In the competitive arena of proprietary trading, Fury Funded Traders (FFT) presents an opportunity for skilled traders to access significant capital without risking their own funds. The firm emphasises a structured evaluation process, where traders first complete a “Challenge” before progressing to live-funded accounts, with transparent rules and risk management clearly outlined. According to FFT’s FAQ, participants keep up to 90% of profits once they succeed in the Challenge stage. With account options tailored to different trading profiles, Fury Funded Traders positions itself as a merit-based platform for both ambitious and seasoned traders. This review will examine FFT’s challenge mechanics, account types, profit splits, risk policies and whether the company’s offering justifies participation in 2025. Whether you’re a disciplined trader or exploring prop-firm funding for the first time, understanding how FFT operates is essential before committing your time and strategy.

Who is Fury Funded Traders?

Established as a professional trading-fund platform, Fury Funded Traders (FFT) offers skilled traders the chance to access substantial capital without risking their personal funds. According to their official website, participants can join a “Challenge” stage after registration, and upon successful completion progress to a live funded account with allocations up to $300,000.

The firm emphasises that traders retain up to 80% of profits, a generous share compared to many peers. With a clear and transparent model, Fury Funded Traders is purpose-built for those with proven discipline and trading skill. This review will dig into FFT’s funding structure, evaluation phases, trading conditions and payout mechanics to determine whether this offering truly adds value in 2025. For any trader evaluating funded account opportunities, understanding FFT’s operational framework is a critical first step.

Brokers That Are Used By Fury Funded Traders

When it comes to the trading infrastructure of Fury Funded Traders (FFT), the firm offers a standard prop-trader funding model but does not publicly disclose a detailed list of the underlying broker-platform providers that execute trades for its funded accounts. In their official FAQ section, FFT highlights that traders will use live funded accounts after passing the evaluation stage. However, unlike some peer firms, there is no published information on which liquidity providers, which broker partnerships, or which trading platforms (such as MetaTrader 5, cTrader, or others) are supported. This lack of transparency means potential applicants should consider asking FFT directly for platform specifications — especially if your trading strategy relies on specific execution conditions, latency or platform features. In short: while FFT offers access to significant capital, the execution gatekeeper (i.e., broker/platform) remains unspecified.

How to Get Funded by Fury Funded Traders?

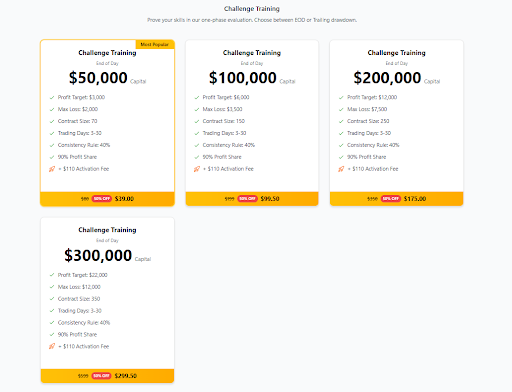

Fury Funded Traders (FFT) operates a clear, performance-based pathway to capital allocation. Traders begin by selecting one of the firm’s published “Challenge” accounts, and upon meeting the specified trading objectives—including profit target, drawdown limits and consistency criteria—they become eligible for real-capital funding.

1. Start a Challenge

According to the firm’s “Challenges” page, traders may choose plans such as a $100,000 capital challenge with a profit target (for instance US $6,000) and a maximum loss of US $3,500. These challenge rules are publicly stated, providing transparency around risk boundaries.

2. Respect the Risk Rules

FFT emphasises that traders must observe all drawdown limits and any “consistency rule” in order to pass the evaluation phase. Their FAQ states: “Once you reach the profit target while respecting the drawdown limits and the consistency rule, you can complete the challenge at any time.” This means that simply achieving the profit target is not enough—discipline and rule adherence are mandatory.

3. Move to a Funded Account

After successful completion of the Challenge, traders transition into a funded account where their risk is borne by FFT and profits are shared. The firm advertises up to 90 % profit share for qualifying traders. At this point, the trader can trade the firm’s capital under live conditions—transparent and aligned with sim-to-live progression.

