In the fast-evolving proprietary trading industry, this thePropTrade review takes a closer look at a rapidly growing prop firm that provides traders with access to simulated funded accounts—without requiring them to risk their own capital. thePropTrade operates with a trader-focused model, offering multiple evaluation programs that reward disciplined trading and proper risk management. With flexible challenge structures, scaling opportunities, and high profit splits, the firm has gained attention among both new and experienced traders in recent years.

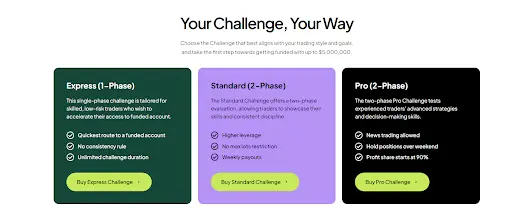

thePropTrade offers several evaluation options, including Express (1-Phase), Standard (2-Phase), and Pro (2-Phase) challenges. Each program is built around predefined profit targets and strict drawdown rules designed to assess a trader’s skill and consistency. Depending on the chosen challenge, traders can work toward accessing funded account sizes that can scale up to $5 million, while earning profit splits of up to 90%, as stated on their official website.

This review covers everything from evaluation program details and trading rules to platform features, scaling policies, and payout structure—providing a clear and accurate picture of what thePropTrade currently offers. Whether you’re a seasoned trader or a beginner looking to enter the prop trading world, understanding how this firm operates is essential before choosing an evaluation program.

Who is thePropTrade?

thePropTrade is a prop-trading firm that offers evaluation Challenges to traders who want to prove their skills and access simulated funded accounts. According to its own website, the firm provides three Challenge options: Standard (2-Phase), Express (1-Phase), and Pro (2-Phase). Through these programs, traders can aim for funded account sizes that the site lists up to $2,000,000.

The firm emphasizes sustainable risk-management principles across all its programs, encouraging disciplined trading and long-term growth. After passing their evaluation, traders must complete a KYC/AML verification before being granted a funded account, according to their FAQ.

Also, thePropTrade confirms that its evaluation and funded accounts use simulated capital, but trades are based on real market prices from liquidity providers.

Brokers That Are Used By thePropTrade

thePropTrade’s trading platform is TradeLocker, a web-based interface available on desktop, tablet, and mobile devices. It integrates powerful risk-management tools such as a margin level bar, pending orders, and a percentage risk tool.

For charting and technical analysis, TradeLocker supports 50+ drawing tools and 100+ trade indicators, giving traders flexibility for advanced strategies. In terms of tradable markets, thePropTrade claims to offer 500+ assets, including forex, indices, metals, energy, and cryptocurrencies.

Leverage settings are clearly defined:

- For evaluation accounts: Forex / Metals up to 1:50, Oils / Indices up to 1:20, Crypto 1:2.

- For funded accounts: Forex up to 1:50, Metals 1:30, Oils / Indices 1:20, Crypto 1:2.

Finally, thePropTrade enforces an activity rule: you need at least one trade every 30 calendar days to maintain your account status.

Who is the CEO of thePropTrade?

Andreas Andreou serves as the CEO of thePropTrade, bringing over a decade of experience in the financial services sector—particularly in forex and CFDs. His career includes executive roles at several prominent brokerages, including serving as the Chief Revenue Officer at BDSwiss, as well as holding senior positions at HFM (formerly HotForex), IronFX, and FXGM.

Andreas’s leadership is marked by a deep understanding of trading infrastructure, client acquisition, and strategic business development. His transition into the proprietary trading industry with the launch of thePropTrade signifies a shift toward creating more accessible and performance-based funding solutions for traders worldwide.

