In the evolving landscape of proprietary trading, SabioTrade has emerged as a modern and tech-driven prop trading firm that provides traders the chance to access institutional-grade capital without risking their own funds. Built around transparency, education, and discipline, SabioTrade combines a flexible funding model with an integrated trading academy to help traders of all levels succeed. But is SabioTrade truly a reliable choice for traders in 2025? This SabioTrade review explores their account types, rules, profit splits, and evaluation process to help you determine whether this firm aligns with your trading goals.

Unlike traditional brokers, SabioTrade operates on a performance-based structure where traders undergo an evaluation phase to demonstrate consistent profitability and risk control. Upon passing, they can trade real funds and earn up to 90% profit split, depending on the selected plan. SabioTrade’s account sizes range from $20,000 to $650,000, catering to both beginners and advanced traders, with leverage up to 1:30 on forex and variable limits for other instruments such as indices, commodities, and crypto.

This SabioTrade Review will further discuss the firm’s rules, payout conditions, and platform features—including its partnership with QuadCode technology—to provide a complete and authentic picture of how the firm operates. Whether you are a new trader seeking growth capital or an experienced professional exploring flexible funding solutions, understanding SabioTrade’s structure and policies is key before joining their program.

Who is SabioTrade?

SabioTrade is a proprietary trading firm that provides traders with the opportunity to trade using company-funded accounts while maintaining strict risk management standards. According to its official website, SabioTrade operates as a global prop trading platform powered by QuadCode technology, offering access to a wide range of financial instruments, including Forex, Stocks, Indices, Commodities, ETFs, and Cryptocurrencies. The firm’s mission is to help traders grow their skills and careers by providing both capital access and professional education through its integrated Sabio Academy.

What distinguishes SabioTrade from many other firms is its focus on transparency, structured trading rules, and realistic funding conditions. The company offers account balances ranging from $20,000 to $650,000, allowing traders to earn up to a 90% profit split depending on their plan. Traders can also test the platform risk-free through a 7-day free trial, gaining first-hand experience of the trading environment before purchasing an evaluation plan.

While SabioTrade’s website does not publicly list a physical office address, its operations, funding structure, and risk policies are clearly defined online, ensuring traders understand all terms before joining. Through its proprietary system and commitment to fair trading conditions, SabioTrade positions itself as a professional-grade prop firm designed for both emerging and experienced traders seeking institutional-style trading access.

Brokers That Are Used By SabioTrade

SabioTrade operates its proprietary trading environment through the QuadCode trading platform, a technology provider known for delivering fast execution, real-time analytics, and multi-asset trading capabilities. According to the firm’s official website, SabioTrade’s infrastructure is fully powered by QuadCode technology, ensuring a smooth and efficient trading experience for users across different asset classes such as Forex, Stocks, Indices, Commodities, ETFs, and Cryptocurrencies.

While SabioTrade does not publicly disclose any partnership with third-party brokers or specific liquidity providers, its collaboration with QuadCode suggests that it utilizes an in-house execution system rather than relying on external brokers like MetaTrader-based firms do. This setup allows SabioTrade to maintain direct control over pricing, spreads, and execution speed, ensuring transparency and fairness during both the evaluation and funded trading phases.

The integration with QuadCode also enables traders to access an intuitive interface and institutional-grade tools, aligning SabioTrade with modern fintech-driven prop trading models.

SabioTrade Review: How to Get Funded?

In the realm of prop trading, SabioTrade offers a single-step evaluation process that traders can complete at their own pace—there is no maximum time limit, as long as the trader places at least one trade every 30 days.

1. Assessment / Evaluation Phase

- Traders aim for a 10% profit target to pass the assessment.

- The Daily Loss Limit is capped at 5%, measured relative to the prior day’s end-of-day balance.

- The Maximum Trailing Drawdown is 6%, and this includes unrealized P&L (open trades) in its calculation.

- There is no minimum number of trading days required—traders may complete the assessment in as little time as they reach the profit target.

