Are forex prop firms legit? That’s the big question traders are asking as these firms grow in popularity. Forex proprietary (prop) trading firms let individuals trade with the firm’s capital in exchange for a share of profits. Typically, a trader pays an entry fee, passes a “challenge” or evaluation (hit profit targets without breaking risk rules), and then gains access to a funded account. Profits are split between trader and firm.

While the model sounds attractive, not every prop firm is trustworthy. Regulators worldwide – from the CFTC in the US to ESMA in Europe – are already watching closely for fraud. In this article, we’ll break down how prop firms work, why some traders worry they’re scams, and how to separate legit opportunities from shady traps.

What Is a Forex Prop Firm?

A proprietary trading firm is a company that trades financial markets using its own capital (not client money). In the “retail prop firm” model, individual traders essentially borrow the firm’s funds. The trader usually pays an upfront fee to enter an evaluation or “challenge” phase. If the trader meets the targets (for example, make 10% profit without losing more than 5%), they get a funded account – often with tens or hundreds of thousands of dollars. Profits on that account are split with the firm. This setup can be a win-win: skilled traders gain access to large capital, and the firm shares in the upside (and shoulders the losses up to a limit).

Prop firms often provide training, software, and a structured program. They differ from a typical broker in that you never use your own capital. However, that also means the firm sets the rules, fee structures, and payout conditions. This is where skepticism arises: because traders risk only their fee, some firms may be tempted to make passing the challenge extremely hard, or worse, cheat to avoid payouts.

The Boom…and the Skepticism

In recent years, the prop trading model has boomed – especially in forex and crypto. Social media is full of traders bragging about funding challenges or mentoring groups built around funded accounts. This growth has triggered regulatory attention. For example, the US Commodities Futures Trading Commission sued a major firm (Traders Global Group, behind “My Forex Funds”) for alleged deceptive practices. Although that case was eventually dismissed due to legal technicalities, it highlighted a key point: retail prop firms operate in a regulatory gray area.

Briefly, most prop firms use their own money and only trade on their own accounts, so they fall outside many investor-protection rules designed for client funds. In the UK, for instance, prop firms “are not directly regulated by the Financial Conduct Authority (FCA) in the same way as traditional online brokers” because they aren’t handling customer money.

In the US, there is no specific license category for retail prop firms; they must simply obey general trading and fraud laws. Likewise, regulators like the EU’s ESMA and Australia’s ASIC are “monitoring” prop firms and considering new rules, but so far oversight is limited to general consumer protection or specific warnings (for example, the Belgian regulator has warned of “shadow investing” by prop firms).

In short, beware: many prop firms are legitimate companies, but scams exist. Some industry watchers claim “trader-funded firms” have attracted regulators’ attention precisely because there are fraudulent operators. The good news is that reputable prop firms do exist; they simply must be vetted carefully.

How to Spot Legit vs. Scam Prop Firms

When evaluating a prop firm, think of it like a checklist of red flags and green flags. Legitimate firms make a point of transparency and professionalism, whereas scams rely on secrecy and shady tactics. A quick reference:

- Business Model & Fees: Legit firms clearly disclose their fee structure (challenge fees, profit splits, etc.). Scammers hide fees or invent gimmicky charges (e.g. “platform access fees”, “account maintenance fees” beyond the published challenge fee).

- Trading Conditions: Legit firms post their trading rules and goals openly. They usually let you trade on real market accounts if funded. Fake firms often impose secret rules, frequent account shutdowns, or even manipulate trades (e.g. artificial delays or slippage) to make you fail. If anything seems too ambiguous or unfair in the contract, consider it a red flag.

- Payouts History: Legit firms publicize real trader success stories and payout proof. They pay winners on schedule. Scam firms often lack evidence of winners or delay payouts, and traders only get testimonials instead of verifiable records.

- Customer Support: Legit firms provide responsive support (live chat, email, clear contact info). Scammers make it hard to get a real person on the line and dodge questions.

