In the evolving landscape of proprietary trading, Evercrest Funding is positioning itself as a modern prop firm focused on disciplined traders seeking access to capital without risking their own funds. Built around a trader-first philosophy, the firm emphasizes transparency, structured evaluations, and performance-driven growth rather than aggressive trading targets. According to its official website, Evercrest Funding aims to partner with skilled traders and provide the funding and support needed to scale responsibly over time.

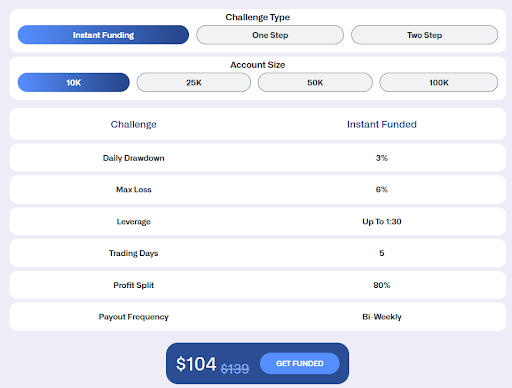

Evercrest Funding offers multiple pathways to becoming funded, including instant funding, one-step, and two-step evaluation models, allowing traders to demonstrate consistency within defined risk parameters. These programs typically include structured rules such as daily drawdown limits, maximum loss caps, and profit targets, designed to reflect realistic trading behavior and risk management. Once funded, traders can access capital allocations across various account sizes and receive an 80% profit split, along with bi-weekly payout opportunities based on performance.

The firm positions itself as a long-term funding partner rather than just a challenge provider. Its mission focuses on helping traders grow through transparent rules, growth-oriented scaling, and realistic risk parameters, reinforcing a model where both the trader and the firm benefit from consistent performance.

This Evercrest Funding review will explore its evaluation structure, account models, trading conditions, and overall value proposition to help traders determine whether the firm aligns with their trading goals in 2026.

Who is Evercrest Funding?

Evercrest Funding is a proprietary trading firm operating under the legal entity Evercrest Funding Limited, a company incorporated in Saint Lucia. The firm provides simulated trading programs designed to help disciplined traders access funding, demonstrate performance, and scale their trading careers within structured risk parameters.

According to its official website, Evercrest Funding was built with the belief that skilled traders deserve capital, transparency, and a real opportunity to grow. The firm focuses on identifying capable traders and supporting them through funding programs, evaluation models, and performance-based scaling opportunities. Its model is centered on partnership, emphasizing that growth comes from consistency, risk awareness, and structured trading, rather than aggressive speculation.

Evercrest Funding positions itself as a trader-first, rule-driven, and performance-focused prop firm, offering clear evaluation pathways, transparent rules, and realistic risk parameters. The company highlights its commitment to providing a professional trading environment with reliable payouts and support designed to help traders progress from evaluation to funded accounts over time.

The firm operates globally and provides access to simulated funding programs, aiming to become a long-term funding partner for traders rather than just a challenge provider. Its core philosophy is built on fairness, clarity, and sustainable trader growth, reinforcing a structure where both the trader and the firm benefit from consistent performance.

Brokers That Are Used by Evercrest Funding

Evercrest Funding operates within a simulated proprietary trading model and provides traders access to institutional-grade trading infrastructure through a stable and professional platform environment. According to the firm’s official website, traders execute positions via MetaTrader 5 (MT5), one of the most widely used platforms in the global trading industry. The company emphasizes stable execution, competitive trading conditions, and performance-focused infrastructure designed to support disciplined trading behavior.

Rather than positioning itself as a traditional retail broker, Evercrest Funding focuses on offering professional trading conditions and structured evaluations where traders demonstrate consistency before accessing funded accounts. The firm highlights its commitment to transparent rules, realistic risk parameters, and a trader-first environment, indicating that the trading setup is built to mirror real-market conditions while maintaining strict risk control.

Additionally, Evercrest Funding states that it provides simulated trading services and supports MT5 usage globally, with certain jurisdictional restrictions depending on regulations. This reinforces that the firm’s infrastructure is designed for performance evaluation and capital scaling rather than acting as a standalone brokerage.

Evercrest Funding Review: How to Get Funded?