- Traders are allowed to hold positions over the weekend under standard plans.

Once a trader satisfies the above conditions (profit target, loss/drawdown limits, and maintaining activity), they qualify for the funded account stage.

2. Funded / Live Trading Stage & Profit Sharing

- After passing, traders receive a funded trading account under the same set of risk rules.

- Profit splits: Starting payout splits of 80%, increasing up to 90%, depending on the account (tariff) level.

- Traders may request weekly payouts, provided all criteria are met.

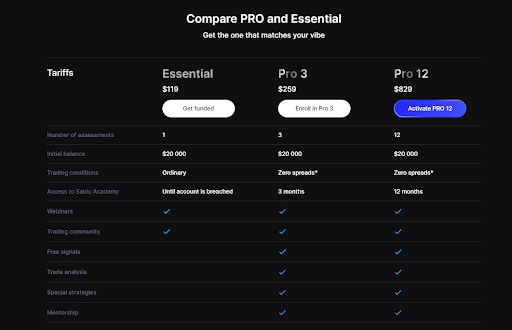

3. Account Plans / Tariffs & Key Parameters

SabioTrade offers a variety of “tariffs” (account types) with different funding levels. Some details from their official site:

| Tariff | Initial Balance | Profit Target | Daily Loss Limit | Max Trailing Drawdown | Profit Split | Notes |

| Essential | $20,000 | 10% | 5% | 6% | 80% | No minimum trading days, no time limit |

| Plus | $50,000 | 10% | 5% | 6% | 80% | Same base rules |

| Advanced | $100,000 | 10% | 5% | 6% | 90% | Higher split |

| Ultimate | $200,000 | 10% | 5% | 6% | 90% | More capital |

| Prime | $650,000 | 10% | 5% | 6% | 90% | For elite level |

Also, SabioTrade supports multiple asset classes with different maximum leverages:

- Forex: 1:30

- Equities (Stocks): 1:20

- Commodities: 1:25

- Cryptocurrencies: 1:3

- Indices (e.g. S&P500, DAX): 1:100

- ETFs: 1:20

SabioTrade Scaling Plan & Funding Programs

SabioTrade provides traders with a clear and flexible pathway to access funded capital through its multi-tiered account plans and progressive scaling system. Designed for both aspiring and experienced traders, the firm emphasizes performance-based growth — rewarding consistent profitability with higher capital allocations and improved profit splits.

The process begins with an assessment phase, where traders are required to demonstrate discipline, consistency, and proper risk management. Unlike many competitors, SabioTrade offers no time limit to complete this evaluation. This allows traders to trade at their own pace, maintaining control over strategy execution without the pressure of strict deadlines. Once the trader achieves the required profit target of 10% while adhering to the firm’s risk limits — a 5% daily loss and 6% maximum trailing drawdown — they can qualify for funding.

Upon successful completion, traders gain access to a SabioFunded Account, where they can trade with real capital and retain up to 90% of their profits. The firm’s scaling plan encourages long-term consistency: traders who maintain profitability and adhere to the firm’s rules can request account scaling, increasing their capital allocation over time.

Below is an overview of SabioTrade’s Funding Programs as listed on their official website:

| Program | Key Features | Scaling & Profit Split | Who It’s For? |

| Essential Account | – Entry-level funding option.- Initial balance: $20,000.- Profit target: 10%.- Risk limits: 5% daily, 6% trailing.- Leverage: up to 1:30 on Forex. | – Profit split: 80%.- Eligible for account scaling upon consistent profits.- Designed for gradual growth and discipline-building. | Beginner traders seeking to learn within a structured and low-capital environment. |

| Plus Account | – Intermediate level plan.- Initial balance: $50,000.- Similar risk parameters as Essential. | – Profit split: 80%.- Can be scaled after proven profitability and rule compliance. | Intermediate traders aiming for larger exposure and steady growth. |

