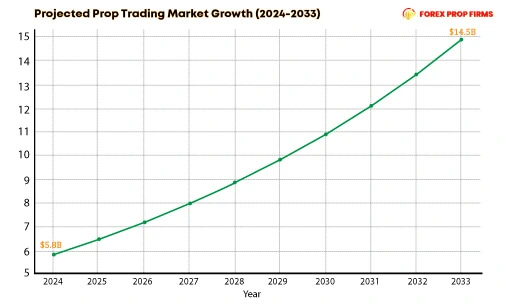

How do Forex Prop Firms work? That’s the question many traders are asking as forex prop trading (proprietary trading) surges in popularity. This model lets traders access large capital without risking their own money. Essentially, a prop firm is a company that provides skilled traders with trading funds in exchange for a share of the profits. In recent years, retail prop trading has exploded, with many firms racing to attract talented Forex traders.

For example, one prop trader notes that “prop firms provide traders with access to significantly larger capital than they might have on their own. Instead of risking your personal funds, you trade the firm’s money and receive a share of the profits”. By lowering the barrier to professional-style trading, prop firms appeal to beginners and intermediates who lack huge accounts but want to trade at scale.

Prop firms operate by collecting challenge/evaluation fees and providing funded demo accounts to qualifying traders. In practice, traders apply to a prop firm program and often pay a one-time fee (or monthly subscription) to begin a structured evaluation or “challenge.” This challenge is typically a two-step process. First, a trader must hit a profit target (for example, +8–10%) within a limited time and without exceeding strict risk limits. Second, after passing phase one, many firms require a short verification phase with another smaller profit target (e.g. +5%) under similar risk rules. For instance, MyForexFunds’ evaluation challenge requires an 8% gain in phase one and 5% in phase two, with a maximum 5% daily drawdown and 12% overall drawdown.

Behind the scenes, all trading during these challenges is usually done in demo accounts. In fact, most retail prop firms never trade with real money during evaluations or even when funded. They use the “demo” account results to judge performance, then replicate or “copy” the winning trades onto real or demo accounts they control.

This means the prop firm technically bears no trading risk – traders get real payouts funded by the pool of challenge fees (often 90%+ of failed challengers’ fees go to payouts). In effect, the firms monetize failures: as one industry analyst explains, the primary revenue source is the one-time evaluation fee from traders. Once a trader passes the challenge, the firm turns on a funded (demo) account for them to trade with the firm’s capital.

What Does a Forex Prop Firm Do?

A forex prop firm provides traders with trading capital and support in exchange for sharing profits. They typically offer:

- Capital Access: Traders use the firm’s funds (often $25K to $200K+ accounts) instead of their own savings.

- Educational Resources: Many firms include webinars or coaching as part of their programs.

- Risk Controls: The firm sets strict rules (max drawdown, position limits, etc.) to protect its capital.

- Profit Sharing: Successful traders keep a large portion of their gains; the firm takes a cut.

For example, FTMO (a well-known Czech-based prop firm) provides funded accounts of up to $1M+ after passing its challenge. Traders don’t need any special credentials – just consistency and discipline. In short, prop firms act as backers: they “allow skilled individuals [to] propel their trading careers by providing capital, training, and general support”. This business model benefits traders (who get big capital and tools) and the firm (which earns from fees and profit splits).

How do Forex Prop Firms work? Money Making Process

While prop firms share a portion of profits with traders, their main earnings usually come from fees and subscriptions. In a typical scenario:

- Evaluation Fees: Traders pay a fee (often $100–$1000) to enter a challenge. Since most traders fail, these fees become the firm’s revenue.

- Subscription Fees: Some firms require paid monthly subscriptions to maintain funded accounts or enter special programs.

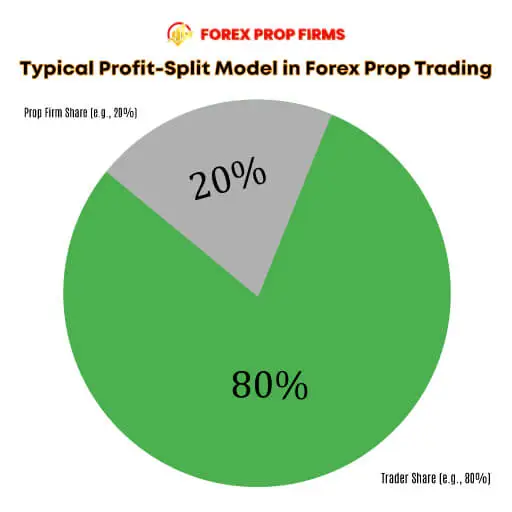

- Profit Splits: Once funded, prop firms take a percentage of the profits traders make. Common profit-split models reward the trader (e.g. 80% to trader, 20% to firm), but firms still profit from each payout.

