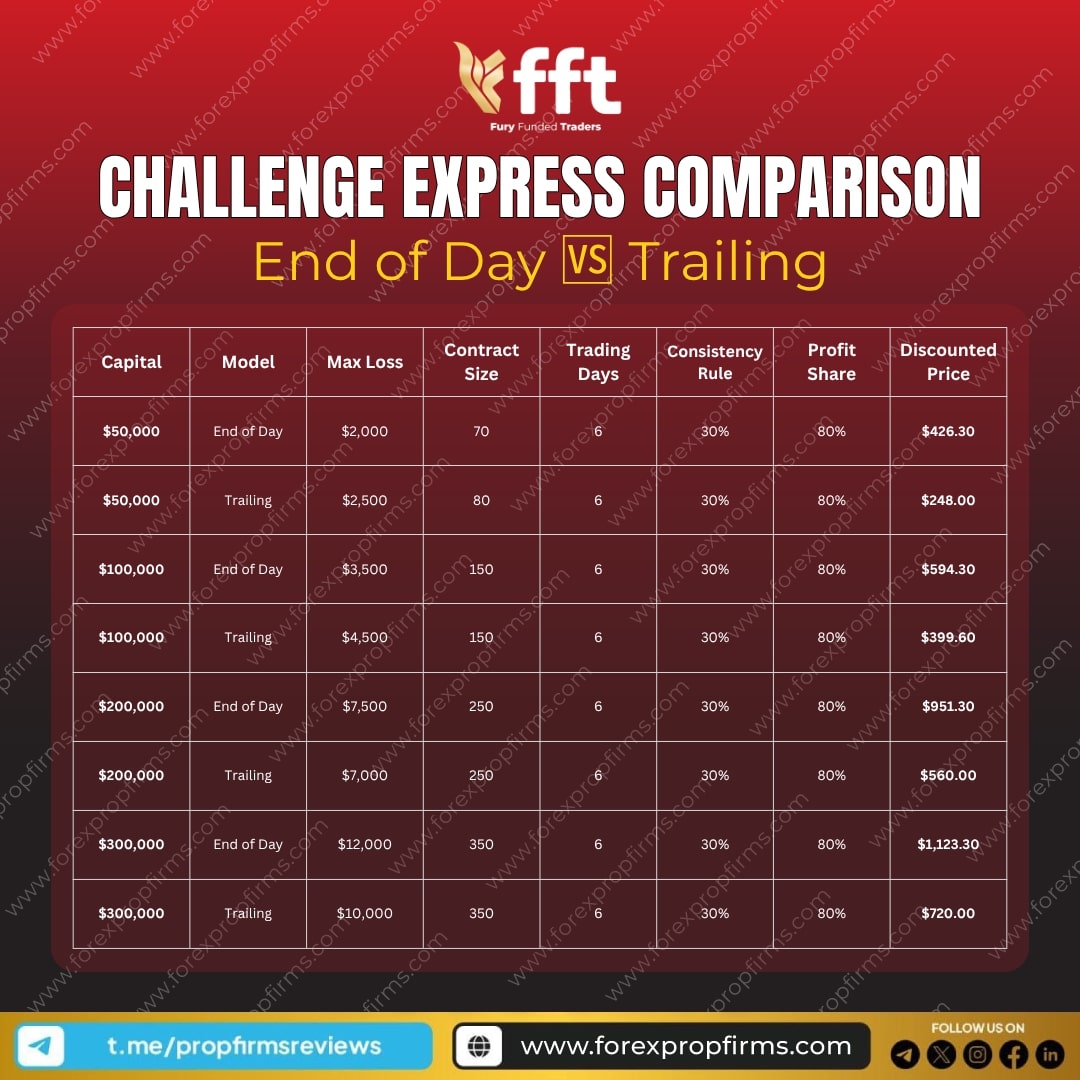

The Fury Funded Trader Challenge Express comparison provides traders with a clear breakdown of how the End of Day and Trailing Drawdown models differ across key evaluation metrics. This overview is designed to help traders understand which structure may align more closely with their risk tolerance, trading pace, and overall strategy. By presenting details such as capital options, maximum loss limits, contract sizes, trading days, and consistency rules, the comparison makes it easier for individuals to assess which model offers a framework that matches their preferred approach.

Fury Funded Trader Challenge Express

The End of Day model may appeal to those who value stable drawdown calculations, while the Trailing model offers a structure that adjusts dynamically with performance. Additionally, the inclusion of discounted prices enables traders to evaluate cost considerations upfront. With both models maintaining the same profit-share structure, the decision ultimately comes down to how a trader manages risk and positions themselves during periods of volatility. This structured comparison equips traders with the necessary information to make a well-informed choice based on their objectives and trading behavior.