His experience and vision have been central to thePropTrade’s rapid growth and credibility within the prop trading community. Under his guidance, the firm has continued to expand its global footprint and refine its trader-focused model.

thePropTrade Review: How to Get Funded?

thePropTrade provides several evaluation programs, each tailored to different trading styles and experience levels. These programs are designed to assess trader skill, risk management, and consistency. The main programs listed on the official site are:

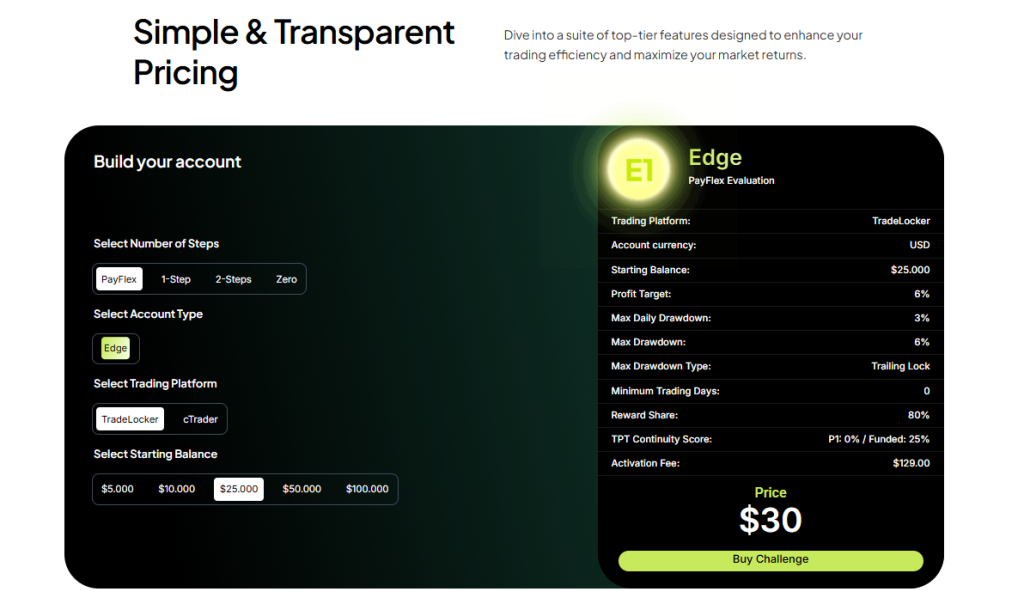

PayFlex Evaluation (Edge)

The PayFlex Evaluation is a flexible program allowing traders to complete the challenge without strict time limitations. Features include:

- Profit target: 12%

- Daily drawdown: 4%

- Overall drawdown: 7%

- Minimum trading days: 3

- Consistency rule: Not required

This program is suitable for traders who prefer more time to complete evaluations and a less restrictive format.

1-Step Evaluation (Classic)

The 1-Step Evaluation is designed for traders looking for a single-step challenge:

- Profit target: 12%

- Daily drawdown: 4%

- Overall drawdown: 7%

- Time limit: Unlimited

- Consistency rule: Not required

It is ideal for traders who want to avoid multi-phase evaluations and reach funded accounts quickly.

2-Step Evaluation (Classic)

The 2-Step Evaluation is the standard offering:

Key features of the Pro Challenge include:

- Phase 1 profit target: 8%

- Phase 2 profit target: 5%

- Daily drawdown: 5%

- Overall drawdown: 10%

- Minimum trading days: None (unlimited duration)

- Consistency rule: Required

This program ensures traders demonstrate both profitability and consistent risk management across two stages before accessing a funded account.

Zero Evaluation (Instant Funding)

The Zero Evaluation program provides instant funding:

- Traders receive immediate access to a funded account

- Profit splits start at 90%

- All funded accounts are based on simulated capital but trade with real market quotes

- Scaling opportunities are available once profit targets are achieved

This program is aimed at experienced traders who prefer to trade immediately without completing standard evaluation phases.

thePropTrade Scaling Plan & Funding Programs

thePropTrade offers a structured scaling plan to grow funded account balances based on performance. Traders can scale accounts up to $5 million. The scaling criteria include maintaining consistent profitability over four consecutive months.

| Scaling Criteria | Account Growth |

|---|---|

| 10% profit per month for 4 consecutive months | 25% account balance increase |

| Withdrawal of profits during scaling | Allowed; scaling progress unaffected |

| Post-scaling profit targets | No requirement to re-hit previous targets |

Scaling ensures traders are rewarded for consistent performance while maintaining strict risk management guidelines.

Trading Instruments and Platforms at thePropTrade

Before diving into specific instruments, it’s important to understand that thePropTrade provides a comprehensive trading environment where traders can access a wide variety of markets through its proprietary TradeLocker platform. This combination of diverse assets and advanced platform features ensures that traders can implement multiple strategies, whether focusing on short-term scalping, swing trading, or long-term position trading. The platform’s integration with TradingView further enhances analysis capabilities, offering professional-grade tools for both novice and experienced traders.