For instance, one analysis notes that if a firm has 10,000 funded traders paying $150/month each, that’s $1.5M per month from subscriptions alone. Add the challenge fees (if only 1% of participants succeed, the rest’s fees flood in), and the firm’s revenue can far exceed the traders’ payouts. As DailyForex summarizes, “most retail prop firms earn most of their revenues from paid-for challenge fees and monthly subscriptions”. The profit splits (often 70/30 to 90/10 in favor of the trader) provide ongoing revenue but are secondary to the large upfront fees.

Popular Forex Prop Firms and Examples

Several prop firms dominate the market, each with unique programs. FTMO (Czech Republic) pioneered the two-step challenge (10% profit target + 5% verification, 10% overall drawdown). The5%ers (Israel) focuses on lower starting capital but scales quickly. The Funded Trader (Canada) offers multiple funding programs (including “instant” funding) and platforms (e.g. Platform 5, DxTrade, cTrader). MyForexFunds (formerly Canada-based) offers three programs (Rapid, Evaluation, Accelerated) with varying targets (e.g. 8%/5% in its two-phase challenge) and profit splits up to 90%.

Real-world numbers highlight the industry’s scale. For example, FTMO reported over $213M in trading turnover in 2023. MyForexFunds (before recent regulatory issues) attracted 135,000+ clients in just two years and collected around $310M in fees. By late 2024, FTMO had over 2.3 million trading accounts (33% growth YoY). Dozens of smaller firms have also launched globally in 2020–2023, though high competition led many (80–100 firms) to shut down by 2024. This boom reflects that prop trading “lowered the barrier” to professional capital, driving rapid growth in the sector.

The Evaluation Process: Fees, Targets, and Rules

To get funded, you typically follow these steps:

- Register and Pay the Fee: Sign up and pay the challenge fee (e.g. $150 for a $100K account). This fee funds the firm and gives you access to the demo challenge account.

- Phase 1 – Hit the Profit Target: Trade on the firm’s demo platform to reach a set profit (often 8–10%) without violating risk limits. For example, MyForexFunds requires +8% profit with max 5% daily drawdown and 12% overall drawdown. Other firms like FTMO require +10%.

- Phase 2 – Verification (if applicable): Some firms add a shorter verification phase (e.g. +5% additional profit) under the same or looser rules to confirm consistency.

- Funded Account Activation: Once both phases are passed, you unlock the funded account. Sometimes your challenge fee is refunded. You can then trade using the firm’s capital in a live or live-like account.

- Ongoing Payouts: Earn profits and withdraw according to the firm’s schedule and profit-split agreement (often monthly or bi-weekly).

Key terms to watch in any evaluation: the profit target (e.g. +8%), maximum drawdown (e.g. 5% daily, 10–12% total), minimum trading days (often 5–10 days), and allowed instruments. Exceeding any drawdown limit or trading rule (e.g. no news trading) typically disqualifies you immediately. Evaluation requirements vary by firm, but they all enforce strict risk limits and timeframes as the cost of funding.

Getting Funded: Profit Splits, Scaling Plans, and Payouts

Once funded, traders keep the majority of profits according to the agreed split. Profit splits commonly range from 70% to 90% in favor of the trader. For example, a firm might offer an 80/20 split, where the trader keeps 80% of gains. Some firms start new traders at lower splits and increase them as performance improves. Higher payouts (up to 90%) are often advertised to reward top performers.

Many prop firms also have scaling plans: if you consistently meet profit targets without violations, your funded account can be increased. For instance, FTMO scales accounts every four months by 25% if profit goals are met. MyForexFunds’ Accelerated program even describes potential scaling from a $2K start up to $1M+ (at higher fees). These plans reward disciplined traders with larger capital over time.

Payouts are usually processed monthly or bi-weekly. For example, MyForexFunds pays out bi-weekly once funded. After paying the trader’s share, the firm keeps its portion to cover fees and operational costs. Thus, even after getting funded, traders continue to provide income to the firm through each profit split.

