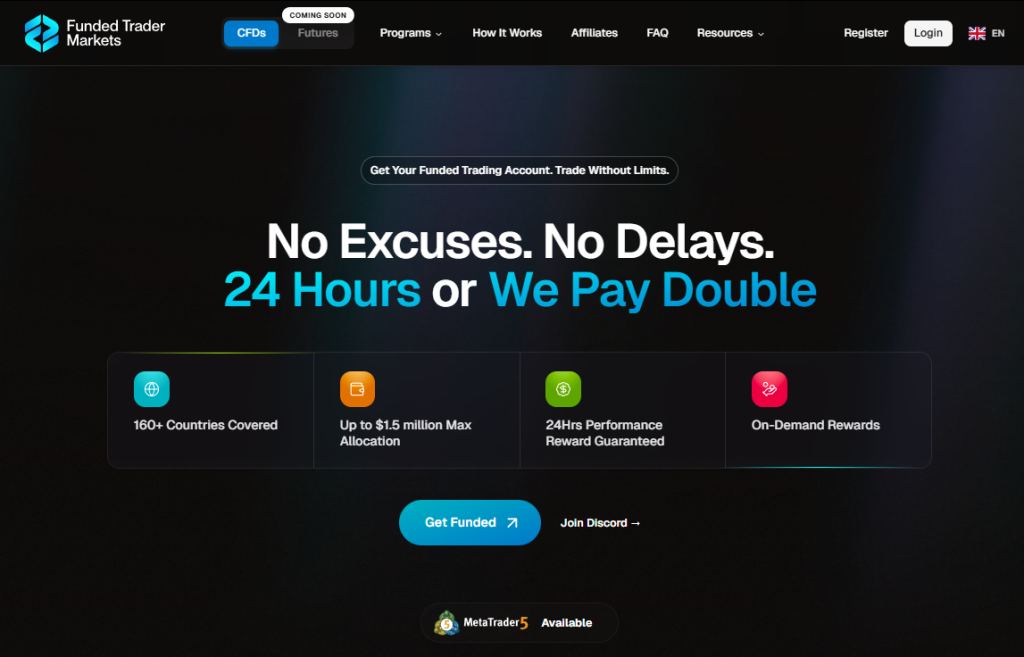

Funded Trader Markets (FTM) positions itself as a modern and flexible proprietary (prop) trading firm that blends education, technology, and funded trading opportunities to help traders scale their skills and capital. According to its official website, FTM operates in over 140–160 countries (depending on the source page), making it a widely accessible platform for traders around the world.

One of the central promises of FTM is fast and flexible funding: they advertise “24 Hours or We Pay Double” for payouts, clearly prioritizing the speed at which traders can access their earnings once they have met the conditions for withdrawal. The firm also offers on-demand payout, which means that once you qualify for a withdrawal, you do not have to wait for a fixed cycle — giving you much more control over your profit-taking.

FTM’s model is built around evaluation challenges (to prove trading ability) but also includes instant funding paths — giving traders both the option to “earn” funded status via a challenge and to jump into a funded simulated account without evaluation. Their Program page clearly outlines three distinct funding paths — 1-Step evaluation, 2-Step evaluation, and Instant Funding — each with its own risk rules, profit targets, and account parameters.

Overall, FTM’s value proposition — as stated on its own site — is attractive to traders who want maximum flexibility, transparency, and speed. They emphasize generous profit splits, no artificial time constraints, and account scaling potential, all while maintaining clearly defined risk rules. This makes FTM a compelling option for serious traders who want to grow both their trading performance and their account balance.

Funding Programs: Breakdown of FTM’s Three Main Paths

A key strength of FTM’s offering is the variety of funding paths. On their “Programs” page, FTM divides its funding solutions into 1-Step Evaluation, 2-Step Evaluation, and Instant Funding. Below, we explore each of these in detail — how they work, who they are designed for, and what the official FTM rules are.