Getting funded with Evercrest Funding involves a structured process designed to evaluate a trader’s consistency, discipline, and risk management rather than short-term aggressive performance. According to the official information available, traders can begin by selecting from three primary pathways: 1-Step Evaluation, 2-Step Evaluation, or Instant Funding, each tailored to different trading styles and experience levels.

The first step is choosing a funding model and purchasing access to the program through a one-time evaluation fee. Traders then trade in a simulated environment, where the objective is to meet defined performance metrics while respecting strict daily drawdown and overall loss limits. These rules are designed to promote realistic trading behavior and responsible capital management.

In the 1-Step model, traders complete a single evaluation phase by reaching the required profit target while maintaining risk limits. The 2-Step model follows a phased structure, allowing the firm to assess performance consistency across multiple stages. For traders seeking immediate access, the Instant Funding option provides a funded account from the start, though it still operates under structured risk controls such as daily drawdown thresholds.

Once a trader successfully completes the evaluation—or begins through instant funding—they receive a simulated funded account and can continue trading under the firm’s rules. From there, traders may request payouts based on performance and work toward scaling opportunities, where account size and capital access increase over time through consistent results.

Evercrest Funding emphasizes that its model is built on transparency, realistic risk parameters, and long-term trader development. The firm’s mission focuses on supporting disciplined traders with structure, funding, and growth opportunities, reinforcing a partnership approach rather than a one-time challenge experience.

Evercrest Funding Scaling Plan & Funding Programs

Evercrest Funding provides a structured pathway to funded trading through its evaluation model and growth-focused funding programs. The firm emphasizes a trader-first funding structure, built around transparency, clear rules, and performance-based progression from evaluation to scaled capital access.

At its core, the process begins with a challenge-based evaluation, where traders must meet defined profit targets while respecting risk parameters before moving toward a funded account environment. The firm positions this model as a way to support disciplined traders and provide real growth opportunities through capital scaling, rather than short-term incentives.

Based on official program details, Evercrest’s evaluation includes measurable objectives and strict risk management requirements. Traders are expected to maintain consistency while following clear trading rules designed to create a professional and stable performance environment.

Overview of Evercrest Funding Programs:

| Program | Key Features | Scaling & Profit Structure | Who It’s For |

| Evercrest Funding Program | • Two-step evaluation process with defined performance targets• Profit targets: around 8% in Step 1 and 4% in Step 2• Risk parameters: approx. 4% daily drawdown and 10% maximum loss• Leverage up to 1:100 | • Designed for performance-based capital growth• Focus on scaling funded traders through consistent profitability• Emphasis on transparent rules and fast payout structure | Traders seeking a clear, disciplined funding pathway with defined rules and scaling potential |

Program details derived from official Evercrest Funding materials and platform disclosures.

Evercrest Funding’s scaling approach is built around consistency and disciplined execution, rather than aggressive or high-risk trading behavior. The firm states that traders who demonstrate stable performance can move from evaluation to funded status and continue progressing within a structured environment designed to support long-term growth.

A key highlight of the funding model is its rule transparency and trader-centric design, ensuring participants clearly understand objectives, drawdown limits, and performance expectations before advancing. This clarity helps traders focus on execution and strategy development instead of navigating complex program conditions.

Key Takeaways:

- Structured Evaluation: Traders must meet defined profit targets and risk parameters before funding eligibility.

- Scaling Opportunities: Growth is tied to consistent performance and disciplined trading behavior.

- Transparent Framework: The firm promotes clarity in rules, payouts, and funding progression.

- Trader-Focused Model: Built to support long-term development rather than short-term results.

Overall, Evercrest Funding’s programs are designed to reward disciplined traders with a clear route from evaluation to funded trading and scaling capital, positioning the firm as a performance-driven platform within the proprietary trading space.

Trading Instruments and Platforms at Evercrest Funding

Understanding the available trading environment is essential when evaluating any proprietary trading firm. Evercrest Funding positions itself as a platform-driven prop firm, providing traders with access to professional infrastructure designed for performance evaluation and funded trading progression. According to the official website, the firm delivers its trading services through a simulated trading model, allowing participants to trade in market-like conditions while following structured risk parameters.