Trading Instruments at thePropTrade

thePropTrade offers access to 500+ tradable assets, including:

- Forex: Major, minor, and exotic currency pairs

- Metals: Gold, Silver, Platinum

- Indices: Global indices

- Energy: Oil and natural gas

- Cryptocurrencies: Bitcoin, Ethereum, and others

All trading is done on simulated accounts with real market quotes, allowing for a realistic trading experience without personal capital risk.

Trading Platforms at thePropTrade

- TradeLocker platform: web-based, desktop, and mobile

- Integration with TradingView: advanced charting and analysis

- Technical tools: 100+ indicators, 50+ drawing tools

- Risk management tools: margin bar, pending orders, percentage risk tools

- Execution: One-click trading and simulated live-market pricing

By combining a wide range of trading instruments with a sophisticated and user-friendly platform, thePropTrade offers a comprehensive trading environment designed to support traders in achieving their financial goals.

thePropTrade Trading Conditions: Spreads, Fees, and Rules

Before exploring the specific details of spreads, fees, and leverage, it’s important to note that thePropTrade maintains a transparent and structured trading environment. Each evaluation and funded account is governed by clearly defined rules that help traders manage risk, maintain discipline, and optimize performance. Understanding these conditions is essential for anyone considering an account, as they directly impact strategy, profit potential, and risk management.

Spreads

- Spreads are variable and market-based, reflecting real-time pricing from liquidity providers.

These tight spreads can enhance trading efficiency, particularly for strategies sensitive to transaction costs. By maintaining low spreads, thePropTrade supports traders in maximizing profitability while minimizing trading expenses.

Fees

- No hidden or recurring fees.

- The only fee is the evaluation fee, which is refundable under certain conditions (see Refund Policy).

This transparent fee structure allows traders to anticipate costs accurately and tailor their strategies accordingly.

Leverage

| Asset Type | Evaluation Accounts | Funded Accounts |

|---|---|---|

| Forex / Metals | Up to 1:50 | Forex 1:50, Metals 1:30 |

| Oils / Indices | Up to 1:20 | 1:20 |

| Crypto | 1:2 | 1:2 |

This leverage structure allows traders to optimize their strategies while adhering to the firm’s risk parameters.

Trading Rules

- Maximum overall drawdown: Static, does not trail with equity

- Daily drawdown limits: Specified per program

- Minimum trading activity: At least 1 trade every 30 days

- News trading: Allowed in Pro challenge

- Weekend trading: Allowed in Pro challenge

- Hedging: Allowed within a single account

- Swap-free accounts: All accounts are swap-free

- Stop loss: Not required on every trade, according to evaluation rules

These rules are designed to encourage effective risk management and consistent performance.

By understanding the key aspects of thePropTrade’s trading conditions, traders can better align their strategies with the firm’s expectations and enhance their chances of passing the challenge.

Subscription and Payment Methods at thePropTrade

Before diving into the details of subscription fees, it’s important to understand that thePropTrade offers a variety of flexible funding programs designed to accommodate traders of all experience levels. Each program comes with a clearly defined fee structure, giving traders full transparency on costs before starting an evaluation. By outlining these options, traders can make informed decisions about which program aligns best with their trading goals and strategy.

Subscription Options and Associated Fees

| Evaluation Program | Fee |

|---|---|

| PayFlex Evaluation (Edge) | Refer to site |

| 1-Step Evaluation (Classic) | Refer to site |

| 2-Step Evaluation (Classic) | Refer to site |

| Zero Evaluation (Instant Funding) | Refer to site |

Available Payment Methods

| Method | Notes |

|---|---|

| Credit/Debit Card | Accepted on site |

| Bank Transfer | Supported |

| E-Wallets | Supported; details on site |

Withdrawal Policies

- Minimum withdrawal: USD 100

- Payouts processed weekly (Fridays)

- No fees charged by thePropTrade; external provider fees may apply

- Profit splits up to 90%

Refund Policy

- Refunds are available if no trades are placed within 14 calendar days

- Also refunded after the second funded account reward, per FAQ

Payment Proof

- Traders report payouts processed weekly

- Verification via TradeLocker account dashboard

thePropTrade vs. Hantec Trader vs. Goat Funded Trader: A Comparative Overview

As the demand for proprietary trading opportunities continues to surge, traders are met with a growing array of firms offering funded accounts and performance-based models. Among them, thePropTrade, Hantec Trader, and Goat Funded Trader each bring distinct value propositions to the table. From flexible evaluation structures to varied profit-sharing schemes, understanding these differences is key to selecting the firm that best matches your trading goals and strategy.