1-Step Evaluation: Fastest Path to Funding

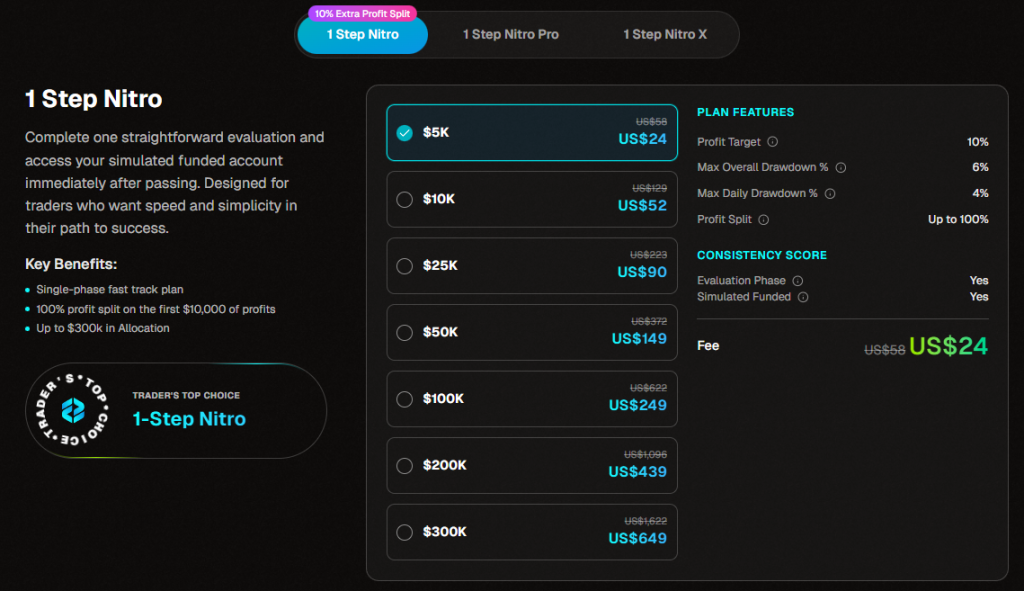

The 1-Step Evaluation program is built for traders who want to complete their evaluation in a single phase and start trading a funded account quickly. FTM explicitly markets this as a “fast track” option, especially for more skilled or confident traders.

Within 1-Step, there are three account tiers, each with different risk/target profiles:

Nitro – the “standard” 1-Step evaluation:

- Profit target: 10%

- Maximum daily drawdown: 4% of the initial balance. According to FTM’s FAQ, this is strictly enforced; for example, if your starting balance is $100,000, 4% is $4,000.

- Maximum overall drawdown: 6% of the balance. FTM’s FAQ clarifies that this drawdown is trailing, meaning it’s calculated relative to the highest recorded balance and does not reset daily.

- Consistency rule: During evaluation, you cannot make more than 50% of your profit target in a single day; once in “simulated funded” (after passing), the limit is 45% per day, which ensures risk control and discourages “one-big-win” strategies.

- Activation or minimum trading days: For Nitro, there is a stated minimum of 5 simulated trading days before you can request a payout or move on; this encourages consistent trading rather than just “hit and run.”

- Profit split: FTM advertises “up to 100%” for profit split on this 1-Step Nitro tier.

- Scaling: According to the 1-Step page, you can scale up your funded account allocation — FTM supports funding accounts up to US$ 800,000 across their 1‐Step plans (at least for certain account sizes).

Nitro Pro – a leaner-cost, more risk-sensitive evaluation:

- Profit target: 8% of initial balance.

- Maximum daily drawdown: 2%. FTM’s FAQ gives a clear example: if your initial balance is $100,000, then a 2% daily drawdown means a stop-out level of $98,000.

- Maximum overall drawdown: 3% trailing from the highest balance, according to FTM’s FAQ. Once the account reaches 3% profit, the drawdown limit becomes fixed to the initial account size.