| Advanced Account | – Professional plan with higher targets.- Initial balance: $100,000.- Access to higher potential rewards. | – Profit split: 90%.- Eligible for scaling to higher tiers with continued success. | Professional traders with consistent performance and advanced strategy execution. |

| Ultimate Account | – High-tier plan for experienced traders.- Starting balance: $200,000.- Increased growth potential and payout frequency. | – Profit split: 90%.- Account can scale to higher balances through consistent returns. | Traders seeking to manage significant capital while maintaining risk discipline. |

| Prime Account | – Elite-tier plan.- Starting balance: $650,000.- Designed for high-performing traders. | – Profit split: 90%.- Scaling opportunities available for top performers. | Institutional-level traders looking for maximum funding and flexibility. |

SabioTrade’s approach to scaling reflects its focus on rewarding consistent and risk-conscious traders. Each plan is structured to help traders gradually grow their capital while enjoying favorable profit-sharing terms. With no minimum trading days, no time restrictions, and a performance-based growth system, SabioTrade offers one of the more trader-friendly funding programs in the proprietary trading industry.

Trading Instruments and Platforms at SabioTrade

In evaluating SabioTrade, one of the stand-out features is the combination of a proprietary trading platform (“Traderoom” / “Traderoom mobile app”) together with a robust dashboard, plus a broad set of tradable asset classes. Below are the 100% authenticated facts about what SabioTrade offers in terms of instruments and trading platform setup.

Trading Instruments at SabioTrade

- SabioTrade offers 250+ assets to trade.

- Asset classes supported include Forex, Stocks, Commodities, Indices, ETFs, and Cryptocurrencies.

- Intraday account plans are offered with 1:100 leverage.

Trading Platform & Tools

- SabioTrade features a proprietary platform (often referred to as “SabioTraderoom” or “Mobile Traderoom”) integrated with their dashboard, so traders can trade directly via SabioTrade’s own system rather than requiring external platforms.

- The platform includes over 100 built-in technical indicators, news feed, price alerts, widgets, calendar, etc.

- Multi-charting: traders can display up to 9 charts simultaneously on their platform.

- SabioTrade has a mobile app (iOS & Android) that provides many of the “Traderoom” features: news feed, indicators, support, etc. The app is optimized for mobile screens, and designed to work even in weaker internet conditions.

SabioTrade Trading Conditions: Spreads, Fees, and Rules

When evaluating SabioTrade as a proprietary trading firm, it’s essential to understand their trading conditions, including spreads, fees, and rules. These elements define the trading environment and help traders align their strategies effectively.

Spreads

SabioTrade offers competitive spreads across various instruments, ensuring cost-effective trading for its users. For major forex pairs like EUR/USD, the spread is approximately 0.4 pips, contributing to SabioTrade’s spreads being among the most attractive in the industry. Indices such as the US100 have spreads around 2.20 points, while commodities like XAU/USD (Gold) feature spreads near 0.08 points. Cryptocurrencies, including BTC/USD, exhibit spreads of about 28.10 points. These tight spreads can enhance trading efficiency, particularly for strategies sensitive to transaction costs. By maintaining low spreads, SabioTrade supports traders in maximizing profitability while minimizing trading expenses.

Fees

SabioTrade’s fee structure varies by asset class:

- Forex: A commission of $3 per lot is applied.

- Commodities: Gold incurs a commission of $1.98 per lot, and Silver $1.20 per lot.

- Indices and Cryptocurrencies: No commissions are charged, as SabioTrade absorbs these costs.

- Stocks: Commissions depend on contract size, number of lots, instrument price, and a percentage commission.

This transparent fee structure allows traders to anticipate costs accurately and tailor their strategies accordingly.

Leverage

SabioTrade offers flexible leverage options to accommodate various trading styles. For forex, the standard SabioTrade leverage is up to 1:100, allowing traders to maximize their positions while maintaining effective risk management. For indices and commodities, the leverage can vary, ensuring that traders have access to appropriate margin requirements. Understanding SabioTrade leverage is crucial for traders aiming to optimize their strategies while adhering to the firm’s risk parameters.

