targets, max losses) that can help traders build good habits and risk management skills.

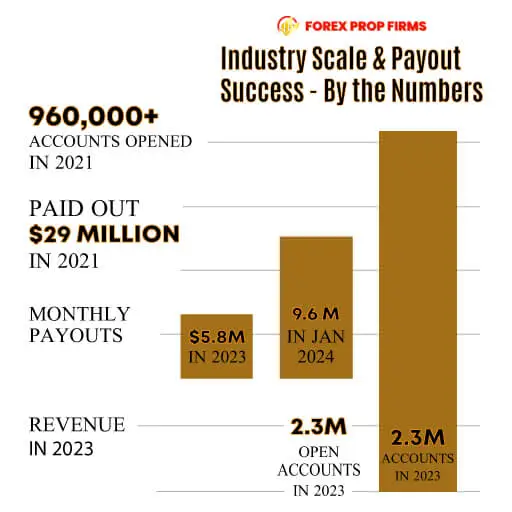

Industry Scale & Payout Success – By the Numbers

To appreciate how significant funded trading has become, consider FTMO’s recent milestones:

- Over 960,000 accounts opened across challenges, verifications, funded accounts, and trials in 2021.

- Paid out $29 million to traders in 2021.

- By 2023, FTMO was distributing around $5.8 million per month and over $9.6 million in January 2024 alone.

- In 2023, the firm generated $213 million in revenue and supported 2.3 million open accounts—a 33% jump year-over-year.

This explosive growth shows that prop trading is more than a side gig—it’s a major financial ecosystem. These firms aren’t small outfits; they have massive operations, large capital flows, and millions of traders relying on structured payouts—making accountability and regulation more important than ever.

Risks and Considerations

- Challenge Fees: Most prop firms charge an initial fee to enter the evaluation (often $100–$500). If you fail the challenge, you lose the fee.

- Strict Rules: Firm rules can be more rigid than a personal account. Breaking rules (e.g. exceeding drawdown, using prohibited strategies) means losing the funded account.

- High Pressure: Knowing you trade with firm capital and must hit targets can be stressful. The “luck” factor is limited; traders must perform consistently under pressure.

- Qualification Difficulty: Many traders fail the evaluation. Success often requires solid strategy and risk control. (The Funded Trader notes that only 1 in 20 Traders Pass Prop Firm Challenges.)

- Limited Asset Scope: Some prop accounts are restricted to certain instruments (e.g. major forex pairs, limited leverage). Check that the firm’s offerings match your strategy.

- Regulatory/Legitimacy Concerns: Always research a prop firm’s reputation. Some smaller firms may have unclear policies or payout issues. Focus on well-reviewed companies and transparent terms.

How to Get Started with a Prop Trading Account

- Research Firms: Compare offerings. Look at account sizes, fees, profit splits, allowed instruments, and community feedback. Examples include FTMO, The5ers, Blue Guardian, etc. (We’ll list some popular names below.)

- Choose a Program: Decide on single-step or multi-step challenges based on your style. For instance, a one-step challenge may have a higher target, whereas a multi-step can ease you in.

- Learn the Rules: Before enrolling, read the firm’s risk rules and challenge requirements carefully. Make sure you understand the profit targets and drawdown limits.

- Practice Trading: Use demo accounts to refine your strategy. Many prop firms allow free trials or sample accounts (FTMO offers a free trial) so you can test if you can meet targets under the official conditions.

- Take the Challenge: Register for the evaluation, pay any fee, and start trading. Follow the rules strictly. Keep a trading log and monitor performance to stay on track.

- Pass to Funded Account: If you meet the goals without breaking rules, you pass the challenge. The firm will then open a funded account for you, often with some initial scaling plan. You can begin trading live, sharing profits with the firm.

- Operate as a Funded Trader: Trade responsibly. Stick to firm rules to maintain funding. Many firms allow regular profit withdrawals, rewarding you for each successful period.

Popular Forex Prop Trading Firms

There are many proprietary trading companies in forex. Some well-known ones include:

- FTMO: A Czech prop firm offering accounts up to $200K demo capital. Traders keep up to 90% of profits.

- The5ers: A global prop firm focusing on forex, allowing traders to manage growing accounts (up to millions) with “hyper-growth” programs.

- Blue Guardian, Alpha Capital Group, BrightFunded, The Prop Trading, FXIFY, Funding Pips, FundedNext, Giimer, Hantec Trader, Quant Tekel, Crypto Fund Trader, Goat Funded Trader, etc.: These and others offer various forex-funded programs with different fees, targets, and profit splits. (Always review each firm’s rules individually.)

Each firm has unique features (e.g. some allow news trading, some have overnight holds, some give instant scaling, etc.). If you’re interested, visit their websites or independent reviews to compare. For example, one recent review notes BrightFunded offers up to 100% profit split and unlimited scaling, while another highlights ThinkCapital’s low fees and up to 90% payout.

Conclusion

A prop firm account in forex is essentially a funded trading opportunity: you trade large sums provided by the company, and in return you share the profits. This model offers the appeal of high leverage and profit potential with limited personal risk. However, it comes with strict rules, costs, and competitive entry challenges. For many serious traders, prop firms are a way to “level up” without needing a big personal bankroll.

If you’re considering this path, start by learning prop trading basics, practicing disciplined strategies, and choosing a reputable firm from the list above. Remember that success requires realistic expectations and solid risk management – just like any trading.