- Consistency rule: For both evaluation and “simulated funded” phases, Nitro Pro imposes a maximum of 20% of the profit target per day. That means for an 8% target, no more than ~1.6% can be made in a single day, per FTM’s own site.

- Profit split: Also “up to 100%” for the first chunk of profits.

- Activation cost: The listed price for Nitro Pro (on their program page) shows a lower challenge fee compared to Nitro, making it attractive for risk-aware traders.

Nitro X – lowest profit target, flexible structure:

- Profit target: 6% of the account. This is the lowest among the 1-Step tier, making it easier to hit for cautious or consistent traders.

- Overall drawdown: 3%, trailing. According to FTM’s FAQ, the trailing drawdown is based on the highest recorded balance (“maximum balance watermark”), not just the initial balance; and once the 3% profit target is reached, the overall drawdown limit becomes fixed to the initial account size.

- Daily drawdown: 3% of the initial balance. FTM’s FAQ gives a detailed rule: at the end of each day (5 PM EST), if there are unrealized positions, the 3% is measured off the higher of equity or balance minus the 3% of initial, to find the stop-out level.

- Consistency: For Nitro X, the consistency rule is looser during “simulated funded” — the site says 25% (i.e., in a day, you should not exceed 25% of that 6% target).

- Activation / reset: Nitro X has an activation fee of US$ 125 (for certain account sizes), per its 1-Step page.

- Profit split: Up to 100%, same as other 1-Step tiers.

- Minimum trading days: For Nitro X, there is a minimum of 5 simulated-account trading days required, according to the program page.

In summary, the 1-Step Evaluation is clearly designed to give maximum flexibility to experienced and risk-aware traders. With no time limit, multiple tiers, and the potential to scale, FTM’s 1-Step option is very attractive for someone confident in their strategy and discipline.

2-Step Evaluation: A More Traditional, Two-Phase Path

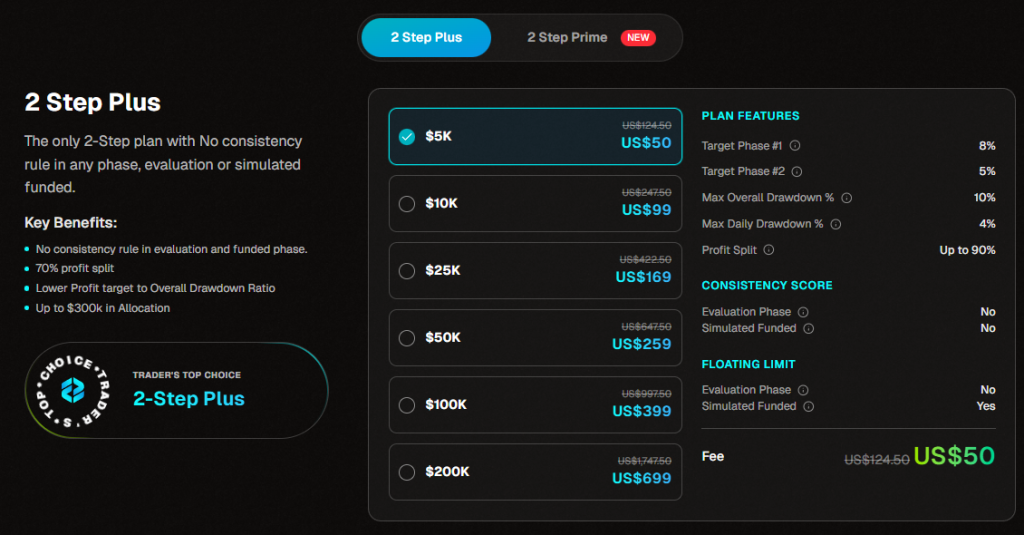

While the 1-Step program is fast and direct, FTM also offers a 2-Step Evaluation, which mirrors more classical challenge-based prop firm models. According to the “Programs” page, 2-Step is suited for traders who may prefer to prove themselves in two phases, possibly reducing initial risk and fee.