Key Takeaway

For traders aiming to join a prop-fund firm in 2025, Fury Funded Traders presents a structured process: select your Challenge → fulfil profit plus risk criteria → access live capital. Traders should carefully review the exact parameters (profit target, max-loss, days of trading) of the chosen Challenge, ensure they fully understand the drawdown rules, and trade with discipline. This ensures the best chance of passing the evaluation and unlocking the profit-sharing benefits.

Fury Funded Traders Scaling Plan & Funding Programs

Fury Funded Traders provides a funding model that emphasises immediate capital access rather than a phased scaling ladder. According to the firm’s FAQ:

“Is there a Scaling Plan? No. The trader may trade all the contracts available in their plan from the very first trading day.”

On the homepage the firm states:

“Get funded up to $300,000 and keep up to 80% of your profits.”

Overview of Fury Funded Traders Funding Program:

Key Takeaways

- No phased scaling path: Unlike many funding programmes that grow your account step-by-step, Fury Funded Traders does not offer a conventional scaling ladder.

- Immediate full contract access: From day one, traders may trade all available contracts under their plan.

- High profit share: Traders keep up to 80% of profits under the stated programme.

- Flat account size: The funding ceiling is up to US$300,000; the site doesn’t list incremental increases as part of a public scaling plan.

Trading Instruments and Platforms at Fury Funded Traders

When assessing Fury Funded Traders (FFT), one key element is the nature of the trading environment offered—both in terms of asset classes and the trading platform. The firm discloses certain specifics in its publicly available documentation.

Platforms

In the FAQs section of FFT’s website, the firm states that trading is performed via the proprietary BlackArrow™ platform. This means that all funded accounts under the program utilize this single dedicated platform, rather than offering multiple third-party platforms (e.g., MetaTrader 4/5, cTrader, etc.).

For traders, this implies that your execution environment will be specific to BlackArrow™, and you should confirm that your trading method or style is compatible with the features and constraints of that platform.

Instruments

From the Terms & Conditions document, FFT states explicitly that:

- “Futures contract trading involves substantial risks and is not suitable for all investors.”

- Additionally, in the “Challenges” section, FFT refers to offering “funding to trade Futures & Equities in American Exchanges” (as part of their programme description).

- Therefore, the publicly confirmed asset classes at FFT are futures contracts and equities, traded via recognised American exchange venues.

Implications for Traders

Given these official disclosures:

- If your strategy is built around spot forex, exotic currency pairs, or non-futures CFD instruments, you should verify directly with FFT whether those are supported—since the publicly stated instrument list emphasises futures and equities.

- Having a single platform (BlackArrow™) means platform compatibility is crucial: ensure the platform supports your required tools (e.g., algorithmic trading, EAs, custom indicators) prior to committing.

- The futures focus means trading hours and market behaviour may differ compared to 24-hour forex markets; risk management and strategy adaptation are important.

Fury Funded Traders Trading Conditions: Spreads, Fees, and Rules

When analyzing Fury Funded Traders, it’s essential to understand their trading conditions—covering spreads, fees, and operational rules—to evaluate how the firm structures its funded programs. Fury emphasizes trader flexibility and a realistic market environment, but their official website provides only partial details regarding specific cost structures such as spreads and commissions.

Spreads and Fees

As per the latest information available on the official Fury Funded Traders website, no publicly listed data specifies spread values or commission rates for trading instruments like Forex pairs, indices, commodities, or cryptocurrencies. Similarly, there is no mention of additional platform fees or hidden charges.

This means that traders interested in joining Fury should verify all trading-cost details directly with the firm before participating in an evaluation or funded account. Although the site does not display precise spreads, the firm markets itself as offering a competitive environment designed to mirror real market conditions. Until exact figures are officially released, Fury’s spread and commission structure should be considered undisclosed but intended to remain trader-friendly.

