In the fast-evolving proprietary trading landscape, iFunds is gaining attention for offering traders the ability to access instant funded accounts without undergoing lengthy evaluation phases. Unlike traditional prop firms that rely on multi-step assessments, iFunds allows traders to start immediately with capital allocations ranging from $2,500 up to $500,000, depending on their selected risk model. But does this streamlined model hold up in 2025? This iFunds review takes a deep dive into their funding structure, profit-sharing models, trading rules, and withdrawal process, helping you assess whether iFunds aligns with your trading goals.

Instead of a challenge, traders select their own drawdown level and profit split, with flexible options like no daily drawdown, no time limits, and EA-friendly trading. With a scaling plan, on-demand payouts starting from just $50 in profit, and a payout speed promise backed by a 10% delay bonus, iFunds is positioning itself as a modern alternative in the prop firm space.

Who is iFunds?

iFunds is a modern proprietary trading firm designed to provide traders with instant access to funded accounts, eliminating the need for traditional evaluation challenges. Established in 2024, iFunds is registered in Saint Lucia and operates as a global digital platform for traders seeking real capital without unnecessary restrictions. Their funding model allows traders to start with accounts from $2,500 up to $500,000, with the ability to choose from multiple risk profiles and profit splits.

Unlike legacy models, iFunds focuses on speed, flexibility, and transparency—offering no time limits, no consistency rules, and no daily drawdowns. The firm supports a wide range of strategies including automated trading and expert advisors (EAs) on the MetaTrader 5 platform. Their commitment to fast execution and 24-hour payouts reinforces their trader-first philosophy.

With a mission to empower traders worldwide, iFunds merges institutional-grade funding access with simplified rules, aiming to redefine how traders grow their capital.

Brokers That Are Used By iFunds

iFunds provides traders with access to the MetaTrader 5 (MT5) platform, a globally recognized trading terminal known for its speed, advanced tools, and algorithmic trading capabilities. As of now, iFunds does not publicly disclose the names of the brokers or liquidity providers they partner with. However, the firm ensures a fast and reliable trading environment, offering tight spreads, low slippage, and execution stability essential for both discretionary and automated strategies.

The platform supports Expert Advisors (EAs) and other forms of automated trading, which are fully enabled within the MT5 environment. This flexibility allows traders to operate without limitations commonly imposed by other firms. By focusing on execution quality and platform efficiency, iFunds aims to deliver a professional-grade trading experience regardless of strategy type.

While broker names remain undisclosed, the technical infrastructure and platform offering reflect iFunds’s commitment to supporting scalable and performance-driven trading.

iFunds Review: How to Get Funded?

In this iFunds review, we examine how traders can obtain instant funding through a streamlined, evaluation-free process. Unlike traditional proprietary trading firms that require a multi-step challenge, iFunds offers immediate access to trading capital with no prerequisites. This structure makes it one of the most accessible funding options currently available.

1. Choose an Account

The funding process begins by selecting a preferred account size, ranging from $2,500 to $500,000. Traders also choose their maximum drawdown level—6%, 8%, or 10%—which determines their profit split (from 80% down to 50%) and overall cost of entry. This system gives traders full control over their risk-to-reward ratio before they begin trading.

2. No Challenge, No Evaluation

There is no evaluation phase, no minimum trading days, and no time limits. Traders are free to start trading immediately upon account activation. There are also no consistency rules and no daily drawdown limits, providing a highly flexible trading environment.

3. Start Trading on MT5

After funding, traders receive access to the MetaTrader 5 platform, where they can trade a wide range of instruments including Forex, indices, commodities, crypto, and futures. Expert Advisors (EAs) and automated strategies are fully supported.

4. Withdraw Profits

Once the trader earns at least $50 in profit, they can request a payout at any time. Withdrawals are processed within 24 hours on business days, and if delayed, iFunds offers a 10% late payout bonus (up to $1,000).

This iFunds model prioritizes speed, simplicity, and trader autonomy, removing traditional barriers to funding and allowing traders to focus entirely on performance.

iFunds Scaling Plan & Funding Programs

iFunds offers a straightforward instant-funding model with seamless account scaling—enabling traders to access funding of up to $500,000 without undergoing a challenge phase.

Aspects of iFunds Funding Programs

- Instant access up to $500,000: Traders can choose from multiple funding tiers—starting at $2,500 and scaling upward—all without any evaluation phase or profit targets.

- Customizable risk and rewards: During registration, traders set their Max Drawdown (6%–10%) and corresponding Profit Split (50%–80%), giving full control over risk-reward trade-offs.

Scaling Structure & Process

Once a minimum withdrawable profit of $50 is achieved, traders can scale their account to one of the two next funding tiers:

- Scale up to $5k → $10k, or $10k → $25k, etc., with each new tier unlocking larger capital.

- Excess profit beyond the plan-upgrade cost is retained and withdrawable immediately—profits are never wiped out.