FTM provides three main 2-Step account variants: 2-Step Speed, 2-Step Standard, and 2-Step Plus. Each is tailored slightly differently in terms of drawdown tolerance, profit targets, and consistency requirements. Let’s break down the details based on FTM’s published program information:

2-Step Speed:

- First (Phase 1) profit target: 8%.

- Second (Phase 2) profit target: 5%. These are explicit on the Programs page.

- Max overall drawdown (evaluation): 8%. Again, FTM’s published rules show this as balance-based.

- Max daily drawdown: 4% per day.

- Consistency rule: On evaluation, you must not make more than 50% of the Phase 1 or 2 target in a day; in simulated funded (after passing both phases), they cap daily profit at 40% of total profit allowed, per their program page.

- Profit split: FTM indicates an 80% profit split for this 2-Step Speed plan.

- Minimum trading days: They require at least 5 days in the simulated account for Phase 1, according to the 2-Step program listing.

2-Step Standard:

- Profit targets: 10% in Phase 1, 5% in Phase 2 per FTM’s page.

- Overall drawdown: 10% (balance-based), according to the program table.

- Daily drawdown: 4% daily limit, same as Speed, stated in the program details.

- Consistency: 50% per day during evaluation, 40% in simulated funded (phase completed) — same model as Speed for their respective targets.

- Profit split: 80% split is given for Standard.

- Minimum trading days: At least 5 simulated days on Phase 1.

2-Step Plus:

- Profit targets: 8% for Phase 1, 5% for Phase 2, based on the program list.

- Max overall drawdown: 10%.

- Daily drawdown: 4% per day.

- Consistency: Their 2-Step Plus plan apparently does not include a simulated funded consistency requirement (“Sim: None”), according to FTM’s table.

- Profit split: 80%.

- Minimum trading days: Phase 1 minimum is 3 days for Plus, plus 5 days for simulated funded for the second phase.

Why choose 2-Step? Based on FTM’s own framing, 2-Step is ideal for traders who prefer a more gradual evaluation journey, possibly paying a lower effective challenge “cost per funded dollar” or trading more conservatively in each phase. The two-phase structure also encourages consistent trading across distinct segments, as opposed to trying to “sprint” for the target in a single step. It may particularly appeal to traders who are risk-averse, or who value structure and a more predictable path to a funded account.