The firm’s challenge fee is highlighted in its promotional materials. Based on Fury’s official social content, the evaluation fee is USD $355. This model aligns with many reputable funding firms that emphasize a one-time fee structure for traders entering the evaluation phase.

Trading Rules

Fury Funded Traders enforces a clear and disciplined rule framework to help traders manage risk effectively throughout the evaluation and funded phases. According to their Terms & Conditions:

- Maximum Loss Rule: Each account operates under a defined maximum loss threshold. Breaching this limit results in account termination, reinforcing disciplined risk management.

- Challenge Phase to Funded Phase: Traders who pass the evaluation successfully progress to a funded account where they can trade live capital under similar parameters, maintaining consistent risk boundaries.

- News and Weekend Trading Allowed: One of Fury’s standout advantages is that traders can engage in news-event trading and hold positions over weekends, a flexibility not commonly allowed by many prop firms.

- Fee Policy: The evaluation fee serves as an entry cost for traders to participate in the challenge, encouraging commitment and disciplined trading performance.

While leverage details are not explicitly published, the firm’s conditions indicate a focus on responsible trading and capital preservation rather than excessive exposure.

Fury Funded Traders’ model demonstrates a balance between flexibility and accountability—allowing traders the freedom to operate across news cycles and weekends, while maintaining limits to safeguard firm capital. For professionals seeking transparency in rules and adaptable market access, these trading conditions make Fury a structured yet trader-oriented platform.

Fury Funded Traders – Trader Community & Support

When assessing a funded-trader program, many prospective participants focus solely on the funding size or profit share—but equally important is the community environment and support infrastructure that underpins trader success. On this front, Fury Funded Traders (FFT) presents several key features worth noting.

24/7 Technical Support

According to FFT’s FAQ page, the firm provides “24/7 technical support for all funded traders”.

This round-the-clock accessibility addresses one of the most critical needs of active traders: the ability to resolve platform or connectivity issues at any hour, ensuring that unexpected disruptions do not derail trading sessions. Having this continuous support signals that the firm recognises the live-market demands and aims to minimise downtime or friction for its funded participants.

Community of Funded Traders

FFT’s FAQ also invites visitors to “read success stories from our community of funded traders.”

While detailed descriptions of community forums or structured peer-networks are not extensively detailed on the website, the presence of a success-story repository suggests that FFT is cultivating a network of funded traders who can potentially share insights, strategies and experiences. For an ambitious trader, access to such a peer group can provide valuable perspectives beyond what can be gleaned from formal training alone.

Transparency and Accessibility

By placing support and community-related details in its FAQ section, FFT underscores a degree of transparency—allowing prospective traders to review the nature of support services before commitment. The clearly stated availability of technical assistance from all hours provides a tangible signal of accessibility. For traders operating in diverse time zones (including the Bangladesh/Asia region), this is an important practical consideration.

What This Means for Traders

- Support readiness: The availability of 24/7 technical support means that traders can expect faster resolution of platform or connectivity issues, which is vital for live-market trading where minutes matter.

- Peer environment: Even if unstructured, a “community of funded traders” and success-story archive create a framework in which traders can feel part of a larger group—reducing isolation and potentially increasing motivation and best-practice exchange.

- Due diligence: While support and community elements are present, an observant trader should still inquire further (via the firm’s support channel) about whether structured forums, mentorship, or interactive peer-to-peer networking exist. The website suggests community activity but does not currently detail the full extent of engagement features (such as dedicated Discord channels, webinars or live coaching).

Key Takeaway

The support and community foundation provided by Fury Funded Traders is solid and clearly communicated. The fact that technical support is available 24/7, combined with visible evidence of a funded-trader community via success-stories, bodes well for traders looking for more than just capital—they’re looking for an ecosystem. That said, traders should still proactively verify how dynamic or interactive the community engagements are (e.g., peer forums, live sessions) and whether support extends beyond technical assistance (e.g., coaching, strategy feedback). When combined with the rest of FFT’s offering, this dimension lends credibility to its proposition and can contribute to a more supportive trading environment.