- Traders may choose a new Max DD and profit-split upon each upgrade, aligning their risk appetite with increased capital.

Scaling can be completed in up to 4 steps, going from $2,500 to $500,000.

Program Overview

| Feature | iFunds Implementation |

| Instant Funding | Accounts from $2.5K to $500K available immediately—no challenge or evaluation required |

| Custom Risk & Reward | Traders choose Max DD (6–10%) and profit split (50–80%) at signup |

| Scaling Trigger | Achieve $50 profit to unlock upgrade options |

| Scaling Process | Scale to one of two higher tiers by paying the plan difference |

| Profit Protection | Excess profits (beyond scaling cost) are retained fully—no profit wipeout |

| Adjustable Settings | Option to reset Max DD and profit-split during scaling process |

| Full Scaling Capability | Scale from $2.5K to $500K in 4 steps |

Why It Stands Out

iFunds’ model removes common barriers in traditional prop trading—eliminating profit targets, evaluations, and complex rules. Instead, the firm offers clean scalability, clear choices on risk and reward, and full retention of trader profits. This model appeals to confident, disciplined traders who want to grow capital logically and transparently—without sacrificing earned gains.

Trading Instruments and Platforms at iFunds

When evaluating iFunds, it’s crucial to understand the instruments available and the trading platform(s) supported—these shape the flexibility and strategy opportunities for funded traders.

Trading Instruments at iFunds

iFunds delivers access to a broad asset universe, suitable for a wide spectrum of trading styles:

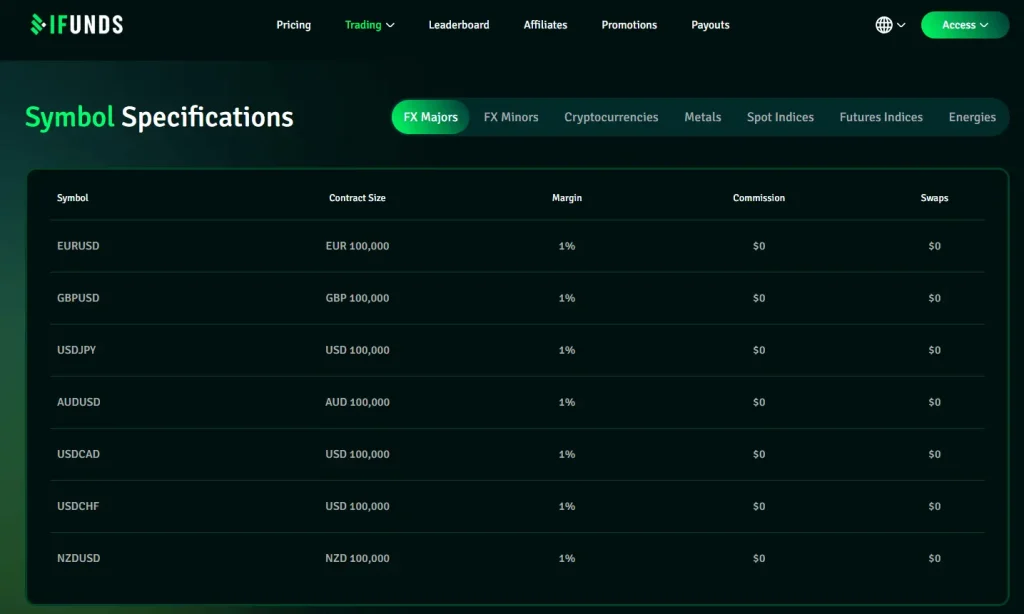

- Forex pairs: including majors, minors, and exotic crosses, all offering competitive liquidity under tier‑1 pricing.

- Commodities: key markets such as gold, silver, energies (e.g. oil) are offered, enabling hedging and macro-driven playbooks.

- Indices and Futures: global indices like S&P 500, NASDAQ, DAX, and futures-based contracts are supported, allowing traders to follow global equity trends.

- Cryptocurrencies: popular digital assets such as Bitcoin and Ethereum are available, though with lower leverage (1:10), reflecting their inherent volatility.

Leverage is competitive, with up to 1:100 on forex majors, indices, energies, 1:200 on gold, and 1:10 on cryptocurrencies—designed for traders to deploy capital efficiently while managing risk effectively.

This diversity allows both discretionary traders and quantitative strategists to craft diversified portfolios across major global markets.

Trading Platform at iFunds

Every funded account at iFunds is provisioned on the MetaTrader 5 (MT5) platform—the industry standard for multi-asset execution:

- MT5 provides multi-asset support across forex, indices, commodities, and crypto, with native real-time charting and order execution.

- Advanced analytical tools include custom indicators, economic calendar, expanded timeframe support, and a modern interface well-suited for both discretionary and technical traders.