Trading Rules

SabioTrade enforces specific rules to promote disciplined trading:

- Maximum Daily Loss: Traders must not exceed a 5% loss of the initial account balance in a single day.

- Maximum Overall Loss: A cumulative loss limit of 10% of the initial account balance is imposed.

- Profit Target: During the SabioTrade Challenge phase, traders are required to achieve a 10% profit target.

- Minimum Trading Days: A minimum of 4 trading days ensures consistent trading activity.

These rules are designed to encourage effective risk management and consistent performance.

By understanding the key aspects of this SabioTrade review, traders can better align their strategies with SabioTrade’s expectations and enhance their chances of passing the challenge.

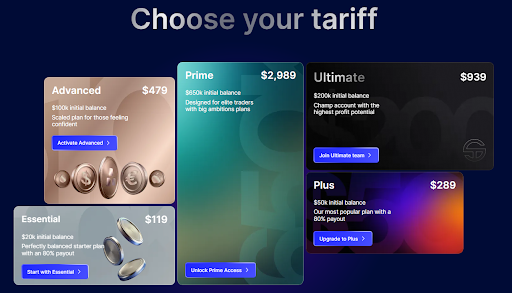

Subscription and Payment Methods at SabioTrade

In this SabioTrade review, understanding the subscription structure and payment methods is essential for traders who are planning to join the firm’s evaluation programs. SabioTrade follows a straightforward subscription-based model, offering multiple account tiers at different price points to suit traders of varying experience levels and risk appetites. The firm emphasizes transparency, affordability, and flexibility, making it easier for traders to choose a program that matches their goals and budget.

Subscription Options and Associated Fees

SabioTrade operates with a one-time subscription fee structure. Each account tier comes with its own initial funding amount and corresponding cost. These fees grant traders access to SabioTrade’s assessment process and, upon successful completion, a funded trading account. The subscription costs are competitively priced, considering the profit split and growth potential offered under each plan.

Below is an overview of SabioTrade’s subscription options and their corresponding fees, as officially listed:

| Account Size | Subscription Fee (USD) | Refundable |

| $20,000 (Essential) | $119 | No |

| $50,000 (Plus) | $289 | No |

| $100,000 (Advanced) | $479 | No |

| $200,000 (Ultimate) | $939 | No |

| $650,000 (Prime) | $2,989 | No |

SabioTrade’s pricing model allows traders to select the account tier that best aligns with their capital ambitions and trading strategy. While the subscription fee is non-refundable, traders gain access to SabioTrade’s mentorship programs, trading dashboard, and Sabio Academy, adding educational value beyond the assessment itself.

Available Payment Methods

SabioTrade provides a diverse range of secure and globally accessible payment options, ensuring convenience for traders across different regions. According to the official website, traders can complete their subscription using major online and digital payment systems.

| Payment Method | Availability | Processing Time |

| Credit/Debit Card | Visa, MasterCard, and other major providers | Instant |

| Cryptocurrency | Bitcoin, Ethereum, USDT, and other supported tokens | Instant / Within a few hours |

| Bank Transfer | Available globally | 1–3 business days |

These payment methods enable traders to start their SabioTrade journey with minimal friction. The instant payment options—particularly cards and crypto—make it convenient for international traders who want to activate their accounts quickly and begin the assessment phase without delays.

Withdrawal and Refund Policy

SabioTrade’s withdrawal process is designed to be transparent and trader-friendly. Payouts can be requested every 7 days, and profits are distributed according to the plan’s profit split—ranging from 80% to 90% in favor of the trader. All open trades must be closed before initiating a withdrawal request.

Unlike some firms, SabioTrade does not offer fee refunds after the evaluation process. However, successful traders benefit from a funded account and ongoing profit opportunities, making the subscription cost a one-time investment toward long-term earning potential.

Key Takeaways

- Transparent Pricing: One-time subscription fees with no hidden charges.