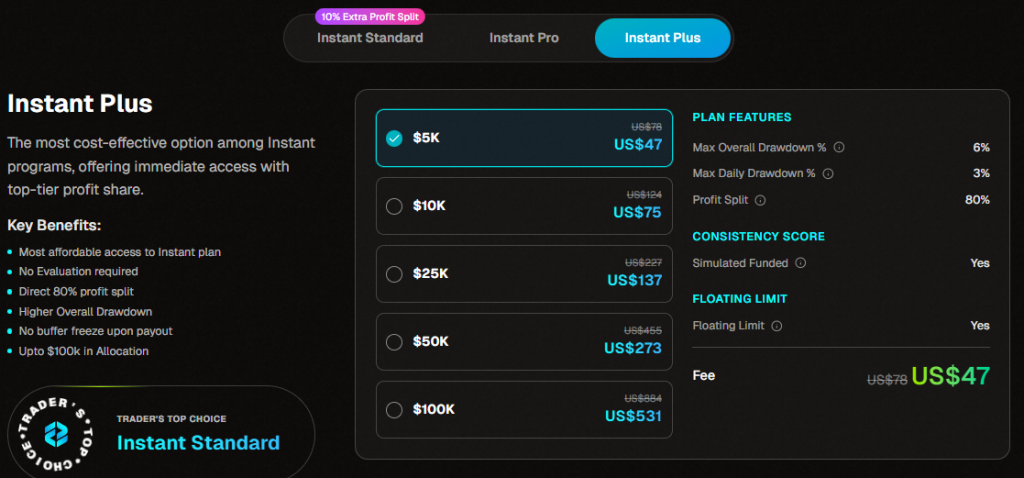

Instant Funding: Trade Simulated Funded Accounts Without a Challenge

Perhaps the most flexible option from FTM is Instant Funding — which eliminates the formal “challenge evaluation” step entirely. According to FTM’s Programs page, Instant Funding allows traders to “skip the evaluation” and begin trading a simulated funded account right away.

Instant Funding provides several account variants (Standard, Pro, Plus), each with different risk parameters and payout mechanics:

Instant Standard:

- Drawdown (Overall): 5% (balance-based) as per FTM’s program list.

- Daily drawdown: 3% per day.

- Consistency (or “consistency score”): The program page lists 20% for simulated funded (meaning you can make up to 20% of some target or unspecified “score” per day).

- Profit split: Up to 80%, according to FTM’s Instant Funding terms.

Instant Pro:

- Overall drawdown: 3% (trailing) as per FTM’s Instant Pro listing.

- Daily drawdown: None in some account sizes, which means there’s no fixed daily stop-out rule (per their program table).

- Consistency: Also 20% on simulated funded side (according to their program page).

- Profit split: Up to 80%, same as Standard Instant.

Instant Plus:

- Overall drawdown: 6% (balance-based), per their program listing.

- Daily drawdown: 3% per day.

- Consistency: 20% for simulated funded.

- Profit split: Up to 80%, same as other Instant tiers.

Why choose Instant Funding? From FTM’s site, Instant Funding appeals to traders who don’t want to go through a challenge but still want to benefit from funded-style accounts. This path is ideal for traders who:

- Prefer to trade from day one without completing a profit-target challenge.

- Want to test their skill in a funded-like environment but are okay with a reduced profit split (since Instant accounts have a lower split ceiling compared to some 1-Step accounts).

- Want flexibility and control — since there is no structured evaluation to “pass,” traders can focus on consistency, risk, and profit generation.

Risk Management & Trading Rules: Drawdowns, Consistency, & Profit Target

One of the most critical areas in any prop-firm model is the risk rules — how much a trader can lose per day, what drawdown is allowed overall, and how “consistency” is enforced. FTM’s official site is quite transparent about these rules for each account type, and this section delves into those details.

Drawdown: Daily & Overall

- For 1-Step Nitro, the maximum daily drawdown is 4% of the initial account balance. FTM’s FAQ gives an example: for a $100,000 account, 4% equals a $4,000 potential stop-out threshold per day, measured against either balance or equity.

- The overall drawdown for Nitro (1-Step) is 6%, and it’s trailing. According to FTM’s FAQ, the 6% is calculated from the highest recorded balance (the “maximum balance watermark”), not just the initial balance — which means as your account grows, the trailing stop-out level adjusts.

- For 1-Step Nitro Pro, the daily drawdown is tighter at 2% of initial balance per day.

- The overall drawdown for Nitro Pro is 3%, per FTM’s documentation, also trailing until a profit target is reached; after that, drawdown is fixed to the initial balance.

- In 1-Step Nitro X, daily drawdown is 3%, according to their FAQ.

- Nitro X’s overall drawdown is 3% trailing, and per FTM’s FAQ, once the account gains 3% profit, the drawdown limit becomes fixed to the initial balance rather than being a dynamic trailing stop.

For 2-Step accounts, the drawdown rules are slightly different:

- 2-Step Speed has a daily drawdown of 4% and an overall drawdown of 8%, per FTM’s program table.

- 2-Step Standard allows 10% overall drawdown and 4% daily drawdown, according to their published parameters.

- 2-Step Plus: same daily drawdown (4%), and overall drawdown is 10%, per FTM’s program listing.