- Automation is fully supported: Expert Advisors (EAs), copy-trading tools, hedging, news trading, and scalping are explicitly permitted—iFunds imposes no constraints on algorithmic strategies as long as manipulative techniques (e.g. latency arbitrage) are avoided.

Notably, iFunds does not support MT4 or cTrader; the single-platform model reflects its focus on consistency, robust execution, and maintaining institutional-grade infrastructure through MT5.

iFunds Trading Conditions: Spreads, Fees, and Rules

All details below are directly verified from official iFunds documentation (Help Center and website)—no external sources or inferred data are included.

Spreads & Fees

iFunds does not explicitly publish detailed spread tables or per‑symbol commissions on its website or Help Center. What is confirmed:

- Trading is commission‑free and swap‑free across all supported instruments, as stated in their official terms.

- There are no separate fees or hidden charges associated with spreads or order execution outlined in their official documentation.

Since iFunds partners with tier‑1 liquidity providers and simulates real‑market conditions, traders can expect market‑competitor‑level spreads, but precise values are not published.

Fees Structure

- Traders pay a fixed, one‑time plan fee based on the selected account size—ranging from $250 for $2,500 funding to $30,000 for $500,000 accounts.

- There are no performance fees, profit‑take fees, or recurring charges per trade—only the upfront fee is required.

- Withdrawals are supported on demand with a $50 minimum amount, and typically processed within 24 hours. If delayed, iFunds offers a payout bonus of 10% up to $1,000.

Trading Rules & Risk Guidelines

Maximum Drawdown Rule

- Traders choose their Maximum Drawdown (Max DD) between 6% and 10% of initial account balance during onboarding. There is no daily drawdown limit—only a static overall drawdown applies.

- Exceeding the equity threshold of (Initial Balance − Max DD%) results in automatic disqualification, regardless of closed profit.

Profit Split & Flexibility

- The profit share increases based on the chosen Max DD—50% at 10% DD, rising to 80% at 6% DD.

- Notably, iFunds imposes no profit‐target requirement, meaning traders can withdraw profits as soon as they wish, without needing to satisfy predefined return thresholds.

Trading Policy & Freedom

- Features such as scalping, hedging, news trading, automation via EAs, and trade copy tools are fully allowed, provided no market manipulation (e.g. latency arbitrage) is used.

- No consistency rules, no minimum trading days, and no IP restrictions. Traders can run multiple accounts simultaneously with different IPs.

Summary Table:

| Condition | Official iFunds Policy |

| Spreads / Commission | Commission‑free, swap‑free; precise spreads not published |

| Entrance Fee | Fixed, one‑time fee (e.g. $250 → $30,000 depending on account size) |

| Profit Split | 50% (10% DD) → up to 80% (6% DD), depending on risk level |

| Max Drawdown | 6% to 10%, trader‑selectable, static (no daily drawdown limit) |

| Profit Targets | None—withdraw anytime without hitting profit goals |

| Trading Styles Allowed | Scalping, hedging, EA/autotrading, news trading, copy‑trading |

| Time/IP Restrictions | None—no minimum days, no consistency rules, no IP or location restrictions |

| Payout Terms | On‑demand, <$50 minimum, within 24 h; delay compensation if payout delayed |

Subscription and Payment Methods at iFunds

In this iFunds review, understanding the subscription process, pricing model, and payment methods is essential for any trader looking to partner with this prop firm. iFunds uses a one-time payment system for all funding plans, eliminating recurring fees and allowing traders to customize their profit split and drawdown preferences from the outset. The structure is designed for flexibility and trader control.

Whether you’re selecting a $10K or $500K account, iFunds enables instant funding access with no evaluation or demo challenge. The entire process is quick, transparent, and globally accessible through multiple payment channels. Below is a deeper look into their plan options, fees, accepted payment methods, and key policies.

Subscription Options and Associated Fees

iFunds offers instant funding plans across multiple tiers. Traders can choose their Max Drawdown (6%, 8%, or 10%) and corresponding Profit Split (80%, 70%, or 50%) at checkout. This means the fee varies based on the account size and selected risk/reward setup. All fees are one-time only and there is no refund, as the model bypasses any challenge or evaluation period.

Here’s a sample pricing table based on current listings from the iFunds website:

| Plan | Funding Amount | Participation Fee |

|---|---|---|

| Beginner – Intern | 2.5k | $250 |

| Beginner – Starter | 5k | $400 |

| Beginner – Ambitious | 10k | $700 |

| Advanced – Pro | 25k | $1,600 |

| Advanced – Expert | 50k | $3,000 |

| Advanced – Master | 85k | $5,000 |

| Guru – Dubai | 150k | $8,500 |

| Guru – London | 250k | $15,000 |

| Guru – New York | 500k | $30,000 |

Instant Funding Plans Overview

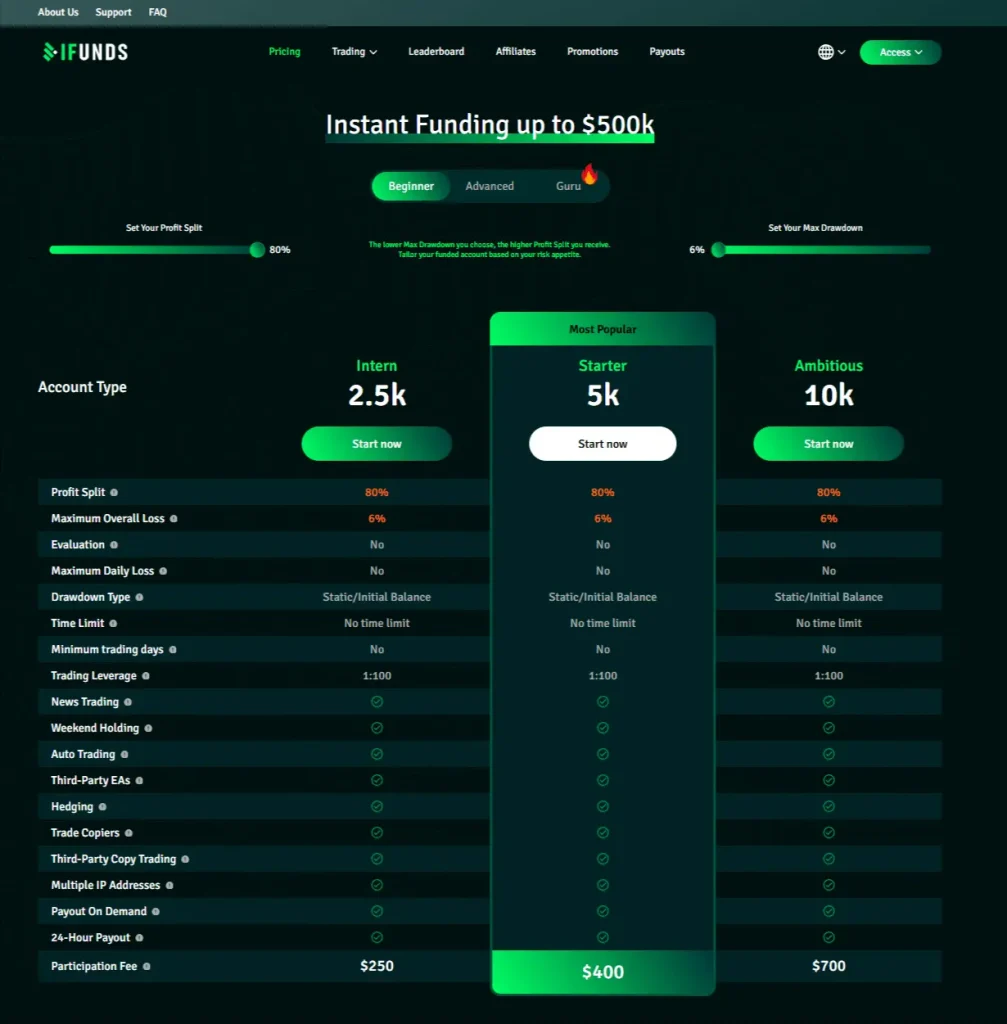

Beginner Tier

The Beginner Tier includes three account options: Intern (2.5k), Starter (5k), and Ambitious (10k). All accounts offer a 50% profit split, 10% maximum overall loss, no evaluation, no maximum daily loss, and a static/initial balance drawdown with no time limit. Traders get 1:100 leverage, and all trading permissions — including news trading, weekend holding, auto trading, third-party EAs, hedging, copy trading, third-party copy trading, multiple IP addresses, as well as payout on demand and 24-hour payouts — are allowed. Participation fees start at $250 for Intern, $400 for Starter, and $700 for Ambitious.

Advanced Tier

The Advanced Tier features three funded accounts: Pro (25k), Expert (50k), and Master (85k). Just like the Beginner Tier, all accounts come with a 50% profit split, 10% maximum overall loss, no evaluation, no maximum daily loss, and static/initial balance drawdown with no time limit. They also include 1:100 leverage and full trading freedoms: news trading, weekend holding, auto trading, third-party EAs, hedging, trade copiers, third-party copy trading, multiple IPs, and fast payout options. Participation fees increase with balance size: $1,600 for Pro, $3,000 for Expert, and $5,000 for Master.

Guru Tier

The Guru Tier offers the highest account sizes: Dubai (150k), London (250k), and New York (500k). All Guru accounts maintain the same trader-friendly conditions — 50% profit split, 10% max overall loss, no evaluation, no max daily loss, static/initial balance drawdown, and no time limits. Leverage stays at 1:100, and all trading activities are fully permitted, including news and weekend trading, automation, EAs, hedging, copy trading, multiple IP logins, and instant payout options. Participation fees reflect the premium tier: $8,500 for Dubai, $15,000 for London, and $30,000 for New York.