Below is a detailed comparison of their core features, designed to help traders make an informed decision.

| Feature | thePropTrade | Hantec Trader | Goat Funded Trader |

| Initial Capital | $5,000 – $100,000 | $2,000 – $200,000 | $5,000 – $200,000 |

| Evaluation Process | PayFlex Evaluation, 1-Step Evaluation, 2-Step Evaluation, Zero Evaluation | Express (1-Stage), Enhanced (2-Stage) | 1-Step, 2-Step, 3-Step, Instant Funding |

| Profit Split | 80% standard; up to 90% with scaling | Up to 90% | 80% standard; up to 100% with add-ons |

| Scaling Plan | Up to 90% profit split through scaling | Scale up to $200,000 accounts upon challenge completion | Not specified |

| Tradable Instruments | Forex, Metals, Oils, Indices, Cryptocurrencies | Not specified | Not specified |

| Trading Platforms | MetaTrader 4, MetaTrader 5 | Not specified | MetaTrader 5 |

| Maximum Drawdown | 7% (Express), 10% (Standard) | 6% | 6% |

| Daily Loss Limit | 4% (Express), 5% (Standard) | 5% | 4% |

| Minimum Trading Days | 3 | 0 | None |

| Maximum Trading Days | Unlimited | Not specified | Unlimited |

| News Trading Allowed | Yes | Not specified | Yes |

| Weekend Holding Allowed | Yes | Not specified | Yes |

| Leverage | Up to 1:50 (Forex, Metals, Oils, Indices); 1:2 (Cryptocurrencies) | Not specified | Up to 1:30 |

Key Takeaways:

- thePropTrade offers a variety of evaluation processes with competitive profit splits and a flexible scaling plan, catering to traders aiming for growth and adaptability.

- Hantec Trader provides straightforward evaluation stages with the potential to scale up to higher account sizes, appealing to traders seeking clear progression paths.

- Goat Funded Trader stands out with its high potential profit splits and the option for instant funding, making it attractive for traders looking for immediate opportunities.

Each firm presents distinct advantages, and traders should consider their individual trading styles, risk tolerance, and growth objectives when selecting from the top forex prop firms that best align with their professional goals.

thePropTrade Trader Community and Support

In the realm of proprietary trading, the strength of a firm’s community and the robustness of its support systems are pivotal to a trader’s success. thePropTrade recognizes this and has cultivated a comprehensive ecosystem designed to empower traders through continuous education, active community engagement, and responsive support services.

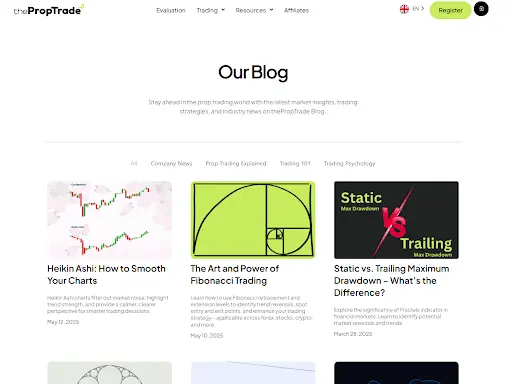

Educational Resources & Webinars

At the heart of thePropTrade’s commitment to trader development lies a wealth of educational resources. The firm offers a series of webinars and live sessions accessible via their Discord server and X (formerly Twitter) platforms. These sessions delve into various trading topics, providing traders with insights into market dynamics and trading strategies.

Complementing these live sessions, thePropTrade maintains an informative blog that covers a range of trading concepts. Articles such as “The Market’s Mood: Understanding Trading Sentiment” and “The Art and Power of Fibonacci Trading” offer traders valuable perspectives on market psychology and technical analysis techniques. These resources are instrumental in helping traders refine their strategies and deepen their market understanding.