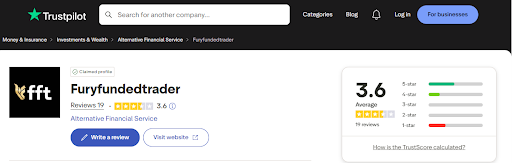

Traders’ Opinion

As reflected on Trustpilot, Fury Funded Traders currently holds an average rating of 3.6 out of 5, based on 18 user reviews. The opinions appear mixed — while several traders commend the firm’s clarity of rules and responsive support, others express concerns about payout timelines and platform performance.

Overall, this score positions Fury Funded Traders as a developing firm that has earned positive feedback for transparency and assistance, but still has room to build stronger consistency and trust among its growing trader community.

Pros & Cons of Fury Funded Traders

Evaluating the strengths and weaknesses of Fury Funded Traders is essential for traders considering their proprietary-funding programme. The table below summarises the key advantages and drawbacks — following that is a brief commentary to provide context.

Commentary:

Fury Funded Traders presents a solid offering for disciplined traders. The ability to keep up to 80% of profits stands out as a strong advantage. Their model allows flexibility via a one-phase challenge or a “instant funding” option, and the draw-down structure offers a choice (EOD vs trailing) which can suit different trading styles. On the flip side, as with all prop-fund firms, the details matter: the exact draw-down limits, challenge costs, account-size tiers and the fine print on profit-split percentages vary and must be reviewed. A trader should carefully review the specific challenge terms they sign up for.

Is Fury Funded Traders Worth It?

When evaluating whether Fury Funded Traders (FFT) is worth your time and investment, several key elements emerge from their publicly-stated offering. According to their FAQ, traders can access funding up to US $300,000 in capital via their professional evaluation program. Importantly, their Terms & Conditions clearly state that all funding provided is virtual/simulated capital and that no real capital is at risk during either the evaluation phase or the funded stage.

This model offers a structured path to large-scale trading without requiring you to deploy your own capital, which addresses a major barrier for many traders. The promise of up to $300,000 in simulated funding — combined with the ability to trade without risking personal capital — is a compelling proposition.

That said, the notion of “worth it” hinges on how well you, as a trader, align with their evaluation rules and can navigate the simulated environment successfully. Because the capital is simulated, performance still requires discipline, strategy, and risk-management — just as if you were trading live. Moreover, while FFT presents a promising model for accessing large trading capital, the firm’s relative newness means it may carry higher uncertainty compared to long-established peers.

If you are a proficient trader with a solid strategy, comfortable trading under simulated-capital conditions and willing to meet the firm’s performance rules, then Fury Funded Traders offers a worthy funding opportunity in the prop-trading space. However, if you require live-capital backed by real funds-at-risk, or desire a long-track record of payout transparency, then you may want to proceed with appropriate caution and perform your own due diligence.

The Final Words

Fury Funded Traders (FFT) positions itself as a modern proprietary trading firm that allows skilled traders to access up to $300,000 in simulated funding through its structured evaluation process. According to their official website — furyfundedtrader.com — the firm offers traders an opportunity to demonstrate their trading discipline, consistency, and strategy without putting personal capital at risk.

FFT emphasizes a transparent model that operates entirely on simulated trading capital, enabling traders to focus on performance rather than financial exposure. The platform’s inclusion of 24/7 technical support and the availability of a funded-trader community reflect its commitment to building a supportive environment where traders can thrive.

While Fury Funded Traders is still a relatively new entrant in the prop-trading space, its clear rules, accessible funding path, and focus on trader performance make it a viable option for dedicated professionals seeking to scale responsibly. However, traders should remain mindful that all capital provided is virtual and should carefully review the firm’s Terms & Conditions before participation.

In summary, Fury Funded Traders offers a structured opportunity for traders who wish to prove their consistency and access significant simulated capital. For those ready to test their skills in a disciplined, rule-driven environment, FFT represents a promising and transparent funding model built for performance-focused traders.