- Flexible Payments: Multiple secure methods, including crypto and traditional banking.

- Fast Processing: Instant activation for card and crypto payments.

- Global Accessibility: Payment systems available for traders worldwide.

- Weekly Withdrawals: Profits can be withdrawn every 7 days.

SabioTrade’s subscription and payment systems are structured to balance accessibility and reliability. By combining transparent pricing with flexible global payment options, the firm ensures that traders can join and scale their funded accounts efficiently and confidently.

SabioTrade vs. Giimer vs. Funding Pips: A Comparative Overview

In the rapidly expanding proprietary trading landscape, firms like SabioTrade, Giimer, and Funding Pips have emerged as platforms enabling traders to access institutional-grade capital while focusing on performance rather than personal funding. Each firm presents unique funding models, evaluation processes, and trading conditions that cater to different trader profiles. The following comparison highlights their key distinctions to help traders make informed decisions.

| Feature | SabioTrade | Giimer | Funding Pips |

| Initial Capital | $20,000 – $650,000 (multiple plans) | Information not publicly specified | $5,000 – $200,000 |

| Evaluation Process | Single-phase evaluation with no time limit, provided the trader remains active every 30 days | Information limited; offers performance-based funding model | Two-phase Challenge – Phase 1 (8% target), Phase 2 (5% target) |

| Profit Split | Up to 90%, depending on plan | Not specified | Up to 80% for funded traders |

| Scaling Plan | Scaling opportunities tied to consistent performance; higher accounts available under Pro programs | Not disclosed | Scaling up to $1,500,000 with continued profitability |

| Tradable Instruments | 250+ assets including Forex, Stocks, Indices, Commodities, ETFs, and Crypto | Not specified | Forex, Indices, Commodities, Crypto |

| Trading Platforms | Proprietary SabioDashboard (QuadCode) | Not specified | MT5 and cTrader |

| Maximum Drawdown | 6% trailing, with 5% daily loss limit | Not disclosed | 10% maximum, 5% daily |

| Minimum Trading Days | None (only activity every 30 days required) | Not disclosed | None (flexible completion pace) |

| News & Weekend Trading | Weekend trading allowed only on selected account types | Not disclosed | Both allowed |

| Leverage | Up to 1:100 on indices; 1:30 on Forex | Not specified | Up to 1:100 |

| Location | Registered in the United Kingdom | Limited public information | United Arab Emirates |

| Support & Community | Mentorship programs, academy access, and 24/7 support | Limited details | 24/7 multilingual live chat support |

Key Insights:

SabioTrade’s flexible evaluation structure and higher capital access make it appealing for experienced traders who value freedom over deadlines. Funding Pips, on the other hand, emphasizes clear performance targets and scalability, suitable for those who prefer structured growth. Giimer remains a lesser-documented entity with limited transparency, making it harder to evaluate its legitimacy and trading conditions.For traders seeking time flexibility, diverse asset coverage, and fast payouts, SabioTrade currently stands out as the most adaptive and professionally structured option among the three.

SabioTrade Trader Community and Support

SabioTrade has built a comprehensive trader ecosystem that focuses on continuous growth, community collaboration, and accessible support — forming the foundation of its trader-focused mission. Unlike many new prop firms that simply offer trading accounts, SabioTrade emphasizes education, mentorship, and engagement, ensuring that every trader—novice or experienced—has access to professional guidance and a supportive trading network. The firm’s philosophy revolves around empowering traders with the right tools, resources, and social environments to grow sustainably in today’s competitive markets.

Educational Resources & Mentorship Programs

At the heart of SabioTrade’s community development lies Sabio Academy, a structured learning platform designed to enhance trader knowledge and skill. The academy offers a range of courses, masterclasses, and webinars that cover crucial aspects of professional trading — from technical and fundamental analysis to risk management, trading psychology, and algorithmic strategies.