Trading Platforms at Evercrest Funding

Evercrest Funding currently supports MetaTrader 5 (MT5) as its primary trading platform. MT5 is widely recognized in the trading industry for its advanced charting tools, multi-asset capabilities, automated trading support, and fast execution environment, making it suitable for both developing and experienced traders. The firm highlights that access to the MT5 platform is provided within its simulated trading framework, ensuring traders can execute strategies in a structured environment aligned with program rules.

The company also notes that platform access may be subject to jurisdictional restrictions, and MT5 availability may not extend to certain regions depending on regulatory requirements. This reflects the firm’s compliance-focused approach and reinforces that its infrastructure is designed to operate within clearly defined operational boundaries.

Trading Instruments at Evercrest Funding

Evercrest Funding operates under a simulated trading account structure, meaning traders interact with market-based pricing environments rather than traditional brokerage accounts. The firm states that the services provided are intended for performance evaluation and funded trading progression, not direct investment or brokerage activity.

While the official site emphasizes the platform and trading framework, it does not publicly specify a detailed list of individual instruments. Instead, the focus is placed on delivering a professional trading environment, structured objectives, and realistic performance conditions that mirror live-market dynamics. This approach ensures traders can apply strategies, manage risk, and demonstrate consistency before advancing within the funding structure.

Infrastructure and Trading Environment

A defining aspect of Evercrest Funding’s setup is its simulated performance model, which aims to replicate real trading conditions while maintaining program-based rules and risk controls. The firm clearly states that trading outcomes depend on each participant’s skill level, discipline, and adherence to program objectives, reinforcing a performance-driven evaluation philosophy.

The infrastructure is positioned to support traders seeking capital growth through structured programs, rather than functioning as a traditional broker offering direct market access. This distinction highlights Evercrest Funding’s role as a prop-style funding provider, where the focus remains on trader development, strategy execution, and consistent performance over time.

Overall, Evercrest Funding’s trading environment centers on MT5 platform accessibility, simulated trading conditions, and structured program rules, creating a controlled ecosystem where traders can demonstrate performance and progress toward funded opportunities.

Evercrest Funding Trading Conditions: Spreads, Fees, and Rules

Understanding the trading conditions at Evercrest Funding is essential for evaluating how the firm structures its proprietary trading environment. Based on information available on the official website, Evercrest Funding operates within a simulated trading framework, meaning traders participate in a performance-based environment that mirrors real market conditions while following strict internal rules and risk parameters. This structure is designed to evaluate discipline, execution, and consistency rather than speculative trading behavior.

Spreads

Evercrest Funding does not publicly disclose exact numerical spread values for specific instruments on its official website. Instead, the firm emphasizes providing a professional trading environment on MetaTrader 5, where pricing and execution are structured to reflect real-market conditions within its simulated model. The objective is to ensure traders operate under realistic trading costs and execution dynamics, supporting fair performance evaluation rather than promotional pricing.

This approach highlights the company’s focus on strategy execution and risk discipline, rather than marketing specific spread benchmarks. As a result, traders are expected to adapt to market-like pricing conditions while operating within the firm’s program structure.

Fees

Evercrest Funding uses a program-based fee model, where traders typically pay a one-time fee to access an evaluation or funding pathway. This fee structure reflects the firm’s role as a proprietary trading provider rather than a retail broker. The payment grants access to the firm’s evaluation environment, trading platform, and funding pathway, rather than direct investment services.

The official website highlights transparency around participation costs and emphasizes that fees are tied to program access, not trading commissions or brokerage services. This distinction reinforces the firm’s position as a performance evaluation provider.

Leverage

Evercrest Funding states that traders operate within defined leverage parameters based on the program selected and the asset environment available on MT5. The firm’s model is structured to support controlled exposure and responsible trading practices aligned with risk management objectives.

Trading Rules

A key component of Evercrest Funding’s structure is its rule-driven trading framework. The firm outlines strict requirements designed to encourage discipline and consistency:

- Risk management controls, including daily and overall drawdown limits within evaluation and funded phases.

- Defined profit objectives, depending on the selected funding pathway.

- Structured program conditions, ensuring traders follow consistent execution standards.

- Simulated performance environment, where adherence to rules determines progression toward funded status.

These rules are intended to replicate the expectations of professional trading environments and ensure that only traders with consistent performance and strong risk control progress through the funding stages.

