How to pass forex prop firm challenge is the question every ambitious trader asks before risking their shot at a funded account. These challenges let you trade with a firm’s money once you prove yourself on a demo account. Passing one can feel like hitting a $50K jackpot overnight, but it’s far from easy.

In fact, most traders fail their first attempt, and industry data shows only about 4% of applicants ever succeed. This high failure rate isn’t because firms want you to lose, but because the evaluation tests your trading skills, discipline, and risk management to the core. The good news? With the right preparation, a solid plan, and steady nerves, you can dramatically improve your odds. In this guide, we’ll break down exactly what a prop firm challenge involves and share proven strategies to help you succeed.

How to Pass Forex Prop Firm Challenge: Understand the Prop Firm Challenge

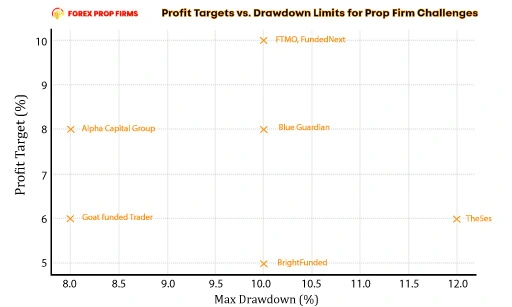

A prop firm challenge is essentially a simulated audition. You trade in a demo account using the firm’s virtual capital, and you must meet specific performance targets without breaking the rules. Typical rules include:

- Profit target: Reach a small profit (usually 6–10% of the initial account balance) within a set period.

- Drawdown limit: Don’t lose more than a fixed percentage (commonly 5–10%) of the account in total or per day.

- Timeframe: Often 30 days, sometimes broken into stages (e.g. a “Phase 1” of 30 days and a shorter “Phase 2”).

- Trading rules: Some firms restrict trading to certain times or forbid high-risk strategies (like news trading or huge leverage).

For example, a $100,000 challenge might require a 6% profit and allow only a 10% overall loss. If your account falls below $90,000, or you lose more than 2% in a single day, you automatically fail. These strict limits mean the firm is testing not just whether you can make money, but whether you can protect that money under pressure. Understanding every rule before you start is critical – accidentally violating a rule (even on a winning trade) can disqualify you.

Develop a Solid Trading Strategy

A well-defined trading strategy is critical for passing the challenge. This means having clear rules for when to enter and exit trades, as well as how much to risk on each trade. For beginners, that might involve a simple trend-following system or a basic breakout strategy. The key is to backtest your plan on historical data in similar market conditions. Backtesting shows if your approach can actually produce consistent wins, and it helps you refine your method before risking any real money.

For example, if your strategy involves trading breakouts on hourly charts, run it on past hourly data to see how often it would hit its profit targets versus getting stopped out. A good strategy will have more winning trades (or bigger wins) than losses. Adjust the trade size (see next section) so that even a string of losses won’t blow your account.

Key strategy tips:

- Pick a strategy that matches the firm’s rules (if scalping isn’t allowed, use a longer timeframe).

- Keep your plan simple and mechanical (avoid guesswork or “feeling lucky” trades).

- Document your rules in writing and stick to them during the challenge.

By trading a tested system instead of making impulsive decisions, you increase your chances of steadily growing the account to the profit goal.

Master Risk Management

Risk management is the cornerstone of surviving a prop firm challenge. In practice, this means:

- Small Position Sizing: Risk only a tiny percentage of your account on each trade. Many challenge veterans recommend risking no more than 1–2% per trade. For instance, on a $100,000 account, risking 1% means a $1,000 stop-loss. This way, even if several trades go bad, you won’t bust out of the challenge.

- Use Stop-Loss Orders: Always set a stop-loss for every trade. This automatically limits your loss on that trade to a predetermined amount. It also ensures you obey the challenge’s rules, since exceeding the drawdown cap ends the challenge.

- Daily Loss Limits: Prop firms often set a maximum loss per day (e.g. 2%). If you hit that limit, you must stop trading that day to avoid instant failure. Treat this like a hard rule. If you lose 2% on Day 1, pause for the day – don’t try to “get it back” and risk blowing the account.

- Overall Drawdown: Be aware of your total account drawdown (often 10% max). If the rule is 10%, that means once you’ve lost $10,000 on a $100,000 demo, you’re out. Watch your equity curve and halt trading if you near that limit.