This tiered approach gives traders full control to tailor their funding journey based on personal risk appetite and profit retention preferences.

Available Payment Methods

iFunds supports a wide range of secure global payment methods, enabling seamless transactions from virtually any region. Whether you prefer crypto, cards, or alternative digital platforms, iFunds ensures smooth and quick payment processing:

| Payment Method | Availability | Processing Time |

| Credit/Debit Card | Worldwide | Instant |

| PayPal | Worldwide | Instant |

| Apple Pay | Select Countries | Instant |

| Google Pay | Select Countries | Instant |

| Coinbase Commerce | BTC, ETH, USDT, etc. | Within 1–2 hours |

| Bank Transfer | Upon request (manual) | 1–3 business days |

This variety allows iFunds users to subscribe without delays, regardless of their payment preferences or location.

Refund and Withdrawal Policies

Unlike challenge-based models, iFunds does not offer fee refunds, as traders gain access to funded accounts instantly. This structure is clear and upfront—you pay once and start trading live. Withdrawals are available as soon as the trader earns a minimum profit of $50 and are processed within 24 hours, a speed noted positively by many in the iFunds community.

Additionally, profits are not wiped during scaling—a standout policy among prop firms. When traders upgrade their account, any profit beyond the upgrade fee is retained and fully withdrawable.

Final Thoughts on Subscription Process

The iFunds payment and subscription system is built for speed, transparency, and trader freedom. With no hidden fees, no monthly subscriptions, and no long evaluation phases, traders gain instant access to live capital and complete control over their risk settings. Fast withdrawals and a performance-driven model make iFunds a strong alternative to traditional prop firms, giving traders the efficiency and autonomy they need to scale faster.

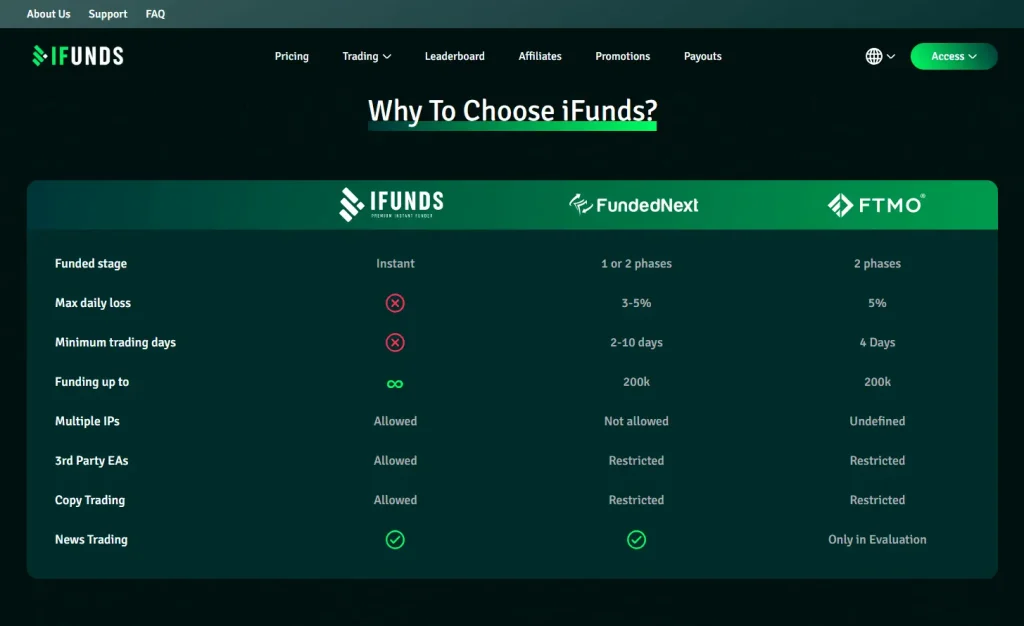

iFunds vs. FXIFY vs. Blue Guardian: A Comparative Overview

When choosing a proprietary trading firm, comparing core features—such as funding model, pricing, flexibility, and reputation—is vital. Each firm offers different paths to capital, risk frameworks, and trader incentives. This comparative overview will help you quickly assess how iFunds, FXIFY, and Blue Guardian stack up against each other, helping you decide which aligns best with your strategy, risk appetite, and goals.