Platforms and Tools Used by Top Prop Firms

Prop firms typically support popular trading platforms and provide performance dashboards:

- MetaTrader 4 & 5: The industry standard for Forex. Firms like FTMO and MyForexFunds allow both MT4 and MT5 trading.

- cTrader and DXtrade: Modern alternatives for advanced traders. FTMO, for example, added a web-based DXtrade platform alongside MT4/5. The Funded Trader now offers cTrader and its own “Match-Trader” interface.

- Proprietary Platforms: Some firms develop or license specialized interfaces (e.g. The Funded Trader’s “Platform 5” for algorithmic trading).

- Trader Dashboards: Almost every firm provides an online dashboard or journal. FTMO’s Trading Journal and The Funded Trader’s Professional Trader Dashboard let you analyze stats, equity curves, and strategies. These tools help both traders and the firm track performance metrics and rule compliance.

Each firm’s website lists its supported tools. For example, FTMO explicitly states it offers MT4, MT5, cTrader, and a new DXtrade web platform. Many firms also integrate with trading platforms like TradingView for charting. Regardless of choice, these tools give you the analytics and order management needed under the prop firm’s rules.

Risk Management and Trade Monitoring

Prop firms enforce strict risk controls to protect their capital. Typical rules include maximum drawdowns, position limits, and often bans on certain strategies (like holding trades over major news). Traders must adhere to these or face account termination. As one source notes, prop firms have “strict risk management protocols [that] leave little room for error, and [they] kick out traders as soon as they breach a tight drawdown window”. In practice, if your account equity falls below the allowed threshold (say, 10% loss from peak), the firm will shut the account.

Firms also monitor trades closely. Many use copy-trading software to replicate your demo trades or log your platform data in real time. Compliance staff or automated systems check that you set required stop-losses, don’t manipulate prices, and trade within permitted instruments. Since most trading (even in funded accounts) often occurs in demo or synthetic accounts, firms can instantly cut off any rule violation.

In short, your success depends not just on profit, but on consistently following the firm’s rules. This fosters discipline: traders can’t gamble, over-leverage, or hide losing positions. While this means less freedom than personal trading, it dramatically reduces the firm’s risk and ensures that payouts come from genuine, rule-abiding performance.

Prop Firms vs. Trading Your Own Money: Pros and Cons

Many beginners wonder: “Is trading with a prop firm better than using my own capital?” The answer depends on your goals:

- Prop Firm Advantages: You get to trade much larger capital (often $100K+) without risking personal funds. This means you can learn and earn big profits (e.g. turning 10% of $100K is $10K) without risking savings or taking a loan. The firm enforces discipline (strict risk rules can keep you from blowing up), and you often gain access to professional tools and a community. Plus, using the firm’s capital means lower personal risk – you can’t lose more than your share (and often not lose any real money at all during evaluation).

- Prop Firm Drawbacks: You only keep a portion of profits. For example, on an 80/20 split you give up 20% of your gains. You also face strict rules: daily drawdowns, fixed timeframes, and trading restrictions that may not suit your preferred style. Violating any rule – even if you were profitable – can result in losing the funded account. There is also the upfront cost: challenge fees or subscriptions, which you forfeit on failure.

- Trading Your Own Account: You have full control – no profit splits and no external rules. All profits belong to you, and you can trade any style or timeframe. This is ideal for long-term account growth and building personal wealth. However, you must risk your own capital and bear all losses. If you blow up your account, there’s no safety net (other than deposit more or quit). Growth can also be slower without outside capital to leverage.

In practice, many traders use both approaches. As Babypips recommends, you can “use prop firm accounts to trade larger capital, generate short-term income, and minimize personal financial risk” while using your own account to build long-term wealth. For example, treat the prop account as an “income” generator and your personal account as an “investment fund.” This way you get the benefits of both worlds: the chance to trade big, funded accounts (with lower personal stakes) and the freedom of your own money over time.

Key FAQs

What does a forex prop firm do?

How do forex prop firms make money?

Are prop firms better than trading my own capital?

In summary, forex prop firms offer a structured path for traders to access substantial funds and professional tools. By understanding the evaluation process, business model, and risk controls (and choosing the right firm), skilled traders can get funded and start profiting while sharing the gains with the firm. Always read a firm’s terms carefully and match it to your style – whether you’re a disciplined scalper or a swing trader – to make the most of this unique opportunity.