Strict risk control preserves your capital and keeps you in the game longer, which is the single biggest factor in reaching the profit target. Remember: the goal is to survive and slowly climb, not to make a fortune overnight. Even if a trade idea looks “perfect,” if it means risking more than your plan allows, pass on it.

🎯 Quick Tip: Many traders even subdivide risk further by using a daily stop. For example, if you set a 1% risk per trade, also set a rule like “stop trading for the day after 5 losses” to enforce discipline.

Control Your Emotions

A prop firm challenge is as much a psychological test as a technical one. It’s easy to get anxious as the deadline looms, or to feel overconfident after a few wins. Emotions like anxiety, frustration, or greed can lead to reckless moves – like abandoning your plan to chase a big win. To pass the challenge, you must master your emotions and stick to your strategy no matter what.

- Stay Disciplined: Write down your trading plan and risk rules, and hold yourself accountable. If you get a string of losses, resist the urge to revenge-trade. If you’re ahead, don’t become overconfident and double your size.

- Keep a Trading Journal: Record why you entered/exited each trade and how you felt. Over time, this helps you spot patterns (e.g., “I get sloppy after winning 3 trades”). Adjust your behavior when you notice emotional mistakes.

- Take Breaks: If you feel stress building, step away from the screen for a few minutes. A clear mind makes better decisions.

Consistent, rule-based execution beats impulsive trading. As one trader puts it, “The intense pressure… can easily trigger emotional responses… These often lead traders to abandon their strategies.” Avoid that trap by acknowledging emotions but not letting them override your plan.

Practice and Start Small

Before you even pay for the challenge, practice on your own demo account with similar rules. Simulate the profit target and drawdown limits, and try to meet them. This not only builds confidence but also reveals any weaknesses in your strategy.

Once you start the real challenge, consider beginning with a smaller account size if the firm allows (e.g. $10K instead of $100K). A smaller target with the same percentage goals reduces pressure while you gain experience. You can always scale up later once you’ve passed one level.

Think of it as learning to drive: start on quiet roads before racing on the highway. By the time you face larger targets, you’ll be better prepared.

💡 Action: Treat the challenge like any other trading day. Take notes, review each session, and tweak your approach. The more carefully you prepare, the less you leave to chance.

Choose the Right Forex Prop Firm

Not all prop firms are the same. Some of the most popular forex prop firms for beginners include FTMO, The5ers, MyForexFunds (also known as FundedNext), ThePropTrade, and BrightFunded, among others. Each has its own rules, so do your homework. For example:

- FTMO: Well-known and transparent, FTMO uses a two-step challenge with a 10% max drawdown and ~6% profit target.

- The5ers: Offers instant funding or challenges with different profit/drawdown rules (their targets are often lower but with quicker payouts).

- Blue Guardian / Alpha Capital / Goat Funded: Newer firms that emphasize flexibility (some even offer no time limits or no fixed targets).

- Funding Pips / Crypto Fund Trader: Niche firms specializing in certain markets (like crypto) or trader-friendly rules.

(And others from the list like FXIFY, Giimer, thePropTrade, Hantec Trader, Quant Tekel – each has variations.)

Choosing a firm that matches your trading style is smart. If you’re a patient swing trader, a longer time limit might suit you. If you prefer quick scalping (and the firm allows it), look for higher daily loss thresholds. Always read the fine print on trading restrictions.

🔍 Pro Tip: Some firms allow unlimited tries (at extra cost) or even free extensions if you’re profitable, which can ease the pressure. Check their FAQ.

FAQ – People Also Ask

Q: What exactly do I need to do to pass?

Q: How long will it take to pass a challenge?

Q: Why do so few traders pass?

Q: Can I use expert advisors (EAs) or automated bots?

Q: What if I fail?

Conclusion

Passing a forex prop firm challenge is a demanding but rewarding goal for beginner traders. It requires clear goals, strict risk management, and iron-clad discipline. By studying the rules in detail, practicing your strategy, and controlling risk (for example, keeping trades to 1% of your account), you put the odds in your favor. Remember, every big trader started somewhere – treat the challenge as a learning opportunity.

If you carefully follow each rule and stay level-headed, you can join the ranks of successful funded traders. Whether you aim for firms like FTMO, BrightFunded, The5ers or others, the steps are the same: plan well, trade smart, and never let emotions derail you. Good luck – your funded account awaits!