- Regulatory Status: Even though many prop firms are lightly regulated, legit ones will mention any registration or oversight they have. For example, they might be registered in an FCA-approved jurisdiction or be members of the NFA (USA). Scams often have no verifiable company registration or rely on obscure offshore addresses. Always check for a license number or directory listing.

- Reputation & Reviews: Legit firms have a track record – look for independent reviews, social media communities, or forex forum discussions. Scam firms often generate overly positive reviews via affiliates or have multiple complaints of “bait-and-switch” tactics.

When in doubt, use a vetting checklist. Real prop firms are transparent (clear terms, visible team, published profit splits) and have proof of payments to funded traders. Shady prop firms use hidden fees and push trades to fail just to keep your fee. Below is a quick comparison:

- Legit Prop Firms: Clear, written rules; transparent fees; proof of trader payouts; fair profit split; a physical address or office; active community feedback. They often return part of your fee if you pass the test and have customer support readily available.

- Scammy Prop Firms: Ambiguous or hidden rules; demands for extra payments (training, platform, “account” fees); many complaints of blocked accounts or denied payouts; no verifiable address or registration. They may advertise 90–100% profit splits but impose impossible targets and quietly lock out winning traders.

Always err on the side of caution. If a firm’s claim “sounds too good to be true,” it probably is.

Common Scam Tactics to Watch For

In practice, fraudulent prop firms often use these tricks:

- Bait Fees with No Benefit: They lure traders with low challenge fees but then demand additional deposits (“training fee,” “api access fee,” etc.) before you can actually trade. Once they collect money, the platform may disappear or your account gets inexplicably terminated.

- Manipulated Trading Environment: Some run your challenge on simulated platforms without telling you, or introduce slippage/delays so you can’t make the profit target. The CFTC’s complaint against My Forex Funds alleged it was using software to “artificially delay or manipulate trades” to make profitable traders lose.

- Hidden Commissions: They take fees from your account with no notice. For example, the CFTC found one firm was charging a “$3 per trade” fee (never disclosed) to drive accounts to bust.

- Forced Failures: If you come close to passing, the challenge terms may mysteriously change (e.g. allow only one more day to reach target, then remove time). Legit firms do not shift the goalposts.

- No Refunds: Legit firms typically refund part of your fee when you pass (or at least offer “one free retest”). Scam firms keep every penny, even if you completed the challenge requirements.

Always read the small print and search online for others’ experiences. Red flags often appear in forum posts or social media (for example, many traders have called out certain firms for “making the challenge impossible” or never paying after numerous emails).

Legal & Regulatory Outlook

United States: In the US, prop firms that let retail traders trade US futures or forex operate in a gray zone. They’re generally not registered as brokers or dealers because they use their own capital, but they are bound by anti-fraud laws. The CFTC sued a major prop firm (My Forex Funds) for fraud in 2023, alleging hidden fees and manipulated trades.

That case was later dismissed on procedural grounds, but it sent a signal: regulators will act if a firm abuses traders. Legit firms in the US may choose to register with the National Futures Association (NFA) or register as an FCM if they solicit US customers. At a minimum, a trustworthy firm will follow existing laws on disclosures and not make false promises.

United Kingdom: UK prop trading firms are likewise not subject to FCA oversight in the way retail brokers are, since they trade with the firm’s capital. In practice, reputable UK or London-based prop firms might register as specialized trading houses under FCA rules. But many “prop firms” that target UK clients are simply online companies registered elsewhere (as highlighted by one report noting firms often incorporate in the UK, US, UAE or offshore islands). Traders in the UK should check if a prop firm claims any FCA regulation – and then verify it on the FCA Register. Even without specific FCA regulation, UK law still requires firms to avoid unfair practices, so any obviously fraudulent scheme could still face enforcement.

