If you’ve been searching for a reliable prop firm that actually puts traders first, this FundingPips prop firm review is worth your time. In a market full of flashy promises and frustrating restrictions, FundingPips brings something rare: transparency, flexibility, and trust—without compromise.

From flexible payout cycles to platform diversity, FundingPips isn’t just keeping up with industry trends—it’s shaping them.

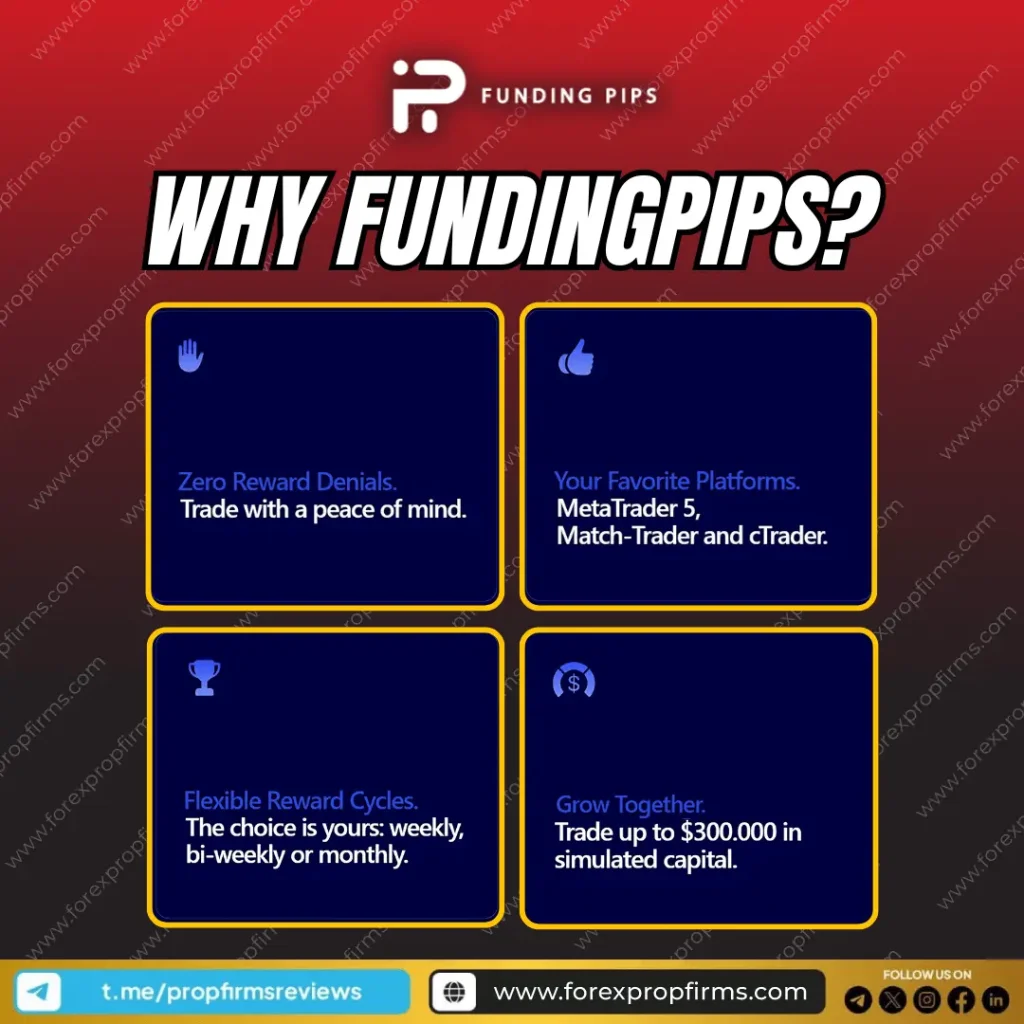

What Makes FundingPips Stand Out?

In a sea of generic prop firms, FundingPips has carved out a name by eliminating some of the most common trader pain points. Here’s a breakdown of what really sets them apart:

- 🔹 Zero Reward Denials – Once you meet the rules, you get paid. Simple.

- 🔹 Platform Freedom – Choose from MT5, Match-Trader, or cTrader—whichever suits your strategy.

- 🔹 Flexible Payout Structure – Weekly, bi-weekly, or monthly—you choose how you get paid.

- 🔹 Scalable Simulated Capital – Start smart and scale up to $300,000 based on performance.

Whether you’re a scalper who thrives on tight setups or a swing trader with longer-term plays, FundingPips offers the tools and structure that adapt to your trading style.

FundingPips Prop Firm Review: A Closer Look at the Experience

Let’s talk details—because transparency is everything when choosing a prop firm.

Payout Structure That Works for You

One of the standout features of FundingPips is its customizable payout cycles. You can opt for weekly, bi-weekly, or monthly payouts, allowing traders to better manage cash flow and reinvest earnings as needed. If you’re tired of rigid or delayed payout models, this is a major plus.

Multiple Platform Support

Another highlight is their support for major trading platforms: MT5, Match-Trader, and cTrader. This is ideal for traders who don’t want to switch platforms just to join a challenge. It also shows that FundingPips is committed to providing options that suit a wide range of strategies and technical setups.

From Startup to Scaled-Up: How You Can Grow With FundingPips

FundingPips is built for growth-minded traders. With capital scaling up to $300,000, the firm offers a clear path for those who want to evolve from smaller accounts to professional-grade capital—without jumping through hoops.

If you’re still evaluating if this firm is right for you, don’t miss our FundingPips review, where we dive deeper into challenge rules, profit split models, and how the firm stacks up against competitors.

Final Thoughts: Is FundingPips the Right Fit?

To sum up this FundingPips prop firm review: if you’re looking for fair rules, real flexibility, and serious scaling potential, this firm deserves your attention.

✅ No reward denials

✅ Weekly to monthly payout cycles

✅ Choice of trading platforms

✅ Up to $300,000 in simulated funding

In a landscape where many prop firms talk big but underdeliver, FundingPips actually walks the talk.