Community Engagement & Social Presence

thePropTrade places a strong emphasis on fostering a vibrant trading community. Their Discord server serves as a central hub where traders can engage in real-time discussions, share insights, and collaborate on trading strategies. This platform encourages peer-to-peer learning and provides a space for traders to support one another.

Beyond Discord, thePropTrade maintains an active presence on various social media platforms, including X (formerly Twitter). Through these channels, the firm shares updates, educational content, and success stories, keeping the community informed and engaged.

24/7 Trader Support

Understanding the dynamic nature of trading, thePropTrade offers round-the-clock customer support to address traders’ needs promptly. Traders can reach out to the support team via live chat, email, or through the Discord community channel. This 24/7 availability ensures that assistance is readily accessible, regardless of time zones or trading hours.

The firm’s support extends beyond technical assistance. Traders undergoing the KYC/AML verification process receive guidance to ensure a smooth transition to funded accounts. Additionally, the support team is available to address inquiries related to account management, trading rules, and platform navigation.

Knowledge Base & Help Center

To empower traders with self-service options, thePropTrade provides a comprehensive Help Center. This repository offers detailed information on various aspects of trading with the firm, including account setup, trading objectives, and platform usage. By accessing the Help Center, traders can find answers to common questions and gain clarity on the firm’s procedures and policies.

Community Initiatives

thePropTrade goes beyond just funding traders—it builds a thriving community. While there may not be explicit mentions of giveaways or challenges, the firm demonstrates its commitment through value-driven community initiatives. These include interactive webinars, highly active social media platforms, and responsive customer support, all designed to empower and connect traders at every stage.

At the core of thePropTrade’s mission is trader development through education and engagement. The firm offers comprehensive learning resources, real-time guidance, and a collaborative environment where traders can share experiences and grow together. This strong support system enables traders to:

✅ Develop smarter trading strategies

✅ Improve risk management skills

✅ Work towards long-term profitability

Whether you’re a beginner or an experienced trader, thePropTrade provides the tools, knowledge, and community backing you need to succeed in the competitive world of trading.

Traders’ Opinions

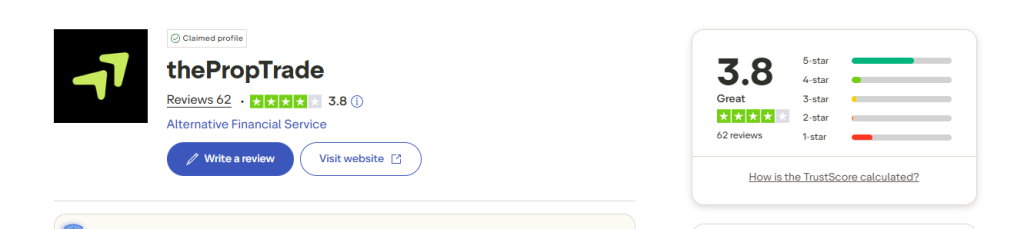

thePropTrade holds a Trustpilot rating of 4.3 out of 5 stars, based on 20 reviews, classifying it as Excellent. Many users praise the platform for its transparency, user-friendly experience, and efficient customer support. A strong proportion of 5-star ratings indicates general satisfaction, while only a small fraction of users expressed concerns.

This positive feedback highlights thePropTrade’s commitment to delivering a reliable and professional trading environment, earning trust among both novice and experienced traders.

thePropTrade Review: Pros and Cons

Evaluating the strengths and limitations of thePropTrade is essential for traders looking to engage with a proprietary trading firm that emphasizes flexibility and performance-based rewards. This balanced overview offers insight into whether thePropTrade aligns with your trading goals and expectations.

Pros and Cons

| Pros | Cons |

| Access to Funded Capital: thePropTrade offers funded accounts up to $200,000, giving traders the chance to grow without risking personal capital. | Evaluation Fees: Participation requires a one-time challenge fee, which may be seen as a barrier by budget-conscious traders. |

| High Profit Split Potential: Traders begin with an 80% profit split, which can increase to 90% based on performance and scaling achievements. | Strict Trading Objectives: The two-step evaluation process includes fixed profit targets and drawdown limits, requiring disciplined execution. |

| Flexible Trading Rules: thePropTrade allows news trading, weekend holding, and imposes no minimum trading days, providing greater strategic freedom. | Limited Asset Transparency: While the firm supports forex and commodities, a full asset list isn’t readily available on the site, which may limit certain strategies. |

| Cost-Effective Entry: Evaluation fees are relatively affordable compared to other firms, starting at just $109, and are fully refundable upon success. | Scaling Plan Criteria: Access to capital scaling depends on consistently meeting performance goals, which can be challenging during volatile markets. |

Key Takeaways:

- Low-Cost, High-Reward Model: thePropTrade allows traders to prove their skills and access large capital allocations for a relatively small and refundable fee.

