If you’re exploring Forex prop firms in 2025, one key feature to consider is how scalable a funded account is. The iFunds account scaling process stands out for its trader-friendly approach that lets you grow your trading capital without losing any of the profits you’ve worked hard to earn.

How the iFunds Account Scaling Process Works

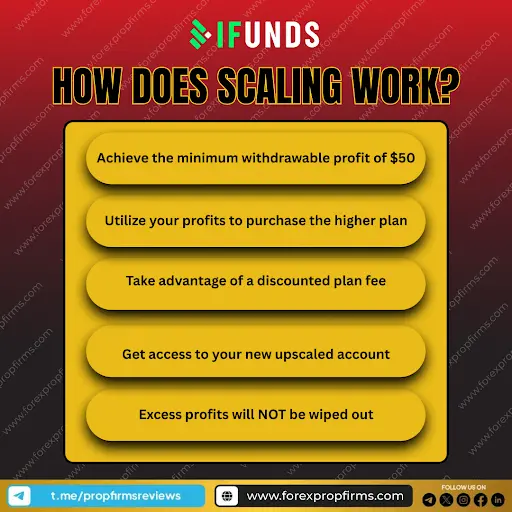

Unlike some prop firms where scaling up can mean starting over or giving up profits, iFunds offers a flexible and rewarding system designed to help traders advance smoothly:

- Reach a minimum withdrawable profit of $50. Once you hit this target, your profits become your gateway to the next level.

- Use your earned profits to purchase an upgrade to a higher funding plan. This means you don’t have to inject new money out of pocket — you’re essentially reinvesting your gains.

- Benefit from discounted pricing on your upgrades. iFunds rewards your success by making the next account level more affordable than starting fresh.

- Access your new, larger funded account. With more capital, you can take bigger positions and aim for higher returns.

- Keep all excess profits with zero wipeout. Perhaps the best part: your earnings remain intact, so you never lose your hard-earned money in the scaling journey.

This transparent and growth-oriented system encourages consistency and rewards disciplined trading behavior, which is why it’s gaining traction among traders looking for prop firms that support sustainable progress.

Why the iFunds Scaling Model Matters in 2025

As the market grows more competitive, traders demand more from their prop firms — not just access to capital but real pathways to expand that capital without penalties. The iFunds account scaling process meets this need by blending flexibility with fairness. Traders can focus on honing their skills and growing their accounts confidently, knowing their profits work for them.

If you want to dive deeper into how iFunds compares with other brokers, check out our full Forex Prop Firms in 2025 review to see why scaling models like iFunds’ are becoming game changers in the funded trading industry.