These rules mean that traders must be careful not only about how much they make but also how much they risk on any given day and overall: the trailing drawdown design (for many of their accounts) is particularly notable, since it forces traders to evolve risk management as their account grows.

Consistency Rules

FTM enforces a “consistency” rule — a limit on how much profit you can make in a single trading day relative to your profit target. This is intended to discourage large, one-day spikes in profit and to reward stable, controlled trading.

- For 1-Step Nitro: the evaluation consistency limit is 50% of the profit target in a day; in the simulated funded account, the cap is 45%.

- For 1-Step Nitro Pro: stricter — only 20% of the 8% target can be made in a single day (that is, around 1.6% of account size if using a 100K account).

- For Nitro X: on the simulated funded side, the daily consistency rule is 25% of the 6% target (i.e., 1.5% of account size if scaled accordingly).

- On 2-Step accounts (Speed, Standard): during evaluation, the limit is 50% of a phase’s target. Once funded (or in a sim funded account after passing), the cap drops to 40% of the total profit target.

These constraints are important for traders to internalize: hitting target too fast in a single day may violate the consistency rule, leading to a challenge failing or payout restriction. The consistency rule encourages a sustained, disciplined trading style rather than high-risk “big bet” days.

Profit Targets

Profit targets vary by program and account tier:

- 1-Step Nitro: 10% target.

- 1-Step Nitro Pro: 8% target.

- 1-Step Nitro X: 6% target.

- 2-Step Speed: Phase 1 = 8%, Phase 2 = 5%.

- 2-Step Standard: Phase 1 = 10%, Phase 2 = 5%.

- 2-Step Plus: Phase 1 = 8%, Phase 2 = 5%.

Profit targets are designed so that passing them gives the trader entry to a “simulated funded” account (or direct funding, depending on the type), after which they can request payouts.

Profit Split & Payout Mechanics

A central attraction of FTM’s prop-trading business model is its profit split — how much of your profits you keep once you are funded or are trading in a simulated funded account — and its payout mechanics. Here’s what their official site says.

Profit Split Structure

FTM provides very competitive profit splits depending on the program:

- In the 1-Step Nitro program, FTM offers 100% profit split up to the first US$10,000 of profit. According to their 1-Step page, this is among the most generous splits for a challenge-based prop firm.

- For 1-Step Nitro Pro, they also offer “up to 100%” profit split, similarly structured.

- In the 1-Step Nitro X program, they maintain 100% profit split, but with the nuance that you must retain 50% of the profits in the account as a buffer. That means half the profits stay in account capital, and the other half can be withdrawn (subject to rules), while still giving a full-split structure.

- For 2-Step programs (Speed, Standard, Plus), FTM’s program table shows a profit split of 80% for each of these variants.

- For Instant Funding, the profit split is “up to 80%” for their Standard, Pro, and Plus variants.

These split structures make it clear that FTM is targeting two main types of traders:

- Those who are willing to pay for evaluation (1-Step) and want a very high profit share;

- Those who prefer to skip evaluation (Instant) but are okay with a slightly lower maximum split.

Payout Mechanics & Speed

On the payout side, FTM emphasizes speed and flexibility:

- Their on-demand payout system means that once you have met the conditions for a payout, you can submit a request and typically don’t have to wait for a fixed “cycle.”

- The “24 Hours or We Pay Double” guarantee is a strong public commitment: according to FTM, if they don’t process your payout within 24 hours, they will pay you double.

- In their reference page (promo/ref page), they claim that “most payouts” are completed in under 2 hours, which is very fast in the prop-firm industry.

This aggressive payout commitment (speed + guarantee) is a major selling point. For funded traders, quick access to profits can significantly improve cash flow and trust in the firm.

Account Scaling & Long-Term Growth

FTM doesn’t just provide a challenge and funding — they also promote a scaling path for high-performing traders. According to their website, the scaling plan is a major component of their long-term offering.