Overall Trading Environment

Evercrest Funding’s trading conditions focus less on promotional metrics and more on discipline, consistency, and structured evaluation. The firm positions its ecosystem as a controlled environment where traders must demonstrate professional-level behavior before advancing to funded opportunities.

By prioritizing transparent rules, structured fees, and realistic trading conditions, Evercrest Funding creates a framework that supports trader development and long-term performance rather than short-term speculation. This design reinforces the firm’s broader philosophy of building sustainable trading careers through disciplined execution and risk management.

Evercrest Funding Subscription and Payment Methods

Understanding the subscription structure and payment process is an important part of evaluating any proprietary trading firm. Based strictly on information available on the official Evercrest Funding website, the firm currently emphasizes access to its funding programs through a structured onboarding process rather than publishing a detailed public pricing table.

Evercrest Funding positions its model around giving traders access to simulated funded accounts and scaling opportunities rather than requiring ongoing subscriptions. The platform promotes early access to its programs, where traders can sign up and participate in funding opportunities and challenges through the firm’s onboarding flow. The official site highlights that traders can access funding opportunities of up to $300,000 in capital and retain up to 100% of profits, which reflects the firm’s core value proposition for participants.

At present, the website does not publicly list a standardized fee schedule, challenge pricing tiers, or subscription costs in the same detailed format used by some legacy prop firms. Instead, Evercrest Funding appears to introduce traders to its programs through registration and onboarding, where eligibility, program access, and any applicable costs are communicated during the sign-up process.

Payment Structure and Onboarding

From the official platform messaging, Evercrest Funding focuses on simplicity and accessibility in its onboarding journey:

- Traders register and gain early access to funding opportunities.

- Participation is tied to the firm’s simulated trading programs rather than direct investment products.

- The company emphasizes that its services are not investment advice and that traders operate within program rules using simulated environments.

This approach aligns with modern prop trading models where access, evaluation, and funding are delivered digitally rather than through recurring subscription plans.

Payouts and Profit Distribution

One of the most clearly stated elements on the official website is the firm’s payout positioning. Evercrest Funding highlights:

- Fast payouts within 24 hours

- Industry-leading profit splits, up to 100%

- A model centered on rewarding performance rather than charging ongoing participation fees

These claims indicate that the firm’s financial structure is designed around trader performance and profit distribution rather than recurring subscription revenue.

Payment Methods

As of the latest official information available, Evercrest Funding does not publicly list specific payment channels such as card payments, bank transfers, e-wallets, or cryptocurrency on its website. This suggests that payment and funding details are communicated directly during the onboarding or challenge registration process.

Refunds and Financial Policies

Similarly, the platform does not publicly disclose a formal refund framework or standardized fee-reversal conditions. Instead, it emphasizes:

- Participation in simulated trading services

- Performance-based progression

- Profit distribution based on trader results

This indicates that operational and financial terms may vary by program and are likely presented during account setup rather than through static pricing documentation.

Key Takeaway

Evercrest Funding’s subscription and payment structure appears to prioritize access, performance, and rapid payouts over traditional fixed subscription models. While the official website clearly promotes fast withdrawals, high profit splits, and capital access, detailed pricing, payment channels, and refund mechanics are not publicly specified and are likely shared during the onboarding process for each funding program.

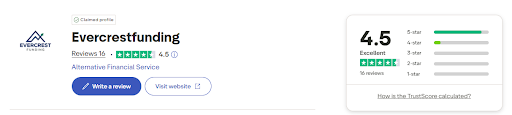

Traders Opinion

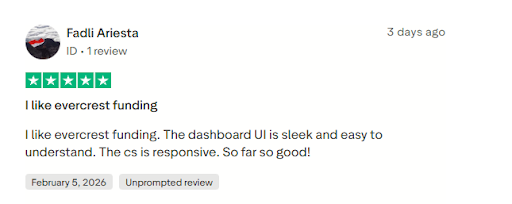

Based on publicly available feedback, Evercrest Funding holds a 4.5-star rating on Trustpilot from 16 reviews, indicating generally positive trader sentiment. Reviewers frequently highlight the firm’s clear trading rules, straightforward evaluation structure, and professional communication.

Traders also point to responsive customer support, particularly when clarifying program conditions or account-related queries. From the firm’s official documentation, Evercrest Funding emphasizes rule transparency, defined risk parameters, and a structured funding pathway, which aligns with what traders mention in their feedback.