- Trader-Friendly Flexibility: With no minimum trading days and relaxed rules on holding over weekends or trading news events, traders have more control over their strategy.

- Performance-Driven Scaling: Traders can benefit from increased payouts and larger accounts by consistently meeting targets, though the path requires precision and risk control.

Ultimately, thePropTrade combines flexibility, affordability, and strong profit incentives into a platform well-suited for serious traders seeking a practical path to professional capital management.

Is thePropTrade Worth It?

thePropTrade positions itself as a competitive player in the prop trading space, offering traders up to $200,000 in funded capital and an attractive profit split of up to 90%. With flexible challenge rules, instant funding options, and low profit targets, the platform provides an accessible route for both beginners and seasoned traders to prove their skills and scale their accounts—without putting their own funds at risk.

What truly sets thePropTrade apart is its transparency in payouts, round-the-clock support, and trader-focused evaluation structure, which minimizes unnecessary constraints. Their simplified pricing, clear rules, and real-time support all contribute to a streamlined experience for serious traders.

As highlighted in this theproptrade review, the firm offers a low-barrier, high-reward funding model, making it a compelling opportunity for those seeking to access substantial capital and grow within a structured, yet supportive, environment.

The Final Words

ThePropTrade is steadily making its mark in the competitive world of proprietary trading, offering a well-rounded platform tailored for both aspiring and experienced traders. With funded accounts reaching up to $200,000 and a scaling plan that rewards consistency, the firm creates a dynamic environment where disciplined traders can truly thrive.

One of the standout features is the up to 90% profit split, which allows traders to maximize their earnings without restrictive conditions. Unlike many competitors, ThePropTrade enforces no minimum trading days, giving traders full control over their pace. Plus, with the freedom to hold trades over the weekend and participate in news trading, it caters to modern strategies and diverse trading styles.

If you’re researching the best prop firms to start with, this ThePropTrade review highlights how its unique mix of flexibility, transparency, and trader-focused features creates a compelling route to success. Its commitment to education, community support, and fair trading conditions makes it more than just a funding firm—it’s a partner in your trading journey. Whether you’re building your first funded account or scaling your trading business, ThePropTrade equips you with the tools, opportunities, and support to go further.

FAQs

1. What payout method does thePropTrade use?

Payouts are processed via cryptocurrency (BTC, ETH, or USDT), debit/credit card, and bank transfer.

Approved profit withdrawals are paid bi-weekly and typically completed within 1 to 3 business days, with no minimum withdrawal threshold and up to 90% profit split for top-performing traders.

2. How does the funding process work at thePropTrade?

Traders must pass either a one-phase (Express) or two-phase (Standard/Pro) challenge to receive funding.

These challenges assess profitability and risk management, and upon passing, traders can manage up to $200,000 in funded accounts with scaling opportunities and flexible trading rules like weekend holding and news trading.

3. What is the profit split at thePropTrade?

Traders start with an 80% profit split, which can increase to 90% based on performance.

This competitive split rewards consistency and is part of thePropTrade’s scaling plan for funded traders who meet performance milestones over time.

4. Is thePropTrade a regulated firm?

No, thePropTrade is not regulated by any recognized financial authority.

While it operates under QuantElite – FZCO in Dubai, traders should be aware that the absence of regulation and undisclosed liquidity partners may pose risk factors for some individuals.

5. What trading platforms and instruments are available at thePropTrade?

thePropTrade uses the TradeLocker platform with TradingView integration, offering over 500 instruments.

Traders can access forex, metals, indices, commodities, and cryptocurrencies with competitive spreads and leverage up to 1:100 for most assets.

6. Are the evaluation fees at thePropTrade refundable?

Yes, evaluation fees are fully refundable after passing the challenge and receiving the first profit payout.

This one-time fee ranges from $109 to $749 depending on the account size, and there are no recurring costs or hidden charges.