Scaling Plan to $3 Million

In FTM’s “Why Choose Us” and other educational content, they explicitly mention that funded traders can scale up to US$ 3 million in account size if they meet performance conditions. While specific “phase-by-phase” scaling rules are not fully detailed on some of the publicly visible pages, FTM’s messaging suggests that consistent performance, risk control, and trade volume will be part of the scaling criteria.

Fixed Monthly Salary Option

One of the more unique claims on FTM’s site is that highly consistent, scaling traders may be eligible for a fixed monthly salary. According to their blog / “Why Choose FTM” content, this salary is awarded to traders who meet certain performance metrics, including consistent profitability over multiple months and maintaining minimum trading activity.

This model is quite trader-friendly: it gives a potential path not just to bigger funded accounts but also to a more stable, predictable income stream — something many prop firms do not clearly offer in their public marketing.

Trading Infrastructure: Platforms, Instruments & Leverage

Understanding which platforms and trading instruments FTM supports is crucial for traders. Based on FTM’s official pages:

- Supported trading platforms: According to their main site, traders can use MetaTrader 5 (MT5), cTrader, and TradeLocker.

- Leverage: FTM’s reference / promo page mentions leverage up to 1:100 for certain accounts.

- Instruments: While FTM doesn’t list every single instrument in its program-overview pages, they mention major forex pairs, indices, metals, and other CFDs in different areas of the site. Given the nature of their funding programs, it is implied that these instruments are available under the accounts, depending on the tier.

This breadth of platform support is helpful: MT5 is widely used and powerful, cTrader appeals to traders who need modern charting and speed, and TradeLocker may offer additional features depending on account type.

Business Model & Sustainability

- An important question for prop traders — “How does the firm stay in business?” — is answered in part by FTM’s own corporate content:

- FTM claims a diversified revenue model: they don’t rely solely on evaluation fees. According to their blog or “Why Choose FTM” page, they list three revenue streams:

- Evaluation (challenge) fees paid by traders.

- A risk model: they identify consistent, profitable traders and may copy their trades into live hedged accounts.

- A hedging model: they offset risk by aggregating and hedging some traders, presumably in a pool to mitigate large losses.

- FTM claims this model is “rigorously tested” and designed to ensure sustainability, allowing the firm to pay out high splits and scale traders while managing risk.

- They are upfront about legal entities in different jurisdictions (e.g., FTM claims operations in multiple countries), and provide risk disclosures, which adds credibility.

By publicly sharing these business-model elements, FTM seeks to reassure traders that its generous payout promises and scaling opportunities are backed by a structured, economically sustainable model — not just “challenge fees only.”

Transparency, Disclosures & Compliance

FTM takes public-facing transparency seriously, according to its website:

- Public payout proof: On its homepage and referral pages, FTM shows a “Recent Payouts” feed or section, which lists names and payout amounts, serving as social proof that they are actively paying traders.

- FAQ and rule clarity: Their FAQ section is detailed, covering the exact drawdown mechanisms (overall and daily), consistency rules, and profit-split nuances for each program.

- Legal and risk disclosures: On the FTM site, there are risk disclosures that warn traders of the potential losses and make clear that trading is not risk-free.

- Geographical and jurisdictional notes: FTM’s site mentions supported countries, plus restrictions; also, their legal entities are clearly listed.

This level of transparency on rules and payouts is a strong positive. For many prop firms, traders must rely on third-party reviews to piece rule sets together — but FTM tries to present much of this in their own materials.

Strengths & Advantages

From the official FTM site, several clear strengths emerge, based on their stated model and programs:

- Speed of Funding & Payout: The “24 Hours or We Pay Double” guarantee and on-demand payouts make FTM very compelling for traders who want their profits quickly.

- Flexible Program Options: With 1-Step (three types), 2-Step (three types), and Instant Funding (three types), FTM caters to many trading styles and risk preferences.