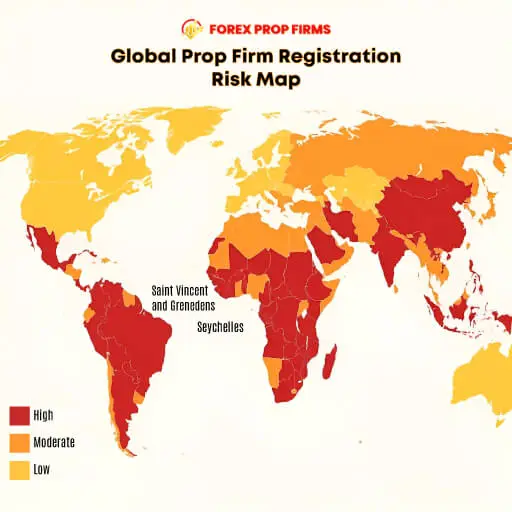

🌍 Where Are Most Prop Firms Registered?

Many retail prop firms avoid strict regulation by incorporating in offshore jurisdictions with light oversight — such as Saint Vincent and the Grenadines (SVG), Seychelles, or UAE free zones. These regions allow firms to operate with minimal regulatory checks, making them attractive for both startups and bad actors.

The heat map below shows the concentration of registered (and often flagged) prop trading firms by region:

📌 Tip: If a firm claims to be registered in an offshore jurisdiction, always double-check its legal status and watch for transparency red flags.

Europe (ESMA & EU): The European Securities and Markets Authority (ESMA) is studying prop trading firms and their risks. Some EU regulators have already issued public warnings: for example, Belgium’s FSMA called prop trading a “game of shadow investing”. Others (in Italy and Spain) have alerted investors to the risks after user complaints. It’s expected that new rules may soon require prop firms to fit under MiFID regulations (as “dealing on own account”) if they service EU clients. In summary, if an EU-based firm says it’s FCA-regulated or NFA-regulated, take it seriously – but if it only claims some vague “supervision,” verify which body.

Australia & Other Jurisdictions: In Australia, ASIC has confirmed it is watching the rise of prop trading, especially since many prop firms offer CFDs under the hood. Other regulators like Cyprus’s CySEC have also hinted they will scrutinize prop firms closely in 2025. Singapore, Hong Kong or other Asia regulators currently have no specific prop firm rules, but general financial and anti-fraud laws still apply.

Takeaway on Legality: Legit prop firms will operate within the law of at least one country, often where they’re incorporated. They may highlight compliance with trading platform regulations or data protection laws. Scam firms tend to hide or omit this information. Always ask: “Where are you registered, and with which regulators?” and confirm independently.

How Do I Know if a Prop Firm Is Real?

Here are common questions skeptical traders ask – with concise answers:

How do I know if a prop firm is real?

Are forex prop firms regulated?

What are common red flags?

Can’t I just pick a big-name prop firm?

Protect Yourself with Due Diligence

Ultimately, treat joining a prop firm like any major financial decision. Do your due diligence:

- Read the fine print: Thoroughly review terms of service, especially termination clauses and profit-split conditions. Legit firms want a “win-win” arrangement. If terms are unfair (giving the firm all flexibility), be skeptical.

- Ask about regulations: “Which regulators oversee you?” Even if the answer is “none directly,” see if they mention any compliance frameworks or internal audits.

- Check reviews: Look for recent trader feedback on independent sites (Forums, Facebook groups, TrustPilot, Reddit, etc.). Genuine funded traders often share proof of profit. One study notes that due diligence is “the name of the game” for picking a firm.

- Start small: If you decide to go ahead, treat the initial fee as a learning expense. Never invest more than you can lose. Good prop firms usually let you try again or scale up without requiring insane new deposits if you pass conditions.

By following these precautions—using a checklist, comparing multiple firms, and verifying credentials—you can steer towards the legitimate operators. Remember that while scams do exist, many prop firms are real businesses offering traders a chance at funding. Balance healthy skepticism with the opportunities offered: if the firm checks all the boxes (transparent, regulated in some way, responsive, proven track record), then it is likely legitimate. Always prioritize your safety and research before parting with any money.