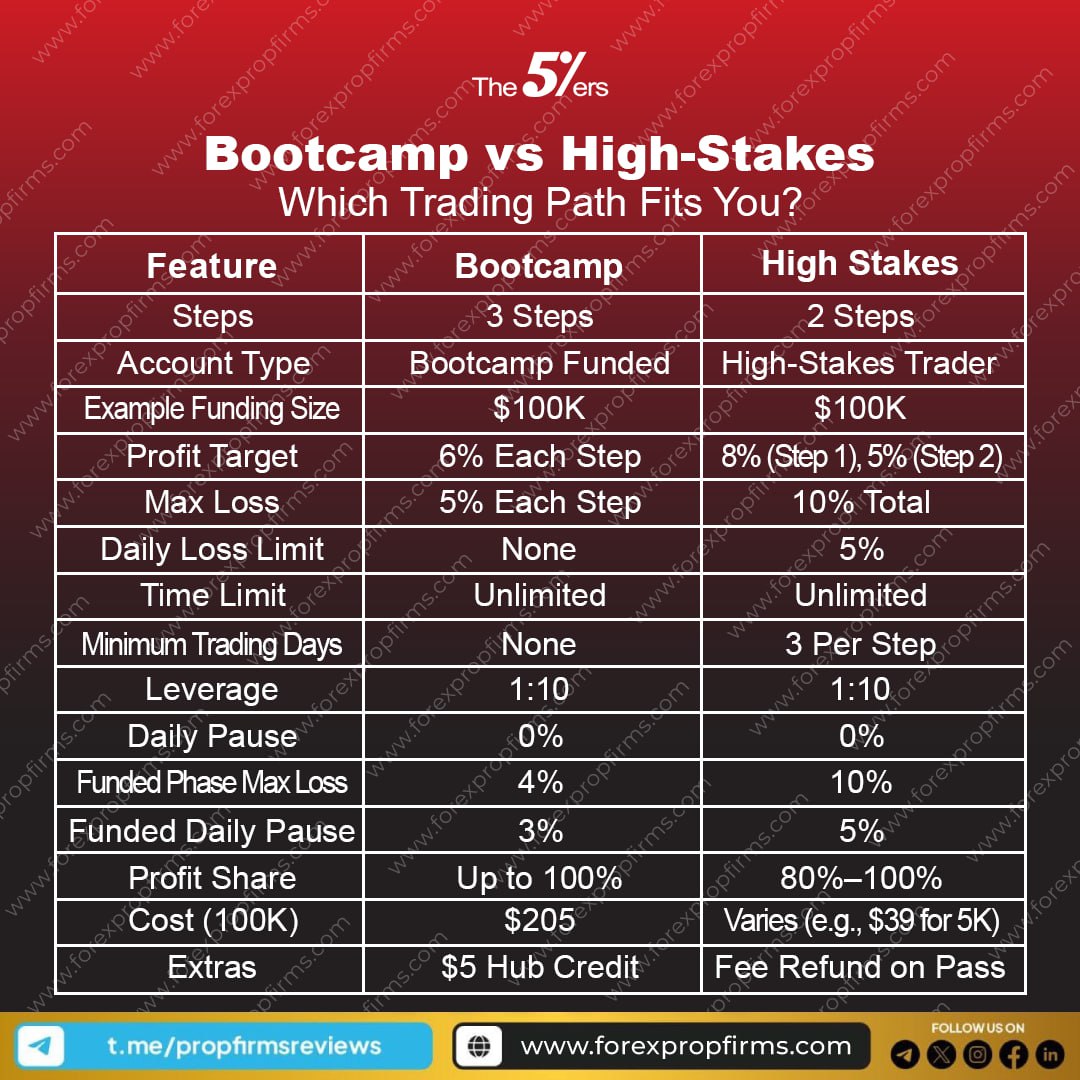

For traders seeking funded accounts, understanding the structure of trading evaluation models is essential. The 5%ers offer two distinct paths—Bootcamp and High-Stakes—each with its own approach to risk, progression, and reward. The Bootcamp model involves a 3-step evaluation, requiring a 6% profit target per step, and notably lacks a daily loss limit. This setup may appeal to traders who prefer flexibility and gradual scaling.

trading evaluation models

On the other hand, the High-Stakes model is more condensed, with only 2 steps and higher initial profit targets—8% in Step 1 and 5% in Step 2. It includes a 5% daily loss limit and a total max loss of 10%, offering a more aggressive structure. Both models provide access to $100K example funding, 1:10 leverage, and unlimited time to complete the evaluation.

Additional features include a $5 hub credit for Bootcamp participants and a fee refund for those who pass the High-Stakes challenge. Profit share ranges from 80% to 100%, depending on performance and model. These trading evaluation models cater to different trader profiles, making it important to assess which structure aligns best with one’s strategy and tolerance for risk.