- High Profit Splits: Especially in 1-Step Nitro and Nitro Pro, with 100% up to the first US$10,000, this is very generous.

- Scalability: The scaling plan to potentially $3 million in funded capital and the possibility of a fixed monthly salary for top traders is a major selling point for the serious, long-term trader.

- Risk Management Clarity: The drawdown limits (daily and overall) are clearly defined. The consistency rule helps ensure that funded traders trade in a controlled manner.

- Transparency: The presence of a detailed FAQ, recent payouts, and business-model disclosure gives a higher level of trustworthiness than many less transparent prop firms.

- Accessible for Many Traders: Because the firm supports a wide range of programs (challenge-based and instant) and platforms, many types of traders (from risk-averse to aggressive) could find a fit.

Considerations, Risks & Potential Drawbacks

While FTM’s model is strongly marketed, there are some important considerations (drawn entirely from FTM’s own published rules) that potential funded traders should carefully assess:

- Consistency Constraints: The daily consistency limits can restrict how aggressively you try to hit profit targets in a single day. If your strategy relies on big swings, you might be limited.

- Trailing Drawdown Risk: In certain accounts (like Nitro), the overall drawdown is trailing — so as your account grows, your allowable drawdown may shift, potentially tightening risk.

- Profit Retention in Nitro X: The requirement to keep 50% of profits in account as a “buffer” means you don’t get to withdraw all profit immediately, even with 100% split — this affects liquidity.

- Scaling Requirements: While scaling to $3 million is possible, the criteria (performance, consistency, trade volume) may be stringent; not all funded traders will achieve it.

- Instant Funding Split: The profit split ceiling for instant funding is lower (80%) compared to 1-Step (100%), so the trade-off for skipping evaluation is less profit share.

- Verification / KYC Process: The site doesn’t detail every step of KYC or account verification publicly; there may be internal onboarding requirements that are not fully transparent upfront.

- Operational Risk: While FTM discloses its business model, the exact mechanics of hedging and risk management are not fully detailed; traders should understand that any prop firm carries structural risk.

Who Might Benefit Most from FTM?

Based on FTM’s own structuring of programs and rules, the ideal candidate for funded trading with them could be:

- Experienced, disciplined traders: Those who understand risk management, can trade consistently, and are comfortable with the consistency rules.

- Growth-focused traders: People who plan to scale over time and are interested in building a long-term prop-trading business rather than cashing out once.

- Traders who value liquidity: Because of on-demand payouts, FTM may be ideal for those who want regular access to profit.

- Risk-averse challenge seekers: Especially with 2-Step or Nitro Pro, where drawdown is more limited, traders who fear large losses may prefer these plans.

- Traders who value transparency: Since FTM publishes many of its rules and business-model details, transparency-minded individuals may see it as a safer bet.

Final Verdict

From the information available on its official website, Funded Trader Markets (FTM) offers a very competitive and flexible prop firm structure. Its combination of fast payouts, generous profit splits (particularly in 1-Step), and a clear, well-communicated set of risk rules makes it an attractive option for many serious traders. The multiple funding paths (1-Step, 2-Step, Instant) further enhance its appeal, accommodating a wide range of trading styles and risk appetites.

In addition, the scaling plan up to US$ 3 million and the potential for a fixed monthly salary create a strong long-term incentive for consistent, profitable traders. The risk-management rules (daily and overall drawdown, consistency limits) also suggest that FTM is serious about responsible funding and not just a “pay-to-play” challenge outfit.

That said, it’s not without trade-offs: the consistency rules may restrict high-volatility strategies, Nitro X’s profit-retention buffer reduces immediate cash-out, and the instant funding path gives up some share of profits.

In summary, FTM is particularly well-suited for dedicated, disciplined traders seeking a scalable, transparent prop-trading path. If you can meet its risk and consistency requirements, FTM offers a powerful platform for long-term funded trading and potentially growing a significant trading business.