In addition to educational content, SabioTrade offers 1-on-1 mentorship sessions through its experienced trading coaches. These sessions focus on helping traders refine their strategies, manage emotional discipline, and understand market behaviors at a deeper level. The company frequently updates its learning materials to stay aligned with current market dynamics, making it a genuine platform for long-term trader development rather than short-term funding alone.

Furthermore, SabioTrade’s webinar series and exclusive workshops are conducted by industry professionals and are open to both funded and evaluation traders. These programs aim to build a knowledge-sharing environment where traders can learn directly from experts and improve their performance in real-world scenarios.

Community Engagement & Sabio PRO Club

SabioTrade’s trader community is not just an add-on — it’s a core component of the firm’s identity. Through the Sabio PRO Club, traders gain access to a dynamic space where they can interact, share strategies, discuss performance, and network with other traders worldwide. The community encourages collaborative growth, allowing traders to exchange insights and learn from each other’s experiences.

The firm also promotes engagement through Telegram and Discord groups, where traders receive market insights, news updates, and trading signals. This constant flow of information helps traders stay informed and connected to market movements. SabioTrade’s focus on creating a collaborative culture has made its trader network a strong backbone of its overall ecosystem.

The community is further strengthened by SabioTrade’s educational blog and social media presence across platforms such as Facebook, Instagram, and X (formerly Twitter). These channels provide updates on new funding programs, feature trader success stories, and share motivational content that keeps the community active and inspired.

24/7 Trader Support & Help Desk

SabioTrade emphasizes responsive and professional customer support, recognizing that traders often operate in fast-paced environments where quick solutions are crucial. The company provides 24/7 multilingual support through live chat, email, and ticket-based systems, ensuring traders can resolve issues promptly.

The Help Desk section on their website acts as a knowledge hub, offering clear explanations about funding programs, trading conditions, and platform functionality. Whether it’s guidance on the evaluation process or assistance with payout procedures, the support team maintains a consistent record of fast, reliable communication.

Community Initiatives & Trader Benefits

To motivate and reward active traders, SabioTrade runs community-driven campaigns, giveaways, and trading competitions, allowing traders to showcase their performance and win additional perks. Traders who demonstrate strong results and consistent discipline are often featured in community highlights, which not only builds credibility but also strengthens morale across the platform.

Additionally, SabioTrade provides free trading signals and market updates to its members, offering insights that can complement their strategies. Such initiatives underscore SabioTrade’s commitment to fostering an interactive, well-supported, and knowledge-oriented trading environment.

Why It Matters

SabioTrade’s focus on education, community, and trader support reflects its mission to bridge the gap between funding opportunities and genuine trader development. By combining Sabio Academy’s structured learning, PRO Club’s collaborative engagement, and round-the-clock support, the firm positions itself as a modern prop trading brand that values both profit potential and personal growth. This multi-layered support ecosystem ensures traders not only get funded but also learn, evolve, and thrive within a community that’s designed for their long-term success.

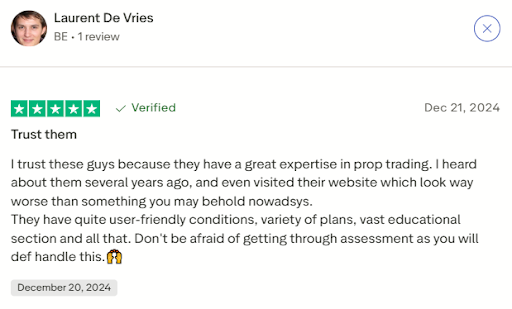

Traders’ Opinion

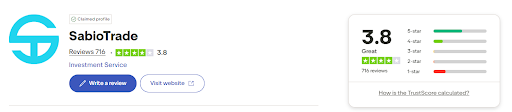

Based on Trustpilot reviews, SabioTrade currently holds an overall rating of 3.8 out of 5 stars, derived from over 700 user reviews. This score reflects a generally positive sentiment toward the firm, with many traders praising its user-friendly platform, educational support, and responsive assistance team.