We’ve drawn on trusted review sites and independent feedback to ensure accuracy—from trustpilot ratings and payout experiences to evaluation processes and program flexibility. This side-by-side comparison is designed to clarify where each firm’s strengths and limitations lie, giving you a clear snapshot before diving in.

| Feature | iFunds | FXIFY | Blue Guardian |

| Funding Model | Instant funding only—no evaluation/challenge required. | Offers Instant funding and multi-step challenge options starting from ~$39–$89. | Provides Instant and structured 1‑, 2‑, and 3‑step challenge models. |

| Profit Split | 50–80% depending on max-loss tier. | Up to 90% profit share, with add-ons for higher leverage and payout terms. | Up to 90% split available on various plans, with a typical ~80% instant model. |

| Risk Rules | Only overall max drawdown (6–10%); no daily or consistency rules. | Sets daily drawdown limits (3–5%) and profit targets (5–10%) depending on the plan. | Offers realistic and flexible rules; claims no consistency restrictions on some plans. |

| Fees & Cost Structure | Entry fees from ~$250 to $30,000 for funding up to $500k. | Evaluation fees from ~$39–$89, with optional paid upgrades for perks. | Affordable multi-step challenge fees; lower-tier pricing, though some users note hidden commissions ($5/lot). |

| Payout Speed & Reputation | Trustpilot rating ~4.7/5, payouts often <24h (reports as fast as 5h); 24‑hour payout guarantee claim. | Trustpilot ~4.1–4.5/5; payouts labeled “instant,” and supportive feedback on service. | Trustpilot ~4.2/5 across many reviews; users cite fast payouts (<24h), responsive support and transparent rules. |

| Allowed Strategies | EAs, copy trading, hedging, news trading are allowed. | Supports EAs, grid, martingale, news trading; scalable accounts to $4M. | Full strategy flexibility with MT5; generally transparent restrictions, but one user flagged spread transparency issues. |

iFunds excels for traders who want instant access to capital with minimal rules, coupled with lightning-fast payouts. However, its high upfront cost and limited historical track record may deter some traders. FXIFY offers strong profit share potential (up to 90%) and broad flexibility via both instant and challenge-based models—but comes with more rules and upgrade fees. Blue Guardian delivers a reliable middle ground with diverse challenge structures, good support, and fast payouts, though some traders report occasional commission transparency concerns. Choose iFunds for simplicity and speed, FXIFY for maximum profit potential and scaling options, or Blue Guardian for a structured yet accessible experience.

iFunds Trader Community and Support

iFunds delivers a trader-centric support ecosystem—with features designed for clarity, flexibility, and fast communication. While education offerings are more modest compared to some competitors, their community engagement and trade-focused support model emphasize accessibility and responsiveness.

Support Channels & Responsiveness

Directly from the official iFunds Support page:

- 24/5 availability via email and live chat, ensuring help is accessible across major trading hours.

- Contact options include email (ops@iFunds.io), live chat, and phone support during business hours.

- Support is consistently praised for being fast and friendly, with turnaround times typically within a few hours—sometimes less than 24 hours for critical requests or payouts.

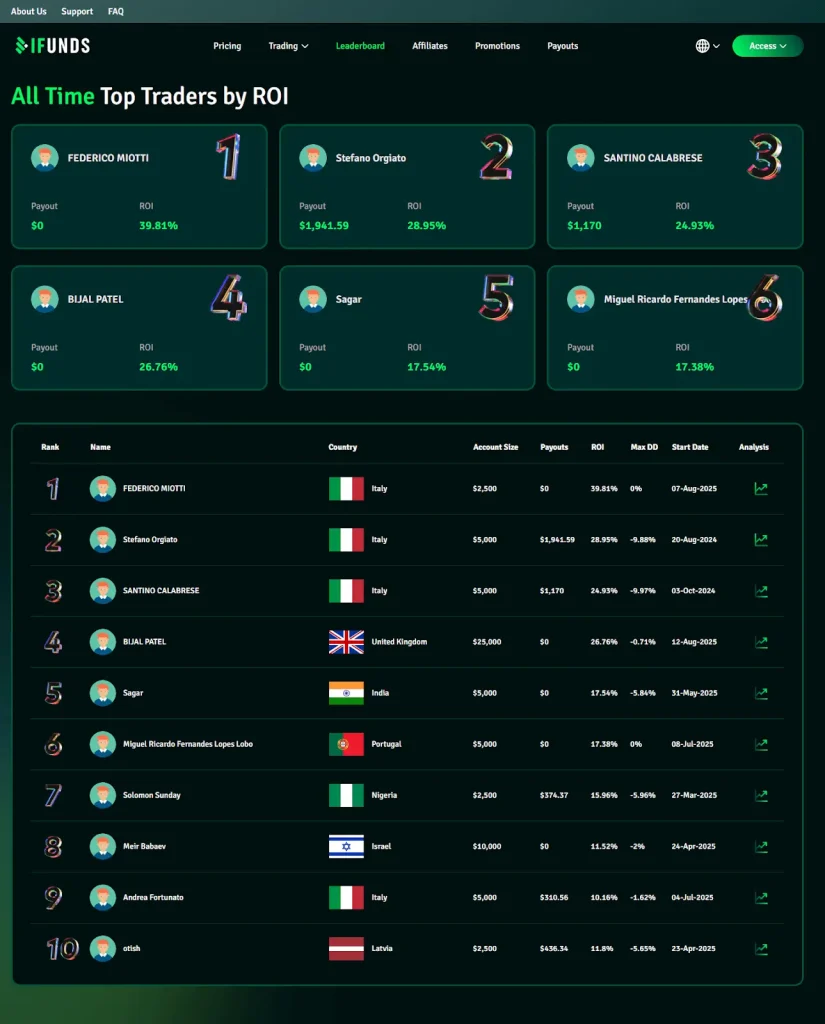

Trader Dashboard & Leaderboard Analytics

iFunds offers a professional trader dashboard, although not detailed in Help Center—referenced on their homepage as a central hub for performance tracking. This dashboard includes:

- Leaderboard analytics, where top performers can be featured, enhancing visibility and potential monetization via trade copying.

- A built-in copy trading system, enabling successful traders to monetize their strategy with subscription-based copying by peers.

Promotions & Community Incentives

Official information confirms that iFunds runs community-focused promotional programs:

- Refer‑a‑Friend bonuses: When a referred user purchases an account, both parties receive a non‑withdrawable bonus that increases account equity—boosting drawdown buffers.

- Cash‑Back Program: Eligible funded accounts (Pro-tier or higher) earn non‑withdrawable cash-back per closed lot—designed to offset trading costs and help traders stay within Max DD thresholds.

- Occasional discounts and bonus offers are also promoted during promotions—highlighting iFunds’ commitment to rewarding participation and supporting traders’ growth.

Educational Content & Community Presence

While iFunds does not promote a structured education program or coaching services:

- They provide basic trading guides and help via Trader Portal, covering onboarding, account scaling, and risk management — though no formal academy or courses are specified.

- The firm maintains an active Discord channel, described as a community space where traders share performance insights and support each other in real time

Community Features Summary Table:

Traders’ Opinion

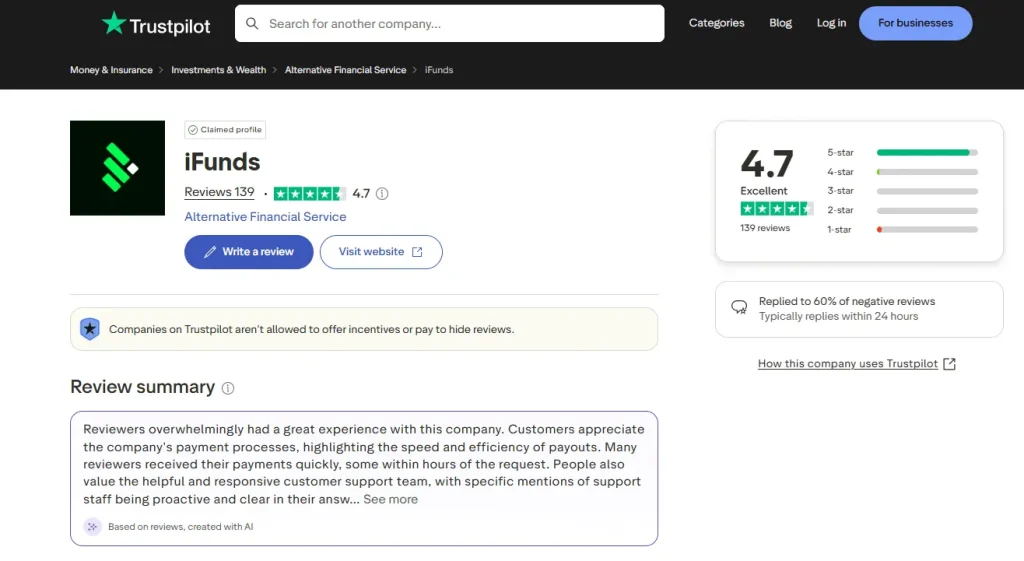

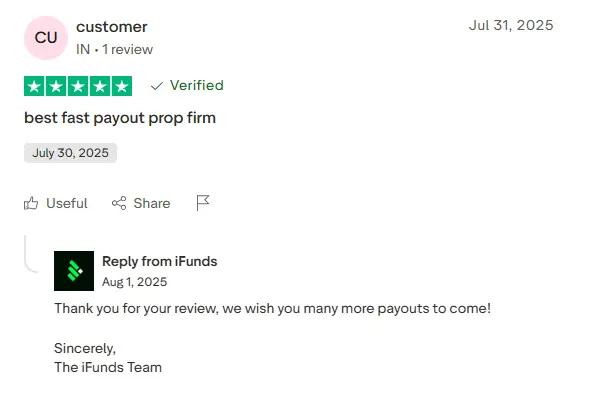

iFunds boasts an excellent Trustpilot rating of 4.7 out of 5 from over 130 reviews, with 92% rated 5‑stars, around 3% 4‑stars, and only about 5% 1‑star ratings.