Overall, trader opinion suggests confidence in the firm’s operational clarity and support reliability, especially among disciplined traders seeking a rules-driven prop firm environment.

Evercrest Funding Review: Pros and Cons

When evaluating Evercrest Funding, it’s important to balance the firm’s strengths and areas where traders should exercise caution. Based on official information and early community feedback, the table below highlights the key pros and cons of trading with Evercrest Funding.

| Pros | Cons |

| Low entry cost and accessible programs: Evercrest Funding offers low-cost evaluation models including one-step, two-step, and instant funding options, making participation affordable for traders at various skill levels. | Very new firm with limited track record: Evercrest Funding was launched recently (2026), so long-term performance data and widespread payout proofs are still emerging. |

| Up to 100% profit split: Traders can retain a large share of profits once funded, which is highly competitive compared to many traditional prop firms. | Simulated trading model: The funding operates via simulated accounts, meaning traders do not trade directly with live broker capital initially. |

| Transparent and clear rules: The firm emphasizes transparent evaluation conditions, defined drawdown limits, and interpretive clarity, helping traders understand exactly what’s required. | Strict risk limits: Some programs feature tight drawdown limits (e.g., 3% daily on instant funding), which may be constraining for certain trading strategies. |

| Instant funding available: Traders can access funded accounts without a lengthy multi-stage challenge if they choose the instant model, offering faster capital access. | Limited independent review data: Because it’s new, there are relatively few external reviews or payout confirmations compared to longer-established prop firms. |

| Positive early user feedback: Traders on Trustpilot report clean platform navigation, clear rules, and responsive support, which are positive early indicators. | Emerging payout proof: While the firm advertises fast payouts, there is still limited public evidence of long-term payout consistency. |

| Focus on disciplined growth: Evercrest’s mission emphasizes risk control, trader discipline, and long-term scaling, which appeals to many disciplined traders. | New in community presence: Compared to older firms with extensive communities and resources, Evercrest is still building its ecosystem and social engagement. |

Key Takeaways:

Evercrest Funding’s low entry costs, high potential profit splits, and clear rules make it attractive, especially for traders who value affordability and transparency. However, its newness and simulated trading structure mean traders should exercise due diligence and consider it as an evolving option rather than a proven leader in proprietary funding.

Is Evercrest Funding Worth It?

Determining whether Evercrest Funding is worth it depends largely on your trading skill level, goals, and risk tolerance. Officially, the firm presents itself as a trader-first proprietary trading partner, offering structured evaluation paths and up to 100% profit retention once funded—features that appeal to traders seeking capital access without traditional brokerage limitations.

Evercrest Funding’s mission emphasizes transparent rules, realistic risk parameters, and growth-oriented scaling, suggesting the firm prioritizes disciplined performance over aggressive targets or hidden conditions.

Early external reviews and community feedback indicate that traders appreciate the clear rule framework, clean platform, and responsive support, which can enhance the overall experience—especially for traders who value structure and consistency.

However, as a new entrant (launched in 2026) with relatively few independent reviews and limited long-term payout history, Evercrest Funding still lacks the extensive track record enjoyed by more established proprietary firms.

In summary, Evercrest Funding can be a compelling option for traders who want affordable entry, transparent conditions, and performance-based profit sharing. That said, its newness and simulated environment mean prospective traders should proceed with realistic expectations and carefully assess whether it aligns with their trading objectives.

The Final Words

Evercrest Funding positions itself as a modern proprietary trading firm focused on providing traders with a structured and transparent pathway to funded trading. According to its official website, the firm emphasizes clear evaluation rules, defined risk limits, and performance-based progression, aiming to create a fair environment for disciplined traders.

What stands out in the Evercrest Funding review is the firm’s commitment to simplicity and clarity. From challenge structure to profit allocation, the rules are presented in a way that allows traders to understand expectations before committing. This approach can be particularly appealing for traders who value consistency, accountability, and rule-based trading over aggressive or unclear models.

While Evercrest Funding is still building its long-term track record, its well-defined framework and trader-centric messaging indicate a serious effort to establish credibility in the prop trading space. For traders willing to follow structured guidelines and demonstrate consistency, Evercrest Funding may represent a promising opportunity worth considering.