However, opinions are mixed—while satisfied users highlight the firm’s fast communication and reliable payouts, others point out areas for improvement in platform functionality and verification speed. Overall, the 3.8 TrustScore indicates that SabioTrade maintains a “Great” reputation among traders, earning appreciation for its transparency and service quality.

SabioTrade Review: Pros and Cons

Evaluating the strengths and limitations of SabioTrade helps traders determine whether this proprietary trading firm aligns with their trading style and financial objectives. As a relatively modern prop trading platform, SabioTrade positions itself as both a funding and mentoring hub, offering traders the chance to access institutional-grade capital while following disciplined risk management parameters.

| Pros | Cons |

| Access to Large Capital Allocations: SabioTrade provides traders with funded accounts ranging from $20,000 to $650,000, depending on the selected plan. This allows qualified traders to scale their performance without risking personal funds. | Participation Fees: Each account tier requires an upfront evaluation fee, which some traders may find relatively high, especially in the larger funding tiers. |

| Attractive Profit Splits: Traders can retain up to 90% of generated profits, one of the most competitive structures in the prop trading industry. | Restricted Trading Styles: Scalping strategies are explicitly prohibited, which may limit traders who prefer short-term, high-frequency approaches. |

| Flexible Evaluation Process: SabioTrade offers no time limit to complete the assessment phase, as long as traders remain active every 30 days. This flexibility gives participants the freedom to trade at their own pace. | Strict Risk Management Rules: Daily loss is capped at 5%, and the maximum trailing drawdown is 6%, requiring strict discipline in trade sizing and exposure. |

| Wide Asset Coverage: The firm supports over 250 tradable assets across forex, stocks, indices, commodities, ETFs, and cryptocurrencies, allowing for strong diversification. | Limited Geographic Availability: U.S. residents are not accepted, restricting access for traders from that region. |

| Fast Payout Processing: SabioTrade claims to process payouts within 24 hours, with weekly withdrawal opportunities for verified accounts. | Weekend Trading Restrictions: Weekend positions are allowed only under certain account types, limiting flexibility for swing traders. |

Key Takeaways:

SabioTrade’s competitive profit-sharing structure, broad asset coverage, and time-flexible evaluation model make it a compelling option for traders seeking growth without external pressure. However, its tight drawdown limits, scalping restrictions, and regional limitations mean that disciplined, medium-term traders will likely benefit the most from this platform.

Is SabioTrade Worth It?

SabioTrade positions itself as a modern proprietary trading firm that offers traders the opportunity to access virtual funding up to $200,000, allowing them to trade without risking personal capital. This model addresses one of the most common challenges in trading—lack of sufficient trading capital—by giving qualified traders the chance to demonstrate skill and consistency while keeping risk minimal.

What sets SabioTrade apart is its focus on education, technology, and community-driven growth. Through its Sabio Academy, the firm provides structured learning materials, mentorship programs, and webinars that help traders develop practical market skills. Additionally, the introduction of Sabioverse, an innovative smart trading workspace, reflects the company’s dedication to integrating technology with professional development—something few prop firms actively pursue.

With these combined elements—funding access, educational empowerment, and technological innovation—SabioTrade represents a compelling choice for traders seeking both opportunity and growth within a transparent, forward-thinking trading ecosystem.

The Final Words

SabioTrade has established itself as a progressive proprietary trading firm that blends funding opportunities, education, and technology into a unified ecosystem for traders. With its funding programs offering access to capital allocations up to $200,000, SabioTrade provides individuals the chance to trade professionally without financial risk to their own funds—a key advantage for traders seeking to scale their performance responsibly.

The firm’s investment in Sabio Academy, mentorship programs, and the innovative Sabioverse demonstrates its commitment to long-term trader development rather than short-term participation. This forward-thinking approach—combining education, community, and innovation—reflects SabioTrade’s mission to create an environment where traders can learn, earn, and evolve simultaneously.

For those looking for a credible and growth-oriented prop trading opportunity, SabioTrade stands out as a firm that not only funds traders but also nurtures their journey toward consistency and success.