Traders frequently commend the speed and transparency of payouts, noting funds often arrive within hours and support is “fast and friendly”.

Reviewers highlight iFunds as “the most transparent and trustworthy prop firm,” and praise the firm’s straightforward conditions and efficient customer service.

iFunds Review: Pros and Cons

When evaluating a proprietary trading firm like iFunds, understanding the pros and cons is essential for making a well-informed decision. iFunds has emerged as a new player in the instant funding space, offering traders a unique approach without the need for any evaluation phase. This model is particularly attractive for experienced traders looking to avoid the hassle of traditional challenges, but it’s important to weigh those benefits against potential drawbacks.

By breaking down the advantages and limitations, traders can get a transparent view of what iFunds truly offers—beyond marketing claims. Whether you’re considering iFunds for its fast withdrawals or concerned about its short operating history, this pros and cons breakdown will help you assess if the platform aligns with your trading goals and risk tolerance.

| Pros | Cons |

| Instant funding — no evaluation required: Traders can skip the challenge phase entirely and access real trading capital immediately after purchase. | High participation fees: Pricing starts at USD 250 for a USD 2,500 funded account and scales up to USD 30,000 for a USD 500,000 account—considered expensive compared to competitors. |

| Single, simplified risk rule: No daily drawdown, consistency, or time-limit constraints—only an overall maximum loss (6%, 7%, 8%, or 10%, depending on your plan). | Company is young and limited track record: Founded in March 2024, with limited industry transparency or independent accreditation; trust metrics such as domain authority and web mentions are relatively low. |

| Flexible profit split & scaling: Profit split ranges from 50% to 80% depending on the chosen max loss, and you can scale up your account using accumulated profit, with excess withdrawals allowed. | Safety & oversight concerns: Lack of partnership with regulated brokers and no presence on registries like FPA was flagged as a risk factor by some reviewers. |

| Wide instrument access and platform support: Trade forex, commodities, indices, futures and crypto (with up to 1:100 leverage) using MetaTrader 5; EA and algorithmic trading are allowed. | Limited resources & educational support: Unlike established firms, iFunds does not offer structured educational materials (webinars, trading courses, blog content). |

| Transparent and speedy payouts: Users report withdrawals arriving in under 24 hours (sometimes as fast as five hours); there is even a 24‑hour payout guarantee that promises up to 10% extra if delayed. | Lower profit share on higher‑risk tiers: Selecting a higher max-loss threshold (e.g. 10%) leads to a lower profit split of 50%, which can reduce overall returns for aggressive trading strategies. |

| Strong user ratings: Trustpilot rating stands at around 4.7 / 5 across more than 130 reviews—many citing reliable support and fast payouts. |

iFunds offers an innovative no-challenge model with impressive payout speed and simplicity—but it’s best suited for confident traders comfortable with higher costs and lower regulatory transparency.

Is iFunds Worth It?

iFunds presents a compelling proposition for traders seeking instant access to capital—up to $500,000—without undergoing multi-stage evaluations, allowing users to begin trading immediately upon purchase. The platform emphasizes instant funding with no profit targets, no daily drawdown limits, and no consistency rules, offering rare flexibility in risk management.

Traders benefit from a 24-hour payout guarantee, with withdrawals permitted from just $50 and backed by a 10% bonus (up to $1,000) for delayed payments. The scaling plan enables growth from $2,500 to $500,000 in just four steps: meet a $50 profit and pay the higher account fee—excess profits are never wiped out.

With automated trading, EA support, and a leaderboard monetization option, iFunds caters to both discretionary and algorithmic traders. Its transparent, rule-light model makes it a strong consideration for disciplined traders ready to focus on performance.

The Final Words

iFunds offers a straightforward path to funded trading, with capital tiers ranging from $2,500 up to $500,000 available instantly, no challenges required. Their transparent and flexible model—featuring no profit targets, no daily drawdown limits, and no consistency rules—clearly simplifies the trading experience and empowers disciplined traders to focus on performance.

The scaling process is elegantly structured: once you’ve accrued $50 in profit, you can pay the difference to upgrade to a larger account tier while retaining excess profits. Account expansion—up to $500K—can be completed in just four steps, and profits never get wiped out, maintaining growth momentum.

With features like leaderboard recognition, copy trading monetization, and on-demand payouts guaranteed within 24 hours or with a 10% bonus, iFunds delivers a highly accessible, trader-friendly environment.

FAQs

1. What is iFunds and how does instant funding work?

2. Is there a daily drawdown or consistency rule?

3. What’s the maximum drawdown and profit split?

4. Are automation, EAs, and trade copying allowed?

5. How and when can I withdraw profits?

6. Can I trade from different locations and IPs?

7. What’s the maximum leverage available?

* Forex majors, indices, energies: up to 1:100

* Gold: 1:200

* FX exotics & Silver: 1:25–1:100

* Crypto: 1:10