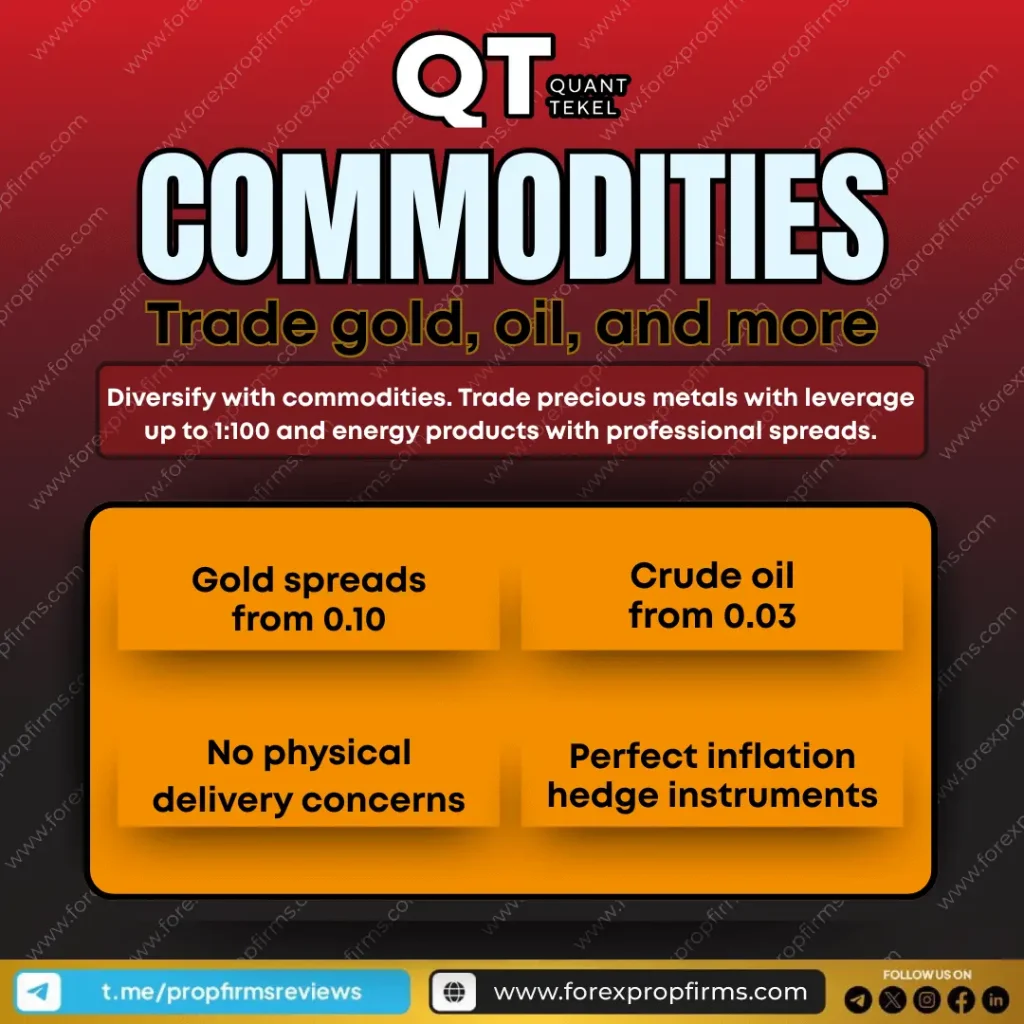

When it comes to navigating the commodities market, Quant Tekel commodities trading stands out as a powerful option for both new and experienced traders. With razor-thin spreads on gold and oil, flexible leverage, and no physical delivery worries, Quant Tekel is reshaping how traders approach inflation-hedging and speculation.

But what really makes them different from traditional brokers? Let’s break it down.

Why Commodities Trading Still Matters in 2025

In an unpredictable market, commodities like gold and oil continue to be safe havens for investors. Whether you’re trying to protect your assets from inflation or simply want to diversify your portfolio, trading commodities offers a practical solution. But it’s not without its challenges—high fees, delivery logistics, and clunky platforms often get in the way.

That’s where Quant Tekel commodities trading flips the script.

What You Get with Quant Tekel Commodities Trading

1. Trade Without the Physical Hassle

Forget about warehouses or shipping. With Quant Tekel, you’re trading contracts—not physical goods—so you avoid all the traditional complications.

2. Competitive Spreads

- Gold spreads from 0.10

- Crude oil spreads from 0.03

These ultra-low spreads mean more value for every trade, especially if you’re trading frequently.

3. Smart Leverage Options

With leverage up to 1:100, you can amplify your exposure to the markets without needing massive capital.

4. Inflation-Hedging Tools

Looking to protect your money during inflation? Commodities like gold are known inflation hedges, and Quant Tekel gives you streamlined access to them.

Perfect for Both Hedgers and Speculators

Whether you’re a long-term hedger looking to secure assets, or a short-term speculator aiming for quick gains, Quant Tekel offers the tools to support your strategy. Their platform is designed for professional-grade access with a user-friendly experience.

Want a Deeper Look?

If you’re curious about the overall broker experience, platform usability, and more, check out this Quant Tekel review for an in-depth analysis before jumping in.

Final Thoughts

Commodities trading has come a long way—and with Quant Tekel commodities trading, it’s finally catching up with modern trader expectations. You get flexibility, transparency, and performance—without the legacy complications.

If you’ve been waiting for the right time (and platform) to start trading commodities, Quant Tekel might just be it.